Think you know the storage industry? Here is a quiz to test your knowledge. See if you can name pictured CEOs, match press release descriptions to suppliers, explain what acronyms mean, name more CEOs, and match logo symbols to suppliers. Answers at the bottom of this article.

Nine CEOs

Name the nine storage CEOs in this set of pictures:

Can you recognise them from their profile?

Storage companies like to provide concise descriptions of what they are about in their press releases. See if you can match the descriptions to the suppliers in the categories below:

a) File sharing suppliers – CTERA, Nasuni and Egnyte

A leading provider of cloud file storage,

A leader in cloud content security and governance

The edge-to-cloud file services leader

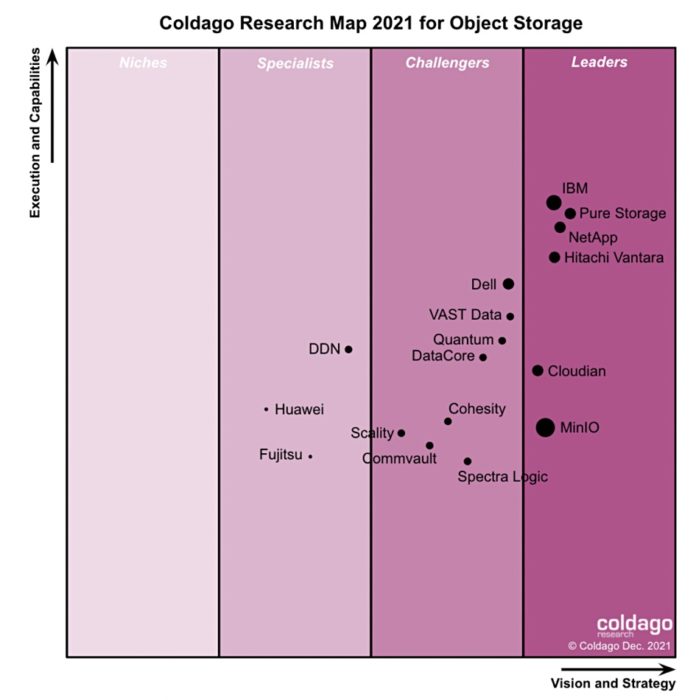

b) Storage software suppliers – Databricks, DataCore Software, Delphix, Diamanti, Komprise, Minio, Nutanix, SingleStore, Snowflake, and WekaIO:

The data platform for AI,

The data and AI company,

A leader in hybrid multicloud computing

The leader in analytics-driven data management as a service,

The largest independent vendor of Software-Defined Storage solutions,

The Data Cloud company,

The industry leading data company for DevOps,

The company that streamlines Kubernetes applications and data management for global enterprises,

The single database for all data-intensive applications,

A pioneer in high performance, Kubernetes-native object storage.

c) SmartNIC and DPU suppliers – Fungible, Liqid, Nebulon and Pensando:

The world’s leading software company delivering data center composability,

A pioneer in data-centric computing,

The leader in distributed computing for the new edge,

The pioneer of smart infrastructure, server-embedded infrastructure software delivered as-a-service.

d) Array suppliers – DDN, Hitachi Vantara, Infinidat, NetApp, Pure Storage, Qumulo and VAST Data:

A global cloud-led, data-centric software company,

The global leader in artificial intelligence (AI) and multicloud data management solutions

The digital infrastructure, data management and analytics, and digital solutions subsidiary of …

The storage software company breaking decades-old tradeoffs

A leading provider of enterprise-class storage solutions,

The IT pioneer that delivers storage as-a-service in a multi-cloud world,

The breakthrough leader in radically simplifying enterprise file data management across hybrid-cloud environments.

e) Media suppliers; an easy one with just Kioxia, Seagate and Western Digital:

A data infrastructure leader,

A world leader in memory solutions,

A world leader in mass-data storage infrastructure solutions

f) Data Protection – Acronis, Clumio, ExaGrid, Rubrik and Veeam:

The industry’s only Tiered Backup Storage solution,

The leader in backup, recovery and data management solutions that deliver Modern Data Protection

An industry leader in simplifying cloud data protection,

The Zero Trust Data Security Company

The global leader in cyber protection

Acronyms

What is the meaning of these acronyms?

