3-2-1 Rule – The storing of a backup in three separate places to ensure one of the versions can be used to recover the backed up data in case the original data is lost. The 3-2-1 rule says that you should have at least three versions of your backup on two separate media types, one of which should be in a separate location. This protects against drive failure, a media failure and a location failure.

Storage Glossary

This is a storage glossary with entries (terms) linked to explanations. It is more than a storage dictionary but not a storage encyclopaedia. New terms will be added as the industry develops its technologies.

- 3 – 3-2-1 Rule – 3-2-1-1-0 – 3D NAND – 3D X-DRAM – 3D XPoint

- 5 – 5G

- A – ACID – AFA – AGI – Air Gap – Anisotropy – Apache Iceberg – Apache Kafka – Apache Spark – APU – Archive – ASCII – ASI – ASIC – ATA – Autoloader – AWS – Azure

- B – Backup – BaM – BEOL – Binary – Binary and Decimal Prefixes – Binary number – Binary Search Tree – Bit – Bit Line – Block – Blockchain – Blu-ray – Bounce buffer – BPM – B-Tree & B+ Tree – Byte

- C – Cache – CAG – CAMM – CAS – CBA – CD – CDFP – Charge Trap – CHS – CIFS – CMOS – Codec – Coercivity – Composable Systems – Compression – Computational Storage – Container – Copilot – CopprLink – COSI – COW – CPU – CSAL – CSI – CXL – Cylinder Head Sector

- D – D2D – D2D2T – DASE – DDR – DDR4 – DDR5 – DDR6 – Data Lake – Data Mesh – Data Warehouse – Decimal – Decimal and Binary Prefixes – Deduplication – DIMM – Disaster Recovery – DNA Storage – DORA – DPU – DRaaS – DRAM – dStorage – DVD – DWPD

- E – E1.L – E1.S – E3.L – E3.S – EAMR – EB – ECC – EDSFF – Ei – EiB – e.MMC – Endurance – ePMR – Erasure Coding – ESCON – Ethernet – ETL – Exabyte – Exbibyte

- F – FC – FCOE – FC-MAMR – FDP – FEOL – FERAM – Fibre Channel – FICON – File – Filer – Flash – Flit – Floating Gate – FPGA – Fractal Index Tree – FRU – FTL – FTP

- G – GCRAM – GDDR – GDS – Gb – GB – GFS – GiB – Gibibyte – Gigabyte – GPU – GPUDirect – GPUDirect RDMA

- H – HAMR – HB – HBA – HBF – HBi – HBM – HBM3E – HCI – HDD – HDMR – HeLC – Hellabyte – Hellabibyte – High Bandwidth Memory – HLC – Host Bus Adapter – Holographic storage – HPC – HSM – HSMR – Hudi

- I – IaaS – IB – Iceberg – IDE – ILM – IO – InfiniBand – IPFS – IPU – IP – iSCSI – iSER – iWARP

- J – JBOD – JBOF – JEDEC – JSON

- K – K8S – Kafka – Kb – KB – Key Value Store – KiB – Kilobyte – Kilobibyte – Kubernetes – KVCache – KVS

- L – Lakehouse – LAN – LBA – LDPC – LLM – Lock – Logical Block Address – Log-Structured Merge Tree – LPDDR – LRDIMM – LRU – LSM-Tree – LTFS – LTO – LUN

- M – M.2 – MAID – MAMR – MAS-MAMR – Mb – MB – MCP – MCR DIMM – Megabyte – Merkle Tree – Metadata – MiB – Mibibyte – MLC – MMIO – MRAM – MR-IOV – MRM – MR-MUF – MS-SSD

- N – Namespace – NAND – NAS – NDMP – Nemo – NFS – NIC – NIM – NIS2 – NOR – NVLink – NVMe – NVMe-oC – NVMe-oF – NVMe FC – NVMe KV – NVMe/TCP

- O – OEM – Object Lock – Object Storage – OCP – OPI – OSFP – OSFP-MSA – OSI – Over-provisioning

- P – PaaS – Parquet – PATA – PB – PBBA – PBW – PCIe – PCM – Pebibyte – Phase-Change Memory – PHY – Physical Air Gap – PiB – PIM – PLC – PMR – pNFS

- Q – QLC – QR Code – QSFP

- R – RAG – RAID – RAIL – Ransomware – RAS – RBOF – RDIMM – RDMA – RDMA over IP – Replication – ReRAM – Resilvering – REST – Retrieval Augmented Generation – RLHF – RNIC – Robot – RoCE – ROW – RPO – RRAM – RTO

- S – S3 – SaaS – SAN – SAS – SATA – SCADA – SCM – SCSI – SDS – SDXI – SerDes – Serverless – SFTP – SI Units – Silo – SiPH – SLC – SMART – SmartNIC – SMB – SME – SMR – Snapshot – SNIA – SoC – SOCAMM – SONiC – SONiC-DASH – Spark – SPC – SPEC – SPOF – SRAM – SR-IOV – SSD – STO – Storage Engine – STT-MRAM

- T – Tape – Tape Cartridge – Tape Library – TB – TCP – TCP/IP – Tebibyte – Terabyte – Thin Provisioning – TiB – TLC – Tokens – TRIE – TRIM – TSV

- U – U.2 – U.3 – UALink – UCIe – UDIMM – UDP – UFS – UPS – USB – UUID

- V – VAAI – VADP – Vector Embeddings – Virtual Air Gap – VLAN – vLLM – VM – Volume – VSS – VTL – V-Tree – vVols

- W – WAF – Wear Leveling – Web3 – WLAN – Wireless LAN – Word Line – WORM – Write Amplification

- X – XPoint

- Y – YB – YiB – Yobibyte – Yottabyte

- Z – ZB – Zebibyte – Zettabyte – ZFS – ZiB – ZNS – Zoned Namespace – Zoned SSD

Storage news ticker – April 14

CData Software says Monrovia Nursery Co. is using its CData Sync product for storage of data from many and varied sources to develop cohesive financial and operational reporting processes. CData Sync has more than 250 available source connectors, such as a MariaDB Excel Add-In. Using CData Sync, a Monrovia team pulls information from a weather tracking API, combines it with e-commerce and payment information in Google Analytics, and analyzes the relationships. It can see how rainfall in Tuscany on a Thursday correlates with a 33 per cent decrease in shipping volume that day. CData Sync helps Monrovia connect its new ERP with Freshdesk data to track pallet shipments and returns. Monrovia drivers can track the retailers who have submitted tickets to pick up delivery pallets, map where they’re located on their delivery routes, and find where any missing pallets might be.

