“You have to spend money to make money” seems to be the mantra being adopted by Backblaze.

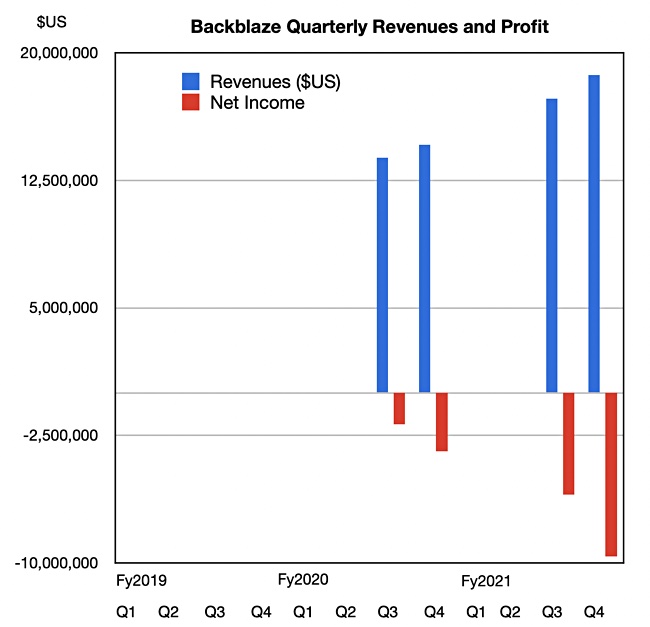

The cloud storage and backup provider reported Q4 fiscal 2021 revenues up 28 per cent year-on-year at $18.7 million with a net loss of $9.6 million. B2 cloud storage revenues were 56 per cent higher at $6.6 million while Computer Backup revenues rose 16 per cent to $11.9 million. Full-year revenues were $67.5 million, up 25 per cent, with a net loss of $21.7 million.

The chart below only shows the information we have – Backblaze has not released the missing numbers. We can see, though, that losses are deepening faster than revenues are rising. Spending has risen.

William Blair analyst Jason Ader told subscribers: “While we expected this bootstrapped business to use its IPO proceeds to drive growth, management made clear that given Backblaze’s market opportunity ($91B cloud storage TAM in 2025, according to IDC), the time is right to step on the sales and marketing gas.”

Ader reckons “Backblaze is a pure-play on SMB cloud adoption, with investors getting a high-growth, independent cloud storage platform supported by a cash-cow computer backup business that can also drive cross-selling opportunities.”

Backblaze had 498,933 customers at quarter end versus 466,298 a year ago.

The outlook for the current quarter (Q1 2022) is for revenues between $19.0 million and $19.5 million, with $83–86 million full-year revenues.

As of 3 March, Backblaze will no longer offer USB flash drive restores. Small restores can be done over the internet with larger restores available on an orderable USB disk drive. Here are the full details on the Backblaze USB Restore, Return, Refund program.