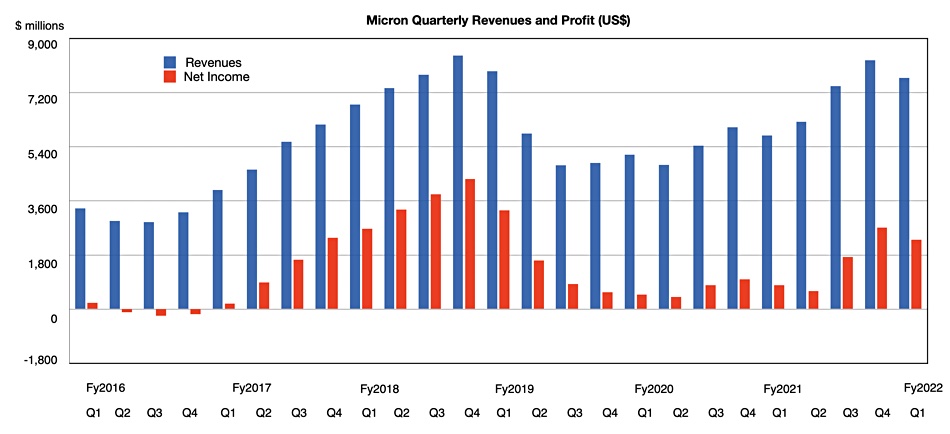

Micron revenues rose 33 per cent to $7.69 billion in its first fiscal 2022 quarter, ended December 2, 2021, as DRAM and NAND sales boomed to a record first quarter level.

There was a profit of $2.31 billion, a 187.7 per cent rise year-on-year, and representing 30 per cent of its revenues.

President and CEO Sanjay Mehrotra said in a results statement: “Micron delivered solid fiscal first quarter results led by strong product portfolio momentum. We are now shipping our industry-leading DRAM and NAND technologies across major end markets, and we delivered new solutions to data center, client, mobile, graphics and automotive customers. “

The market for its products looks good: “As powerful secular trends including 5G, AI, and EV adoption fuel demand growth, our technology leadership and world-class execution position us to create significant shareholder value in fiscal 2022 and beyond.”

His results presentation talked of “outstanding results and solid profitability. Micron is “on track to deliver record revenue and robust profitability in fiscal 2022.” This will be helped by Micron rapidly ramping its 1-alpha, said to be industry-leading, and 176-layer NAND products and achieving excellent yields; these products are now shipping across its major end markets. ”

DRAM represented 73 per cent of its revenues in the quarter, $5.6 billion – up 38 per cent annually, with NAND making up 24 per cent at $1.84 billion, a 19 per cent annual increase.

Revenues by business unit:

- Compute and networking – $3.4 billion, up 34 per cent Y/Y

- Mobile – $1.91 billion, up 27 per cent

- Storage – $1.15 billion, up 26 per cent

- Embedded – $1.22 billion – the second highest in Micron’s history and up 51 per cent – reflecting strength in auto and IoT markets.

The auto growth momentum was mentioned by Wells Fargo analyst Aaron Rakers, who said Micron currently sees Level 3 ADAS designs with 140GB of DRAM capacity vs. Gartner estimates that it’s currently at ~2.5GB/vehicle today. In NAND, Micron is seeing Level 3 ADAS vehicles with 1TB of capacity versus Gartner estimates of ~70GB/vehicle currently. These are huge rises.

Financial summary:

- Gross margin – 46.4 per cent compared to 30.1 per cent a year ago

- Cash from operations – $3.9 billion

- Diluted EPS – $2.04 compared to $0.71 a year ago

- Cash and cash equivalents – $8.68bn

Mehrotra said Micron was combatting supply chain issues with longer-term arrangements: ”We are seeing greater commitment and collaboration on supply planning, including the use of long-term agreements. Today, over 75 per cent of our revenue comes from volume-based annual agreements, a significant increase from five years ago when they accounted for around 10 per cent of our revenue.“

Micron will deal with demand for denser chips by employing transitions to smaller nodes in DRAM and continued layer count increases in 3D NAND. This strategy could run out of steam for DRAM after 2025 and it may then have to add more DRAM foundry capacity on a greenfield site.

The outlook for next quarter is for revenues of $7.5 billion plus/minus $200 million, a 20.3 per cent increase year-on-year. It is planning to deliver record revenue with solid profitability in FY22 with stronger bit shipment growth in the second half of the fiscal year.