…

FD Technologies has entered into a strategic partnership agreement with Microsoft to expand the reach of its KX Insights streaming data analytics platform for real-time decision making. First, KX Insights will be embedded natively on the Microsoft Azure platform as a first class service, with KX generating revenue based on consumption. This will enable customers to store and access their data using complex event processing, high-performance analytics and machine learning interfaces on one unified and easy-to-use platform that will work seamlessly with Microsoft services. Second, KX has agreed to work with Microsoft to target new applications and services that will accelerate innovation and growth for organisations in the financial services sector.

…

IBM has announced IBM Impact – a framework for the company’s environmental, social, and governance (ESG) work that reflects how it aspires to create a more sustainable, equitable, and ethical future. It has also published its first Environmental, Social and Governance (ESG) report, the 2021 ESG report. It outlines three pillars in the IBM Impact program: Environmental Impact, Equitable Impact, and Ethical Impact. The latter will sit well with various people suing IBM for age discrimination, mis-classifying mainframe sales, and contract mistakes with the UK’s Co-operative Insurance.

Environmentally IBM intends to achieve net zero greenhouse gas emissions by 2030, divert 90 per cent of non-hazardous waste from landfill and incineration by 2025, and initiate 100 client engagements or research projects with environmental benefits by 2025.

…

LucidLink, whose FileSpaces software presents public cloud object storage as a local filer, has launched Filespaces v2.0. It has new metadata streaming with advanced algorithms for internet-based file streaming. Filespaces is faster and users can browse Filespaces of any size with hundreds of millions of files without the downtime seen with traditional cloud storage file synchronization technology. There are instantly accessible snapshots to restore prior versions of individual files or revert entire Filespaces to earlier points. Filespaces has improved distributed global file locking which improves performance with increased resilience in a distributed environment. Windows users receive a file locking experience on par with network-attached storage (NAS). The software is available in the Azure marketplace.

…

Pure Storage has issued its ESG report as well. It says Pure system use provides an up to 80 per cent reduction in direct carbon usage for customers versus competitive all-flash systems – a saving equivalent to 132,634 miles (213,453 km) driven by an average vehicle. The company hopes to achieve a 50 per cent intensity reduction in market-based scope 1 and 2 GHG emissions per employee from FY20 to FY30. It will achieve Net Zero market-based scope 1 and 2 emissions by FY40 and there will be a 66 per cent intensity reduction in use of sold products scope 3 emissions per effective petabyte shipped from FY20 to FY30. CEO Charlie Giancarlo has written a blog about Pure’s ESG goals.

…

Scale-out hybrid cloud filer supplier Qumulo says it now includes nine of the world’s top ten media and entertainment companies among its more than 1000 enterprise customers. This follows record-breaking progress during its previous fiscal year, where Qumulo saw a customer base expansion of more than 40 per cent, and added over 200 new customers to its roster.

…

Hyperconverged infrastructure HC3 appliance vendor Scale Computing has entered the Australian market via a tie-up with SecureServ, which distributes cyber security and networking products.

…

All-flash file-based array supplier VAST Data’s federal subsidiary is partnering with Mercury Systems to deliver rugged, high-performance storage systems for edge-based data capture and AI computing. These will be based on VAST’s Ceres product line, with its 1RU chassis and Nvidia BlueField smartNIC access. The addition of a ruggedized hardware enclosure allows VAST and its industry team members to satisfy the data flow demands of C5ISR (Command, Control, Computers, Communications, Cyber, Intelligence Surveillance and Reconnaissance) so that commanders and their personnel can have reliable and secure access to the data that informs their mission. Rugged Ceres will meet the defense industry’s SWaP (Size, Weight and Power) requirements.

…

WEKA, the very fast filesystem supplier, appointed erstwhile NetApp CEO Dan Warmenhoven to its board of directors on April 4. Warmenhoven served as CEO of NetApp from 1994 to 2009, helping to steer the company to its initial public offering in 1995; he later became its executive chairperson, a position he held from 2009 to 2014. He has served on the boards of Alteryx, Aruba Networks, Cohesity, Palo Alto Networks, and Redback Networks. WEKA says he is joining it “as the company continues to sustain a hypergrowth trajectory – shattering its sales and revenue goals for its fiscal year 2022.” That’s a hostage to fortune if the revenue goods don’t come in for the rest of 2022.

…

Nutanix’s CFO exits to join startup

Nutanix CFO Duston Williams has resigned for pastures new with Rukmini Sivaraman, senior veep of Financial Planning & Analysis, promoted to replace him.

Williams is leaving to become the CFO of an as-yet unamed pre-IPO company in a different market area. In a statement he said: “With the Company’s business model evolution well underway, I have decided that now is the right time to take on a new challenge.”

Nutanix CEO and president Rajiv Ramaswami issued a statement congratulating Williams: “We are incredibly grateful to Duston for the many contributions he has made to Nutanix during his time as CFO. Since joining Nutanix in 2014, Duston has played an instrumental role in our success. He guided Nutanix through our IPO in 2016 and was critical to the planning for, and execution of, our transition to a subscription business model, which will position Nutanix for future sustainable, profitable growth and value creation.

“I especially appreciated his support and partnership during my transition to Nutanix in December 2020. His hard work and leadership have earned him this exciting new opportunity and we look forward to cheering him on in the future.”

Rukmini Sivaraman was previously Nutanix’ Chief People Officer, and before that SVP of People and Business Operations. Further back, she worked for eight years as an investment banker at Goldman Sachs in New York, executing strategic transactions, including IPOs, mergers and acquisitions, and debt financing transactions for software companies.

There have been several other exec moves recently at Nutanix as Ramaswami puts his stamp on the company:

- Lee Caswell came in to be SVP of product marketing in February, coming from Ramaswami’s old company, VMware

- Mandy Dhaliwal was appointed Chief Marketing Officer in March, joining from Boomi,

- Shyam Desirazu became head of engineering this month, also coming from VMware.

Williams is to remain with Nutanix through April 30, 2022 and will work with Sivaraman to help smooth the transition.

The hyperconverged hybrid cloud company also confirmed that its financial performance for the current fiscal quarter and financial year remains on track.

There’s no flash in ExaGrid’s plan, says exec

ExaGrid makes disk-based purpose-built backup appliances and its CEO told us he sees no need to move to flash media.

We suggested ExaGrid might add an SSD front end as a competitive response to flash-based backup target systems from Pure Storage, StorOne and VAST Data, not forgetting the DRAM-cached InfiniGuard system from Infinidat.

