Backup and cloud storage provider Backblaze has filed for an IPO and launched its roadshow.

It intends to offer 6,250,000 shares of its Class A common stock to the public at an expected price between $15 and $17 per share.

Backblaze was started up by seven people: CEO Gleb Budman, VP sales Nilay Patel, chief cloud officer Tim Nufire, server architect Billy Ng, CTO Brian Wilson, VP Casey Jones, and software engineer Damon Uyeda. Its website mentions and shows seven founders:

However the SI filing states: “Backblaze was incorporated … by five founders … Gleb, Brian, and Casey, joined shortly thereafter by Tim and Billy. … The first two [co-workers] after the five original founders deserve special mention as demi-founders: Damon Uyeda and Nilay Patel.” That clears that up.

Backblaze’s filing also says the founders “formed a salary tontine where, until the public offering is finalised, a core group of the original founders and some other very early employees agreed to make the same salary. This solidarity helped us build and sustain our culture through the first 14 years of our evolution.” That gives an insight into the somewhat unique company culture at Backblaze.

The company was incorporated in 2007 and decided not to go the venture capital route, preferring to bootstrap its operations. Consequently its funding events have been sparse: $300K in 2009, a $5 million A-round in 2012, and a $2 million event in 2020 plus a $10 million convertible note round in August this year. That’s just $17.3 million over 15 years.

The filing states: “Our operations have historically been efficient with limited outside investment. Prior to issuing $10 million of convertible notes (which we also refer to as a Simple Agreement for Future Equity agreement (SAFE)) in a private financing round in August 2021, we had raised less than $3 million in outside equity since our founding in 2007.”

Hmm. A 2012 Budman blog says Backblaze took in $5 million from TMT Investments.

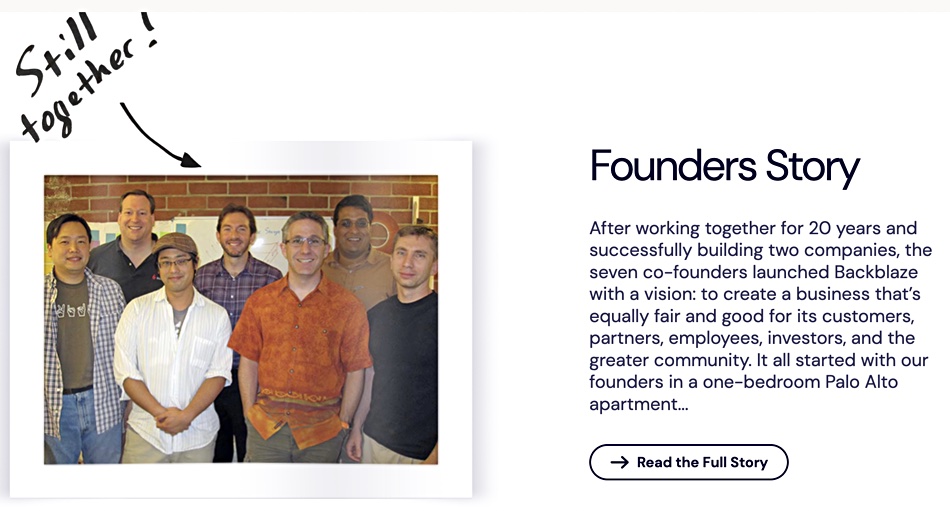

There are two main products: B2 Cloud Storage and Computer Backup. Its main competition comes from the big three CSPs: Amazon, Azure and Google. Backblaze also cites on-premises offerings from Dell EMC and NetApp as competition.

