Privately-owned ExaGrid has reported what it says is its sixth consecutive quarter of revenue growth, as it fights for market share with on-premises disk-based, purpose-built backup appliance makers.

The company provides scale-out, 2-tiered backup storage with a front-end disk-cache, the Landing Zone or performance tier, which writes backup data directly to disk for the fastest backups, and restores directly from disk for the fastest restores and VM boots.

Data is then moved to a long-term deduplicated Retention Tier to reduce the amount of retention storage and its cost. ExaGrid’s growth is accelerating, the company said, and it is hiring over 50 additional inside and field sales staff worldwide.

As a private firm, its profit/loss accounts are not available for public scrutiny.

President and CEO Bill Andrews said of the latest results: “ExaGrid’s continued momentum is the result of the ongoing expansion of our sales team and working with our channel partners across the globe. We continue to see that organizations are realizing that primary storage disk is too expensive for longer-term retention and that traditional deduplication appliances don’t deliver the backup and restore performance needed to ensure that data is always available.”

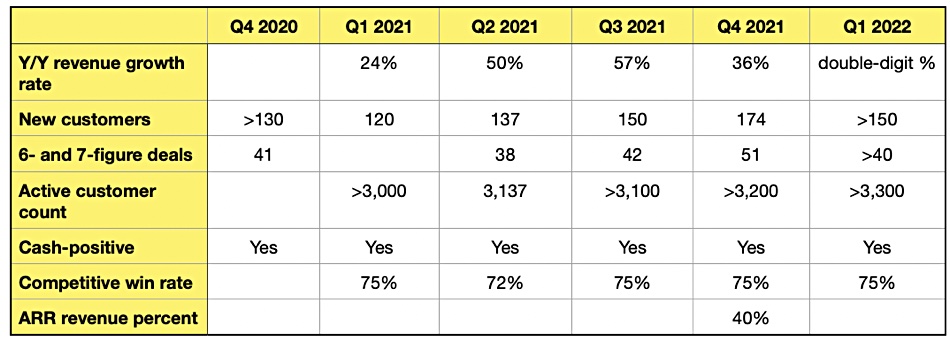

We’ve tabulated the numbers in each of ExaGrid’s recent quarterly results announcements:

ExaGrid claims it is consistently winning in competitive bids against:

- Low-cost primary disk storage – more expensive than ExaGrid, inadequate dedupe ratios,

- Dell EMC PowerProtect/Data Domain,

- Veritas 5330, 5340, etc.,

- HPE StoreOnce,

- Flash/SSD-based systems – 5x the price of low-cost, primary storage disk

Andrews told us that some companies are pushing “flash for backup storage as that is all they have to sell. It is far too expensive for backup.”

He went on to claim ExaGrid sees “Rubrik or Cohesity when the customer is changing the backup app because they have to replace the backup app and the backup storage, at the same time, to compete. We see them in about 10 percent of the deals. ExaGrid goes in with a backup application: mostly Veeam and sometimes Commvault or HYCU if the customer is replacing both their backup application and backup storage at the same time.”

“In summary, disk is too expensive for backup due to retention and deduplication appliances are too slow and not scalable. ExaGrid’s Tiered Backup Storage… take[s] the pros of disk (ExaGrid Landing Zone) and the pros of deduplication appliances (ExaGrid repository) and offers both with scale-out storage.”

The suppliers who can beat ExaGrid on speed will be the flash-based backup systems such as Pure’s FlashBlade, the VAST Data Universal Storage system in data protection guise, Infindat’s high-end enterprise InfiniGuard system with DRAM caching and three dedupe engines, and StorOne.

In our view ExaGrid could rearchitect its front-end Landing Zone to use SSDs and potentially match the speed of the Pure, VAST, Infinidat and StorOne systems, while retaining its disk-based, globally deduped Retention Tier. The purpose-built backup appliances from Dell EMC, HPE and Veritas face speed, global dedupe and scale issues, which is where ExaGrid is hoping to make wins. They would need major architectural makeovers to match ExaGrid and systems from Pure, VAST and StorOne.