An email conversation then ensued between ExaGid CEO Bill Andrews and B&F in which he pretty much squashed the proposition.

Blocks & Files: Why wouldn’t you use flash media in the front end backup job Landing Zone? It’s faster than disk.

Bill Andrews: Standard primary storage disk is slower as it is typically scale-up and CIFs. ExaGrid uses the proprietary protocols which are faster such as the Veeam Data Mover, Veritas NetBackup OST, etc. This is true of flash as well.

But ExaGrid has done the math. To put flash in the Landing Zone would greatly increase the cost and resulting price without the added value. The backup performance is no different. First the media servers cannot keep up so the flash would sit there idle. It is overkill.

Second, flash file systems are built for small database transactions and not large sequential files so, believe it or not, we beat flash in head to head tests because we are optimized for large sequential files and we also do job concurrency.

Blocks & Files: How is ExaGrid optimized?

Bill Andrews: ExaGrid is optimized for large backup jobs. In backup you have huge jobs that consist of hundreds to thousands of files per job. Other storage including flash is not. Disk is optimized for Word, Excel, etc. files. Flash is optimized for database transactions.

Blocks & Files: The key constraint then is the media server?

Bill Andrews: ExaGrid is scale-out and ExaGrid uses job concurrency. Typically, the media servers are not putting the data out fast enough to overwhelm ExaGrid and the cost to get media servers that would is too expensive. If this dynamic changes then we may do flash in the Landing Zone someday.

Blocks & Files: What’s the take away here?

Bill Andrews: The net is customers test ExaGrid against flash and say: “Wow you were faster and you are a pittance of the price.” We don’t get value from adding flash to our front-end because we don’t need any additional performance.

All of the above is why, at this point, we are faster than anything out there and being faster still may or may not be possible depending on the media servers, and even if it was, the question is: what will the customer pay for that? (cost versus value equation).

Comment

We think two other factors might influence things in the future. One is having the media servers get faster because they run in flash-based systems. The second would be a rising need for faster restores. Other things being equal a restore from SSDs ought to be faster than one from disks.

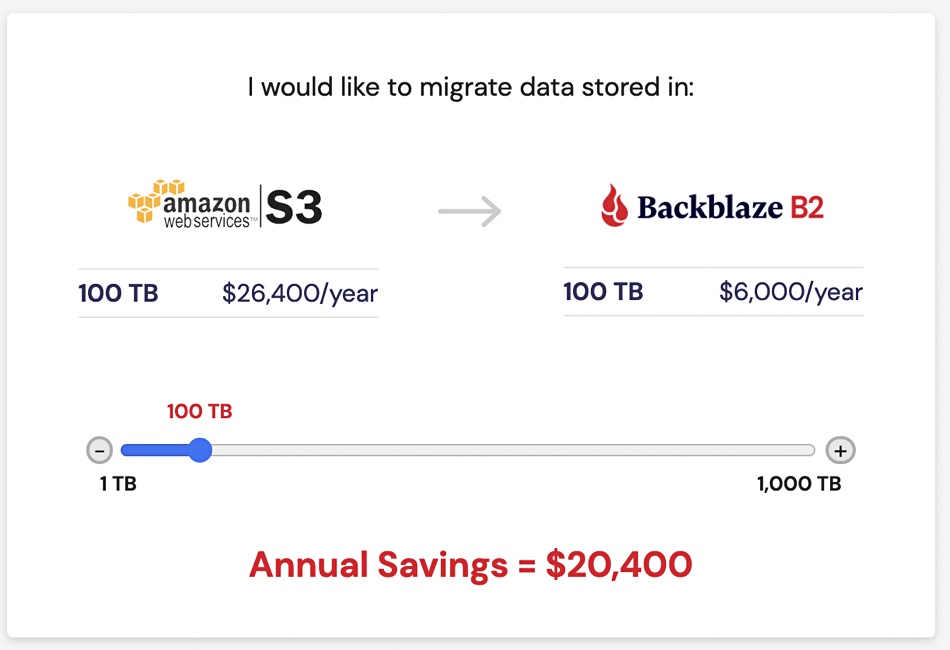

Backblaze puts out cloud storage migration service

Cloud storage provider Backblaze has set up a Universal Data Migration service where it will cover data transfer and egress charges from other suppliers – with the caveat that you have to commit to move at least 10TB of data to its B2 Cloud Storage service and keep it there.

It’s a turnkey service and covers migration from other public clouds, storage attached to servers, NAS, SAN, tape libraries (LTO) and cloud drives, such as Apple’s iCloud. Backblaze says its service covers practically any source data location.

Backblaze’s Nilay Patel, VP of Sales and Partnerships, said: “Vendor lock-in is the number one challenge organizations face with existing storage solutions – Universal Data Migration is here to answer that challenge.” The vendor claims it does this “without unnecessary costs or complexities.”

Previous inward migration services offered by Backblaze, such as a Cloud to Cloud offering and its Fireball physical disk transfer, have been rolled up into the Universal Data Migration service. Fireball is akin to Amazon’s Snowball and is a storage array chassis with 96TB of capacity that is rented for $550 for 30 days. It’s shipped to a customer’s site where data is transferred across a 10GbitE link and then the device is shipped back to Backblaze for data upload to the customer’s B2 cloud account.

The Universal Data Migration service is now available with the 10TB minimum data transfer proviso along with a term commitment.

B2 storage costs $0.005/GB/month, compared to Amazon S3’s $0.021GB/month. The egress charge is $0.01/GB/month in contrast to Amazon’s $0.05/GB/month.

Backblaze itself is being challenged by IDrive Backup and its IDrive e2 S3 compatible cloud object storage, with the first 10GB free and pricing starting at $0.005/GB/month, the same as Backblaze B2. But there are no ingress/egress fees, and no charge for downloading data. IDrive e2 is US-based, where it has 8 edge locations.

Backblaze, Idrive and other tier 2 cloud storage providers exist under an Amazon S3 pricing umbrella. With a history of reducing prices, Amazon may well drop S3 prices again and so lower the appeal of these tier 2 CSP price-cutters.

A Backblaze blog is scheduled to talk about the universal Data Migration service.