- HAMR

- MAS-MAMR

- CXL

- HBM2e

- ETL

- EAMR

- ZNS

- EMIB

- iSCSI

- RoCE

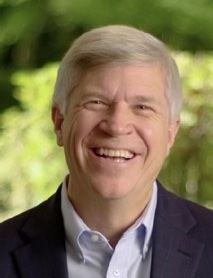

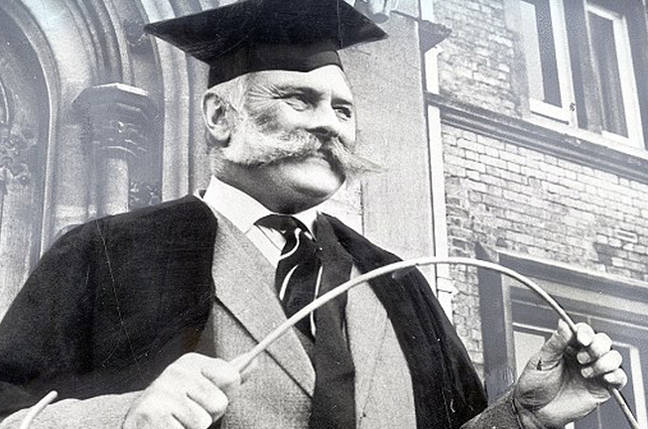

Nine more Storage Supplier CEOs

Match the names and faces of storage supplier CEOs:

Storage supplier logos

Which storage suppliers from Druva, Hitachi Vantara, Liqid, Rubrik, StorONE, WekaIO, Qumulo, Panzura and DDN do the logos belong to?

Spoiler alert! Answers below

Nine storage CEOs – from top to bottom by row left to right

- Hock Tan of Broadcom

- Antonio Neri of HPE

- Liran Eschel of CTERA

- Jill Stellfox of Panzura,

- Liran Zvebel of WekaIO

- Phil Bullinger of Infinidat

- Sumit Puri of Liqid

- Dario Zamarian of Pavilion Data

- Alex Bouzari of DDN

Press Release descriptions;

- (a) Nasuni, Egnyte, CTERA in order

- (b) WekaIO, Databricks, Nutanix, Komprise, DataCore Software, Snowflake, Delphix, Diamanti, SingleStore, MinIO in order.

- (c) Liqid, Fungible, Pensando, Nebulon in order.

- (d) NetApp, DDN, Hitachi Vantara, VAST Data, Infinidat, Pure Sturage and Qumulo in order.

- (e) Western Digital, Kioxia, and Seagate in order.

- (f) ExaGrid, Veeam, Clumio, Rubrik and Acronis in order.

Acronyms

- HAMR – Heat-Assisted Magnetic Recording

- MAS-MAMR – Microwave Assisted Switching-Microwave Assisted Magnetic Recording

- CXL – Compute Express Link

- HBM2e – High Bandwidth Memory gen 2 Extended

- ETL – Extract, Transform and Load

- EAMR – Energy-Assisted Magnetic Recording

- ZNS – Zone Nemespace Specification

- EMIB – Embedded Multi-die Interconnect Bridge

- iSCSi – Internet Small Computer Systems Interface

- RoCE – RDMA over Converged Ethernet with RDMA being Remote Direct Memory Access

Nine More CEOs

From top to bottom by row left to right;

- Herb Hunt – Nyriad,

- Coby Hannnoch – Weebit Nano

- Evan Powell – MayaData – now ex-CEO too

- Chris Gladwyn – Ocient

- Anand Eswaran – Veeam

- Mohit Aron – Cohesity

- Kumar Goswami – Komprise

- Rajiv Ramaswami – Nutanix

- Bill Andrews – ExaGrid.

Storage supplier logos

From top to bottom by row left to right;

- DDN, Panzura and Qumulo,

- WekaIO, StorONE and Rubrik,

- Liqid, Hitachi Vantara, and Druva.