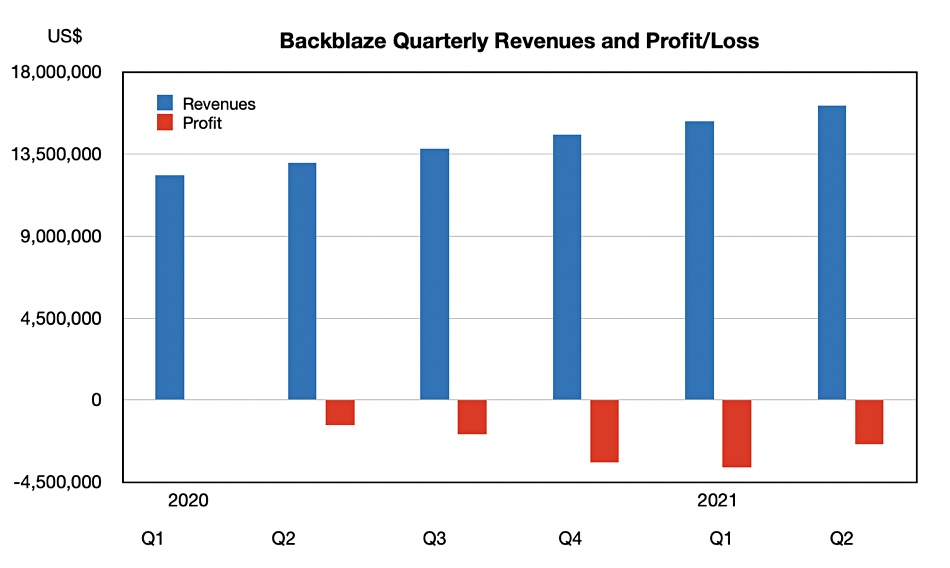

Backblaze has accumulated more than 500,000 customers, mostly mid-market, based in more than 175 countries. Some 28 per cent of its revenues come from outside the USA — this is a global business. It says it has a $65 million in annual recurring revenue (ARR) with a 100 per cent net retention rate. The current Backblaze annual revenue run rate is $64.6 million.

The company has relatively has low sales and marketing costs. Its filing states: “We have a highly efficient go-to-market model that is built on a self-serve selling motion. Prospective customers find us through a variety of channels including our website, partners, and brand advocates. We have fostered deep community engagement with valuable content we share on our blog — in 2020 alone, more than 3 million readers consumed content that we shared there. Our content encourages organic, inbound traffic that we believe serves as our greatest source of advocates and referrals.”

And, “in recent years we have begun to invest in a sales-assisted selling motion to identify opportunities to increase business with existing customers and to assist larger customers in adopting our services. Our sales-assisted selling motion has experienced substantial growth and helps customers that, in 2020, were approximately 20 times larger in terms of average revenue per customer than our self-serve customers.”

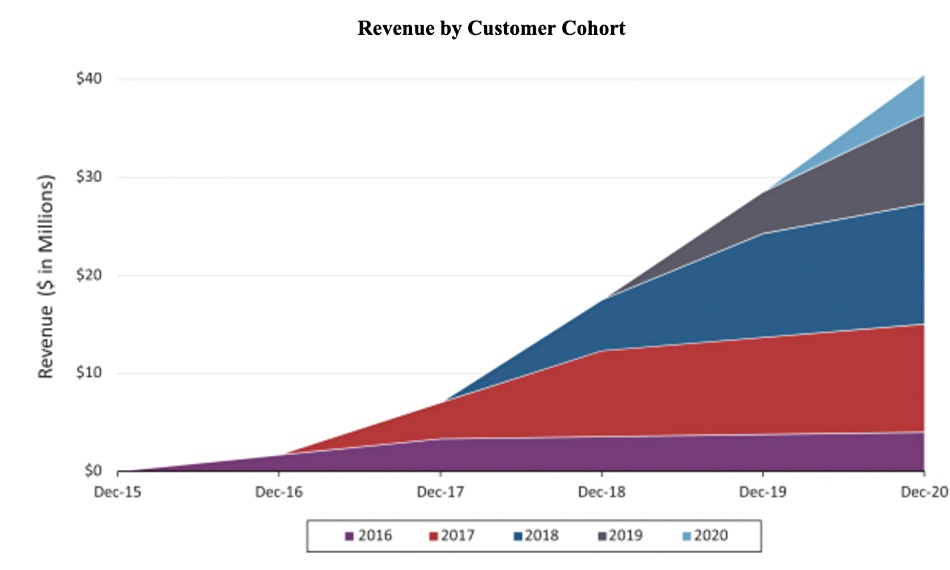

Substantially all of Backblaze’s revenue is recurring. It has a land-and-expand strategy — as customers generate, store, and back up more data, they use Backblaze more.

We are looking here at a steadily-growing business with loyal customers. Backblaze expects to launch new products adjacent to its current offerings, which will provide it with the ability to further cross-sell and upsell — and grow more.

We think a comparable and probably competing business is private-equity-owned Datto. It provides cloud backup services to over one million small and medium sized businesses (SMBs) through more than 17,000 managed service provider (MSPs) partners. Datto ran its IPO in October last year and raised $549 million.