SMART brings Optane memory to AMD and Arm

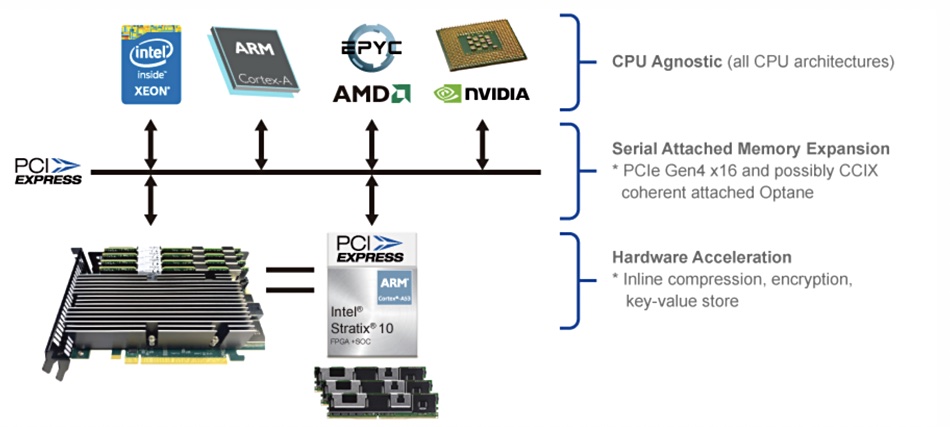

System-on-chip builder SMART Modular Technologies has a PCIe card that it says opens up Optane memory use to AMD, Arm and Nvidia GPU servers.

Optane persistent memory (PMem) DIMM products are only directly supported by gen 2 (Cascade Lake) and later Xeon CPUs as they have certain Optane PMem controller functions embedded inside their chip and communicate with PMem products using the DDR-T protocol. That has meant AMD, Arm and Nidia GPU servers could not be fitted with Optane PMem products.

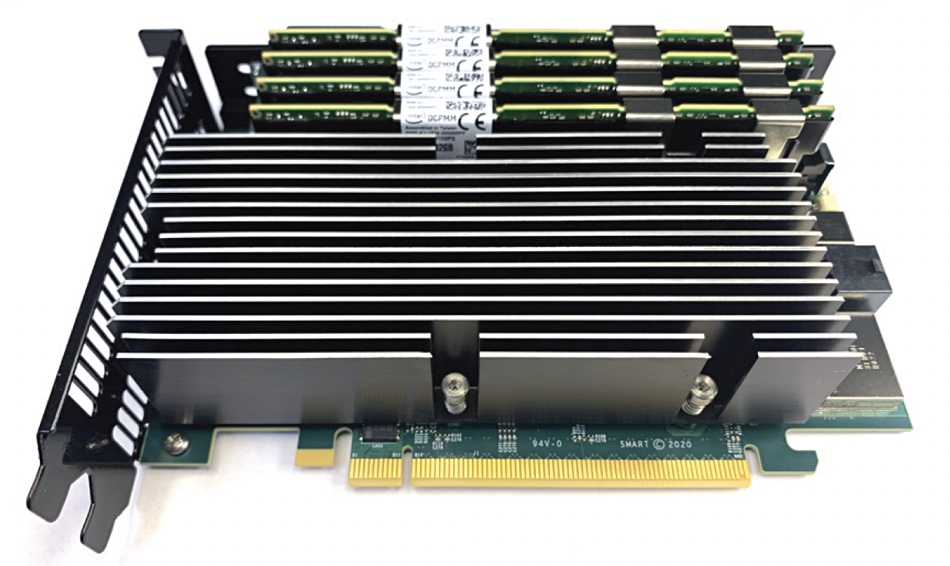

The Kestral AIC card contains 2TB of Optane DIMMs, an Intel Stratix-10 DX FPGA, and a 4-core Arm A53 SoC with dedicated on-board 2GB DDR4 memory and 8GB of eMMC storage acceleration. It has a PCIe-Gen4-x16 or PCIe-Gen3-x16 interface independent of the motherboard CPU. The two use cases are memory acceleration or system acceleration through computational storage.

SMART Modular’s VP Engineering Mike Rubino said: “With the advancement of new interconnect standards such as CXL and OpenCAPI, SMART’s new family of SMART Kestral AICs addresses the industry’s need for a variety of new memory module form factors and interfaces for memory expansion and acceleration.”

Kestral comes in a Full-Height, Half-Length (FHHL) dual slot form factor with less than 150W Thermal Design Power (TDP) using a passive heatsink. There are four DIMM slots with two independent channels, which can be populated with up to four Optane DIMMs up to 512GB each or two DDR4 RDIMMs up to 256GB each. The card’s latency is <350ns.

SMART said that its future AICs “will be capable of supporting 4TB of Optane Memory in persistent App Direct Mode via normal load/store semantics for all CPU architectures.” The Kestral product web page and downloadable technical brief contain some details about these two use cases but leave several questions unanswered.

The technical brief’s memory expansion diagram mentions CCIX.

CCIX was a server-memory bus development standard effort from 2020 providing cache-coherent memory. It was accompanied by the CXL, Gen-Z, and OpenCAPI alternatives. CXL absorbed the Gen-Z group and has emerged triumphant with CCIX and OpenCAPI relegated to niche applications.

SMART’s diagram says: “PCIe Gen4x16 and possibly CCIX” as if it’s not a done deal. We’ve asked SMART to explain what’s going in here. And we have also asked what software is necessary on the AMD, Arm, and Nvidia systems to support the Kestral card’s Optane memory as an adjunct to the host’s own DRAM.

This diagram also covers the computational storage use case with the FPGA capable of carrying out hardware-accelerated compression, key value store compaction, encryption and RAID 1 calculations.

