’Tis the season for predictions — usually vendor predictions — and they always seem to predict, astoundingly, that demand for the vendor’s products will rise because the vendor’s strategic vision is correct. We thought we would try to make our own predictions.

But first a warning. I bought shares in Violin Systems in one of its incarnations — being impressed by the then-CEO, Kevin DeNuccio. Violin tanked and so did the shares, and so did my trust in my own judgement over such things. So take these predictions as a bit of fun.

1. There will be IPOs for Cohesity, Databricks, Druva, Rubrik and WekaIO.

Data protection-stroke-management has enabled Cohesity, started up in 2013, and Rubrik, founded in 2014, to grow very quickly indeed, and investing VCs must be baying for exit blood. They have invested more than $550 million in Rubrik and $660 million in Cohesity. Rubrik has been strengthening its board — an encouraging sign.

Data protector Druva, founded in 2008, has grown impressively too and reacted well to the move into SaaS services. There are $475 million of invested VC capital in Druva and it is waiting to be set free in a glorious exit.

Seven-year-old Databricks is part of the data analytics bandwagon, with the golden example of Snowflake’s IPO out there to emulate. Its total invested VC capital is an awesome $3.6 billion, making Cohesity, Druva and Rubrik look like VC-backed also-rans.

WekaIO is a file system phenomenon. It’s another 2013-era startup and has taken in just $67 million — a comparative minnow. It hired an exec chairman and also a president in August and has become the file system to beat in benchmarks such as STAC, and has won an eight-figure deal in the last couple of weeks.

2. 22TB HDD and 24–25TB SMR HDDs appear as the incremental disk drive development flywheel just carries on spinning.

The disk drive manufacturing triopoly members have all made announcements about making stepwise capacity advances towards a 30TB or so gateway to HAMR technology.

Western Digital is talking about 10- and even 11-platter drives, which would add around 2.2TB per platter to current 9-platter 20TB drives. It has its OptiNAND controller flash and firmware technology and Toshiba has its MAS-MAMR providing rungs in the capacity ladder reaching upwards to 30TB.

Seagate is actively developing HAMR but keeping capacity pace with Western Digital in conventionally recorded drives.

It is a golden era in hard disk drive developments.

2a) Toshiba will introduce a 20TB disk drive.

The company is at the 18TB level while both Seagate and Western Digital have 20TB offerings. Toshiba has its MAS-MAMR technology and we are convinced a 20TB drive will be announced by the middle of 2022.

3. Ruler format SSDs appear in servers and arrays.

This is a little behind the curve, as they have already started appearing — for example Inspur has launched a ruler-supporting reference server system with Samsung. DDN has also said it will support EDSFF drives. These drives enable more flash capacity in standard chassis than the classic 2.5-inch (U.2) and M.2 drive formats.

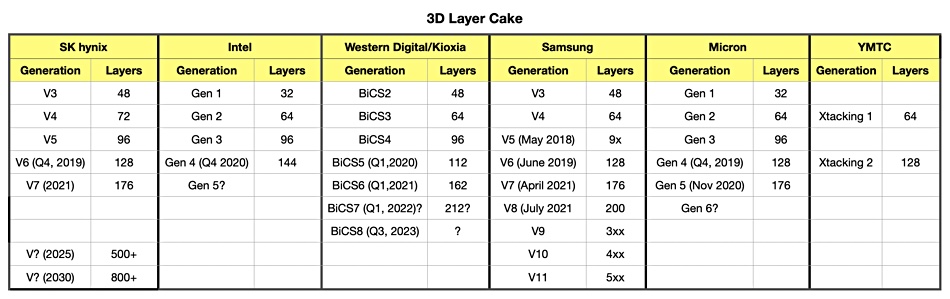

4. 3D NAND layer counts creep past 200 as new technology levels in NAND manufacturing are reached.

SK Hynix introduced 176 layers this year while Kioxia and Western Digital reached 162 with their BiCS 6 technology. We think we may hear about BiCS 7 and, say, 212 layers, in 2022.

Samsung reached 176 layers this year with its V7 tech and V8 with 200+ layers beckons. Micron reached the 176 layer count in November 2020 and so its next step, to generation of its 3D NAND, will probably break past the 200 level as well.

5. One or more of AWS, Azure and the Google Cloud Platform will provide their own in-cloud backup services.

There have been several suppliers providing in-public cloud application backup services, such as Clumio. Cohesity has its offering and so too does Druva.

It seems to us that the big three cloud vendors — AWS, Azure and GCP — are leaving money on the table. It’s not inconceivable that one of them may buy a data-protection vendor to get the technology they need. After all, GCP bought Elastifile to get the in-cloud filesystem technology it needed.

5. VC will pump money into data lake and allied analytics software.

The example of Snowflake’s IPO and Databricks’ incredible $3.6 billion funding will make my software startup with technology to access, store, manage and analyse data better look attractive to VCs. Blinded by the Snowflake/Databricks light they will pour money into the likes of Airbyte, Ahana, and Dremio.