Bechtle pulls HPE Primera array from datacenter over performance issues

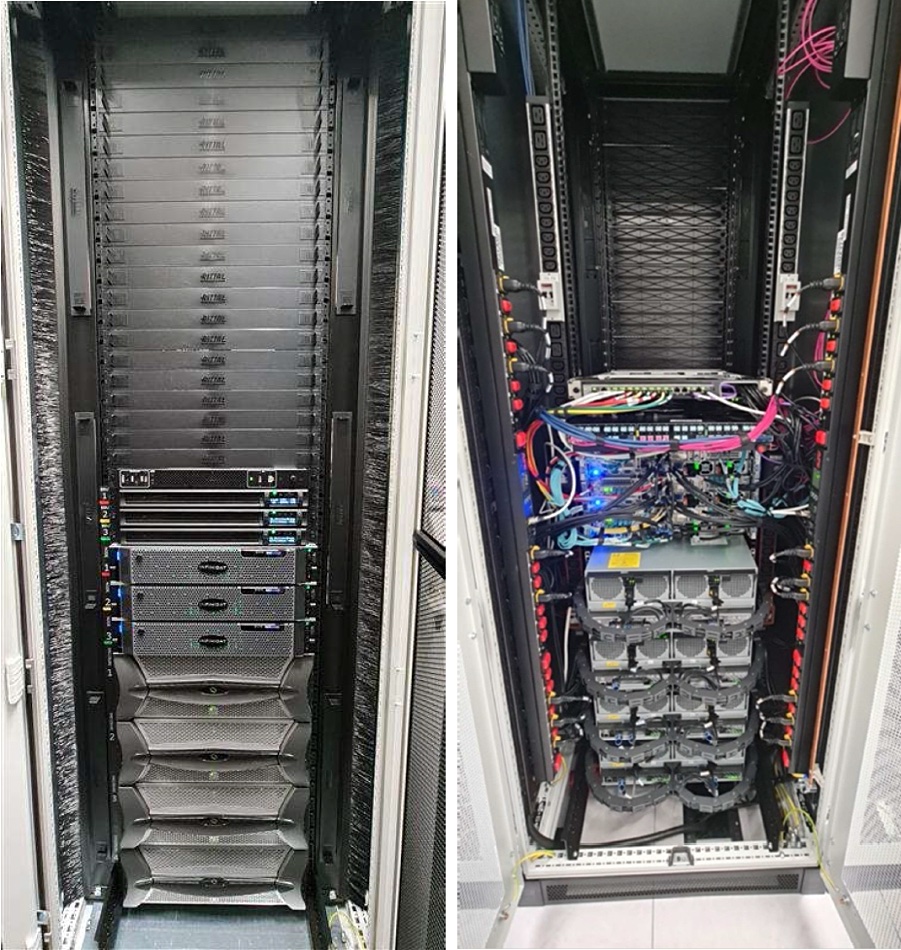

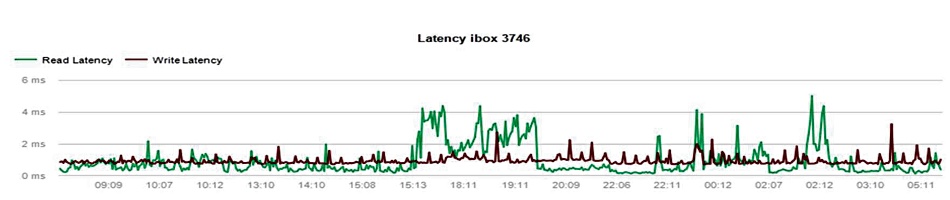

German IT services company Bechtle replaced a faulty HPE Primera array in its data centre with an Infinidat equivalent when HPE support could not resolve a firmware problem expeditiously.

Bechtle, headquartered in Neckarsulm, north of Stuttgart, is a $6 billion turnover multinational IT products and services supplier with 80 offices, 12,700 employees and more than 70,000 customers. It used a Primera array as part of its hosting environment for managed services.

The firm said it first encountered a problem with its Primera storage array in 2021 which prevented it from performing properly as the workload scaled up. Talking at an IT press tour event in Israel this month, Eckhard Meissinger, Bechtle’s head of Datacenters, said there were “massive performance issues with the existing storage system” – the Primera system.

He added that the “frequency of the faults led to a loss of trust among our customers” and “we had to pay a lot of contractual penalties.”

Meissinger said he was told by Primera Level 3 support that the problem affected 1 percent of HPE’s Primera customers. HPE offered a 3PAR replacement array as a solution to the issue, but then – according to Bechtle – subsequently withdrew the offer as it suffered the same firmware glitch.

Both the Primera and 3PAR arrays rely on a proprietary ASIC to carry out functions such as zero detect, RAID parity calculation, checksums and some deduplication tasks, accelerating them far beyond the speed of software carrying out the same functions.

As the location of the fault was in firmware, it seems the Bechtle workload encountered an issue in the Primera and 3PAR ASIC subsystem.

HPE was unable to fix the problem over a number of weeks, because it was a major bug fix issue, according to Bechtle. As a result, Bechtle went out to tender for a replacement system, eventually choosing one from Infinidat. It bought a 1PB InfiniBox array.

The array became operational in January this year after three weeks of testing. Thousands of Bechtle clients use the system and – to date – it has exhibited 100 percent availability, and performance close to or equal to an all-flash system. Bechtle said that with a capacity utilization of 70 percent, the savings compared to competitors such as NetApp and Pure are about €35 per TB. When utilization is higher than 70 percent, the claimed savings are about €40-45 per TB.

Bechtle is now in the process of becoming a public Infinidat reference customer.

That’s quite a turnaround as Bechtle was honoured as Hewlett Packard Enterprise’s Global Solution Provider of the Year for Germany, Austria, Switzerland, and Russia in June 2019, with HPE CEO Antonio Neri present at the ceremony. Bechtle was also HPE’s DACH Solution Provider of the Year 2020.

We have asked HPE what was the nature of the problem and why it could not be fixed in a timescale that met Bechtle’s requirements. An HPE spokesperson replied: “HPE as a policy does not comment on our customers.”

MAID

MAID – Massive Array of Idle Disks to store persistent but little-used data on mostly spun-down disks. Envisage a disk array with a cache of spinning drives and a residual archive of idle, non-spinning drives. The idea is to have a faster access archive than a tape library with lower electricity draw than an array of fully spinning drives. If a data read request is not present on the cache drives, then the data is located on an idle drive and it is spun up and then the data accessed. Startup Copan used the MAID concept in its disk drive arrays in the late 2000s but crashed. Its assets were bought by SGI which persisted with the technology in 2010. It didn’t take off.

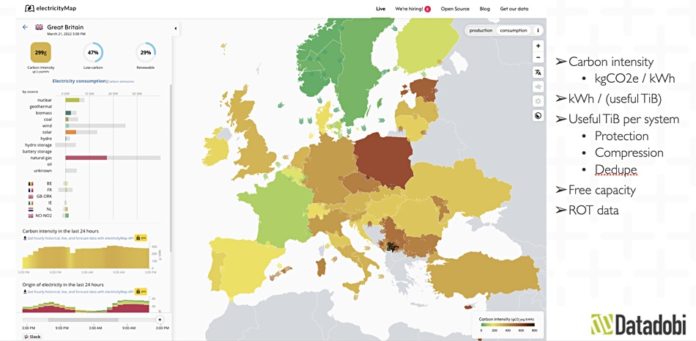

StorageMAP charts uncharted unstructured data oceans, estimates carbon footprints

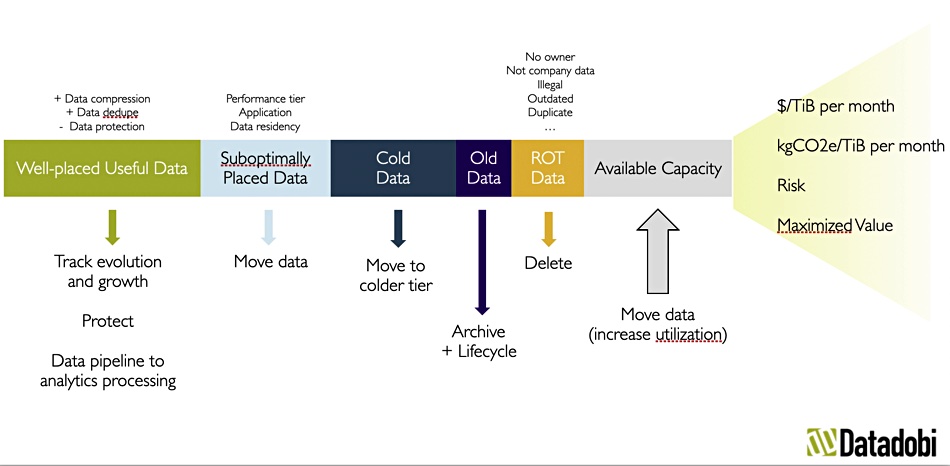

Datadobi claims its new StorageMAP product can chart entire file and object storage estates, revealing a customer’s unknown data arsenal and shining light on their low-value or useless data that is wasting IT spending and hiking up the carbon footprint.

The uncontrolled accumulation of file and object data by private businesses and public sector bodies is putting them under increasing budget pressure. Filers and object systems are filling up with uncharted oceans of data.

What a business doesn’t know it has cannot be used – or even stored in the right place. StorageMAP has a file and object scanning engine that’s part of Datadobi’s migration product and produces metadata about unstructured data that can be viewed through a management GUI.

Datadobi CTO Carl D’Halluin said: “Enterprises cannot handle the pace of unstructured data growth on their own. Managing unstructured data across today’s heterogeneous environments is a specialist activity,” which needs tools such as StorageMap.

One of the first things customers can find with it is the number files and objects they have, who they belong to and where they are stored. Customers might find, for example, multi-terabyte folders belonging to ex-employees which are still being backed up – perhaps because the offboarding process didn’t work as intended.

Once the resident techies know what they have and where it’s stored, they can start assessing its value – ie, the number of accesses in the last week or month – and take action if it is on the wrong tier of storage. They can find the redundant, obsolete, and trivial (ROT) data and delete it, reducing storage costs. They can assess the risk profile of the data, and the type of action to take on it.

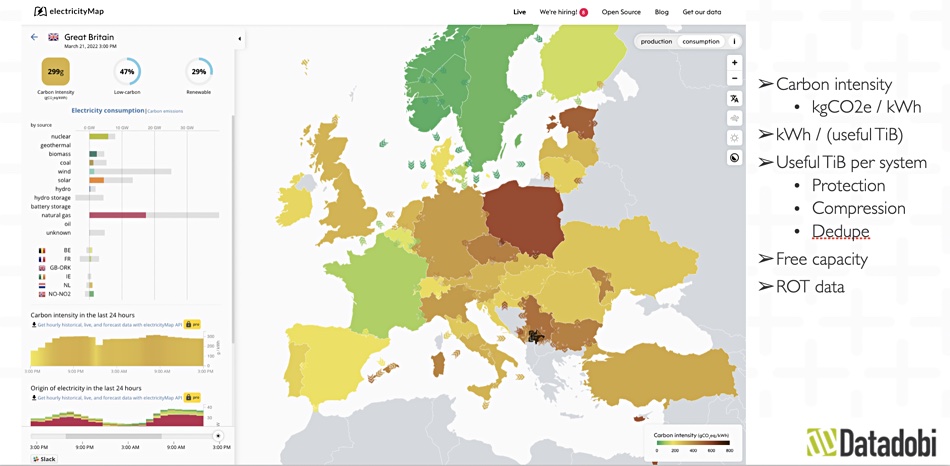

Storage admins can identify data that could feed analysis routines in the public cloud and move it there; or add their own tags (custom metadata) to file and objects so that they can track environmentally sensitive aspects of data storage. StorageMAP helps organizations to meet their CO2 reduction targets through carbon accounting of unstructured data storage in the cloud and in the datacenter, or so DataDobi claims.

Reducing an enterprise’s carbon footprint is becoming a more pressing concern for board members and CEOs. Knowing, for example, the carbon footprint of datacenters in different countries, and knowing where data is stored, means techies can consider moving it from a high carbon footprint datacenter to a lower one. They can also measure and monitor the carbon intensity of your unstructured data storage.

Vinny Choinski, senior lab analyst at ESG, said: “One of the biggest challenges I see IT operations facing today is the fact that they do not have a single view into the entire data storage environment or the ability to organize and restructure their data quickly and easily. Without that, it is practically impossible for IT to improve operational efficiency and to make their piles of unstructured data work for the business.”

StorageMAP is sold as a “pay-as-you-grow” model that allows customers to first understand their unstructured data environment before committing to take any necessary actions required by the business. Datadobi sells purchasable Action Add-ons such as a migration package.

Other suppliers provide software which can be used to index and locate files and objects, such as Data Dynamics with StorageX file lifecycle management SW; Hammerspace and its global file data environment; and data lifecycle management supplier Komprise.

Krishna Subramanian, co-founder, COO and president of Komprise, took issue with having separate functions within a lifecycle offering: “Analytics is key to effective data management but perhaps even more important is how it is incorporated. The industry practice of a separate analytics function that has to tag data and a separate migration module that moves data and disrupts user access is cumbersome and difficult to adopt.”

In her view: “We find one platform for analytics, automated policies derived from the analytics and transparent data management is key to exabyte-scale adoption.”

Datadobi said its functions are integrated and StorageMAP is a fully-fledged data management platform, putting companies in control of their data’s cost, carbon footprint, risk, and value.