6. Both Infinidat and VAST Data will emerge as a major high-end storage array and filer suppliers.

Infinidat has weathered the CEO handover from Moshe Yanai to Phil Bullinger. The new CEO is emphasising the channel more and Infinidat’s memory-caching technology works with all-flash capacity storage as well as all-HDD. Bullinger has extended Infinidat’s exec team and hired IBM’s chief storage marketeer, Eric Herzog, to do the same job for Infinidat. As Infinidat’s high-end block access array fortunes rise, so too will IBM’s storage hardware sales fall, until a new mainframe gets the DS8000 moving again.

VAST Data is a phenomenon. It’s notching up huge sales wins for its all-flash file storage access, like seven-figure wins at the Department of Defense and was valued at $37 billion at an $83 million fourth round of funding in May.

Back then we said: “It launched its first product in 2019 and ended its second fiscal year with nearly 100 customers and a near-$100 million run rate of annualised software revenues, quadruple that of 2020. It was also cash flow-positive.” VAST has exited the hardware business and launched an initiative to go into the fast restore business — the turf that Pure’s FlashBlade has had all to itself up until now.

We think that both Infinidat and VAST Data will be thinking about their IPO prospects. We also think other companies will be looking at them as possible acquisition targets.

7. Either Komprise or Hammerspace may be acquired.

The reasoning here is that unstructured data amounts are growing and growing and growing. The ability to keep track of huge populations of files — think trillions — and huge multi-exabyte-plus capacities while using tiering to manage costs will become more and more important. Ocient in the structured data space is similarly well-positioned though at an earlier stage of corporate development.

8. Cisco will exit the server market.

It is no longer a large enough portion of its business to worry about. The UCS presence in the hyper-converged market is nearly nonexistent. Cisco’s UCS products are getting squeezed between Dell EMC and HPE on the one hand, and Supermicro and ODM manufacturers on the other. Sell it off Mr Robbins, and use the capital more productively elsewhere.

9. The flash/disk crossover will not happen.

Flash costs per TB are not declining fast enough to overtake declining HDD cost per TB. Both Seagate and Western Digital are confident that any crossover with flash becoming less expensive in cost per TB terms is at least a decade away. The flash industry is not making positive noises about penta-level cell flash (5bits/cell) and the marginal gains from 3D NAND layer count increases appear to be diminishing.

10. PCIe 4 will become mainstream and PCIe 5 will start making inroads.

This will pave the way for CXL and server CPU-memory disaggregation. Exactly how this will play out is unclear.

11. Computational storage and DNA storage will make incremental progress, but neither will experience a breakout.

The former because it doesn’t yet have killer use cases and the latter because it is simply too slow, no matter its incredible density.

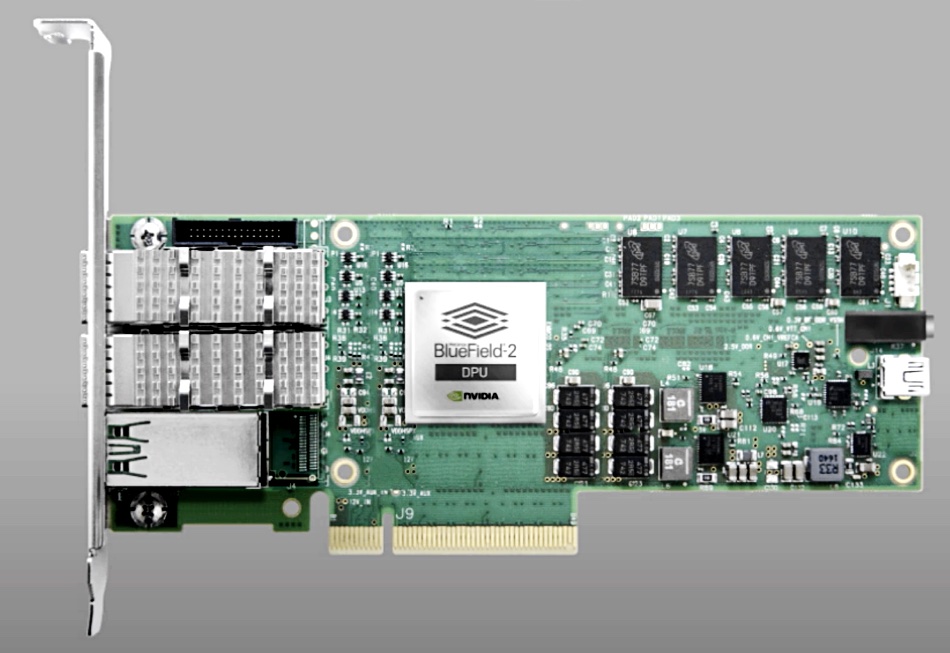

SmartNICs and DPUs will also make incremental progress, as will composable systems software. Other minor predictions are that Intel will re-commit to Optane and introduce a third-generation technology with an increased layer count. No container storage startup will make a breakthrough, as all the major storage suppliers have their own Kubernetes technology.

That’s it. Shoot them down if you wish. There’s a target on my back ready and waiting.