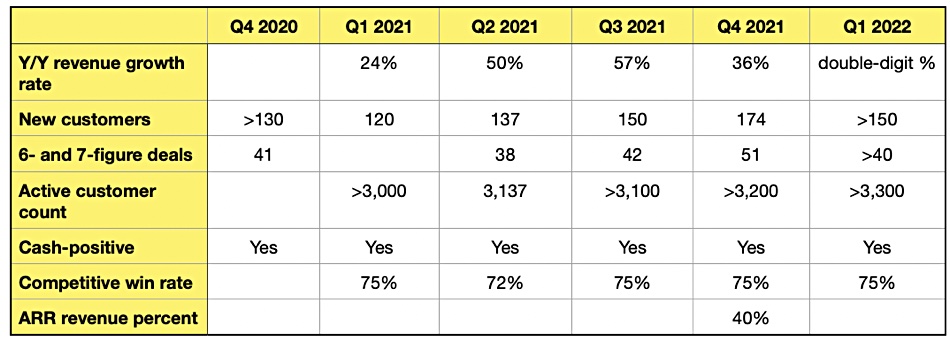

Tiered backup storage player ExaGrid turns in Q1 numbers

Privately-owned ExaGrid has reported what it says is its sixth consecutive quarter of revenue growth, as it fights for market share with on-premises disk-based, purpose-built backup appliance makers.

The company provides scale-out, 2-tiered backup storage with a front-end disk-cache, the Landing Zone or performance tier, which writes backup data directly to disk for the fastest backups, and restores directly from disk for the fastest restores and VM boots.

Data is then moved to a long-term deduplicated Retention Tier to reduce the amount of retention storage and its cost. ExaGrid’s growth is accelerating, the company said, and it is hiring over 50 additional inside and field sales staff worldwide.

As a private firm, its profit/loss accounts are not available for public scrutiny.

President and CEO Bill Andrews said of the latest results: “ExaGrid’s continued momentum is the result of the ongoing expansion of our sales team and working with our channel partners across the globe. We continue to see that organizations are realizing that primary storage disk is too expensive for longer-term retention and that traditional deduplication appliances don’t deliver the backup and restore performance needed to ensure that data is always available.”

We’ve tabulated the numbers in each of ExaGrid’s recent quarterly results announcements:

ExaGrid claims it is consistently winning in competitive bids against:

- Low-cost primary disk storage – more expensive than ExaGrid, inadequate dedupe ratios,

- Dell EMC PowerProtect/Data Domain,

- Veritas 5330, 5340, etc.,

- HPE StoreOnce,

- Flash/SSD-based systems – 5x the price of low-cost, primary storage disk

Andrews told us that some companies are pushing “flash for backup storage as that is all they have to sell. It is far too expensive for backup.”

He went on to claim ExaGrid sees “Rubrik or Cohesity when the customer is changing the backup app because they have to replace the backup app and the backup storage, at the same time, to compete. We see them in about 10 percent of the deals. ExaGrid goes in with a backup application: mostly Veeam and sometimes Commvault or HYCU if the customer is replacing both their backup application and backup storage at the same time.”

“In summary, disk is too expensive for backup due to retention and deduplication appliances are too slow and not scalable. ExaGrid’s Tiered Backup Storage… take[s] the pros of disk (ExaGrid Landing Zone) and the pros of deduplication appliances (ExaGrid repository) and offers both with scale-out storage.”

The suppliers who can beat ExaGrid on speed will be the flash-based backup systems such as Pure’s FlashBlade, the VAST Data Universal Storage system in data protection guise, Infindat’s high-end enterprise InfiniGuard system with DRAM caching and three dedupe engines, and StorOne.

In our view ExaGrid could rearchitect its front-end Landing Zone to use SSDs and potentially match the speed of the Pure, VAST, Infinidat and StorOne systems, while retaining its disk-based, globally deduped Retention Tier. The purpose-built backup appliances from Dell EMC, HPE and Veritas face speed, global dedupe and scale issues, which is where ExaGrid is hoping to make wins. They would need major architectural makeovers to match ExaGrid and systems from Pure, VAST and StorOne.

Storage news ticker – 12 April

….

In-cloud Saas data protector Clumio announced news of its Clumio Protect for Amazon DynamoDB, with granular recovery, improved audit readiness and reduced TCO for long-term backups. Clumio said it delivers cloud customers a fast setup process, turnkey ransomware protection, one-click recovery of their databases, centralized compliance reporting, and actionable insights to reduce data risks. Clumio Protect for Amazon DynamoDB can backup Amazon DynamoDB tables and items in less than 15 minutes with no upfront sizing, planning, or additional resources needed to setup in AWS accounts, Clumio added. The service will be generally available April 21, 2022.

…

Druva has gained Nutanix Ready certification for its SaaS data protection offering (DataResiliency Cloud) for Nutanix AHV HCI hybrid cloud. It covers protection for Nutanix workloads across data centers, remote offices, and Nutanix Clusters on AWS through a secure, automated, and simplified platform that requires no additional hardware or software. It works across platforms, applications, and geographies. Druva claimed it’s the only SaaS-based offering with support for Nutanix, and includes image-based backups, support for Prism Central and Prism Element, application-consistent snapshots of Nutanix AHV VMs, reduced cost with long-term retention and a CloudCache secondary storage to retain optional local backup copies for up to 30 days for stricter RTO/RPO or industry-specific compliance.

…

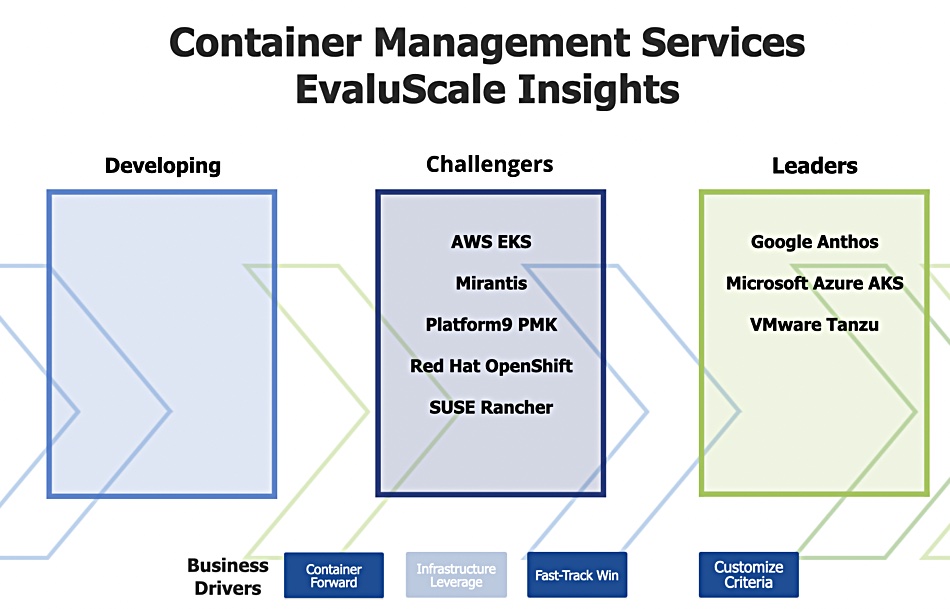

The Evaluator Group has announced its 2022 EvaluScale Insights for Container Management Systems for Platforms and Services. The EvaluScale Insights is based on deep research published by Evaluator Group with technology comparison and selection criteria known as EvaluScale Comparison Matrices. The EvaluScale Insights examines and ranks the vendors as Leaders, Challengers and Developing with a weighting based on the EvaluScale selection criteria and business drivers. The 2022 EvaluScale Insights Leaders: Container Management Platforms Leaders (see diagram above;)

- Container Forward: Red Hat Open Shift, SUSE Rancher and D2IQ

- Infrastructure Leverage: VMware Tanzu

- Fast Track Win: Red Hat Open Shift, Azure Stack and D2IQ

Container Management Service Leaders (see diagram below);

- Container Forward: Google GKE/Anthos Azure AKS, SUSE Rancher, VMware Tanzu

- Infrastructure Leverage: Google GKE/Anthos, Azure AKS, Mirantis, VMware Tanzu

- Fast Track Win: AWS EKS, Google GKE/Anthos, Azure AKS, Red Hat OpenShift, VMware Tanzu

…

An Intel VMD driver for vSphere can be used to create NVMe RAID1 setups. Intel Volume Management Device (VMD) works with the Xeon family of processors to enable additional control and management of NVMe devices. Intel VMD is similar to an HBA controller but for NVMe SSDs. Hot Plug, LED management, and error handling are some of the features available. The Intel-enabled NVMe driver for vSphere now supports RAID 1 volumes for boot and data. There’s more data here.

…

Kioxia KumoScale Software v2.0 is built around the NVM Express over Fabrics (NVMe-oF) protocol and delivers high performance NVMe flash storage as a disaggregated networked service. It includes additional bare metal deployment options, seamless support for OpenID Connect 1.0, and support for NVIDIA Magnum IO GPUDirect Storage (GDS). GDS enables a direct data path for direct memory access (DMA) transfers between GPU memory and storage, which avoids a bounce buffer through the CPU. KumoScale software behaves as a storage adapter to GDS.

OpenID Connect is an identity layer on top of the OAuth 2.0 protocol that allows Clients to verify the identity of users and session based on the authentication performed by an Authorization Server for service account permissions. V2.0 also includes CSI raw block support, and an embedded Grafana storage analytics dashboard.

…

Satori, which provides a Universal Data Access Service for cloud-based data stores and infrastructure, is adding support for three relational databases – MySQL, CockroachDB and MariaDB. Users can now control access to data stored in these databases in a streamlined, secure and non-disruptive way. Yoav Cohen, CTO at Satori, said. “As new choices like CockroachDB and MariaDB see rapid adoption within the enterprise, we also saw the need to meet the growing demand for managing access to sensitive data in these databases while realizing the vision of universal data access. Now Satori customers can hook into these popular services, alongside other leading data platforms including Amazon Redshift and Snowflake, without having to build such capabilities themselves.”

…

Vehera LTD, trading as Storage Made Easy today announced a record year of bookings, growing over 100 per cent year-on-year. This included its highest quarterly bookings ever in the fourth quarter and its largest seven figure sale. Company CEO Jim Liddle said: “During the pandemic we have seen companies shift to use on-cloud object storage in combination with on-cloud or on-site file storage. This shift has meant that companies required a flexible global namespace to enable employees to easily and transparently work with their hybrid file and object data sets wherever they reside.” SME’s File Fabric product meets that need “without any lock-in enabling companies to continue to directly access their data assets and take direct advantage of low cost analytics and other applications offered by large cloud vendors such as Amazon, Microsoft and Google.” The business is owned by Moore Strategic Ventures and did not make public it’s actual financial results.

…

StorPool Storage was listed as the 413th fastest-growing company in Europe as part of Financial Times’ in-depth special report focused on organizations that achieved the highest compound annual growth rate in revenue between 2017 and 2020. StorPool achieved a CAGR during the queried timeframe of 69.29 percent. This was nearly double the minimum average growth rate – 36.5 percent – required to be included in this year’s ranking. StorPool Storage is a primary storage platform designed for large-scale cloud infrastructure. It converts sets of standard servers into primary or secondary storage systems and provides thin-provisioned volumes to the workloads and applications running in on-premise clouds with multi-site, multi-cluster and BC/DR capabilities .

…

VMware said it has worked closely with other tech firms, including Pensando Systems, to deliver a single infrastructure platform across silicon and OEM vendors in the DPU space under the auspices of Project Monterey. AMD’s purchase of Pensando seemingly validates VMware’s belief in the future of the data center as a distributed and heterogeneous architecture – which will continue to evolve by embracing newer types of devices and accelerators. VMware sdaid it is actively engaged with Pensando Systems to jointly work on a distributed data center architecture.

…

VMware announced VMware Cloud Flex Storage, a natively integrated, elastic and scalable disaggregated cloud storage that mitigates the scalability issues faced by users on VMware Cloud on AWS. With VMware Cloud on AWS, cost economics were less than ideal and there were challenges associated with scaling its default vSAN storage. The only way to scale is to add or remove hosts, which means the addition or removal of CPU and memory in chunks, regardless of whether it was needed or not. VMware Cloud Flex Storage adds on-demand capacity and easy cost-effective scalability that requires no more than just a few clicks. Read a Gestalt IT blog for more info.

…

Replicator WANdisco said it saw strong trading in Q122 following significant contract wins for its LiveData Migrator (LDM) solution, both directly and via key cloud channel partners including Azure, AWS and IBM, and analytics partners Databricks and Snowflake. Eg; see Canadian National Railway. Its unaudited Q122 bookings are $5.8 million: up from $1.1 million a year ago. Ending RPO (Remaining Performance Obligations) is expected to be approximately $14 million for Q122: up significantly from $4.2m a year ago. Continued high visibility of it’s near-term business pipeline underpins confidence in strong 2022 trading.

…

HPE’s data protector Zerto has published a ransomware report about an ESG study revealing that gaps in readiness are seriously impacting the ability of many organizations to manage and recover from attacks. While organizations recognize that one of the best protections against a ransomware attack is the ability to recover from it, many are still struggling to counteract ransomware when prevention has failed. So, natch, buy Zerto’s services to help. Find out more in its downloadable e-book, “The Long Road Ahead to Ransomware Preparedness.”

…