SK Hynix is rebranding its acquired Intel SSD business as Solidigm with Intel’s ex-non-volatile products boss Rob Crooke as its CEO.

This is only the first phase of a 2-stage transaction, and SK Hynix is making a $7 billion stage payment to buy Intel’s SSD business and the Dalian NAND flash manufacturing facility in China.

The second phase will see SK Hynix pay Intel $2 billion around March 2025 to complete the deal and get IP related to the manufacture and design of NAND flash wafers, R&D employees for NAND flash wafers, the Dalian facility workforce, and the other associated tangible and intangible assets.

SK Hynix vice chairman and co-CEO Park Jung-ho issued a statement: “This acquisition will present a paradigm shifting moment for SK Hynix’s NAND flash business to enter the global top tier level. With this acquisition, SK hynix will be one step further in its path towards [becoming a] global first technology company.”

Crooke said: “Solidigm is poised to be the world’s next big semiconductor company, which presents an unprecedented opportunity to reinvent the data memory and storage industry. We are steadfast in our commitment to lead the data industry in a way that can truly fuel human advancement.”

Steady on. Let’s not get carried away Rob.

SK Hynix subsidiary Solidgm is headquartered in San Jose and will manage product development, manufacturing, and sales of its SSD products separate from SK Hynix’s NAND products. The name Solidigm, it says, refers to it creating “a new solid-state paradigm that provides unmatched customer service and revolutionises the memory storage industry.”

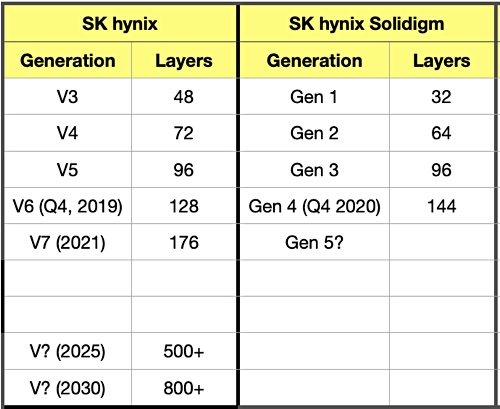

It’s not clear how it will do that as it is lagging the industry in terms of 3D layer count. While competitors are introducing 176-layer product Solidigm is at the 144-layer level. Secondly it has no storage-class memory technology as Intel is retaining its Optane business. SK Hynix says it, Solidigm, and Intel will cooperate with each other for a successful final close of the acquisition deal. It seems to us that, were Solidigm to introduce a storage-class memory product competing with Optane, then Intel would be mightily displeased.

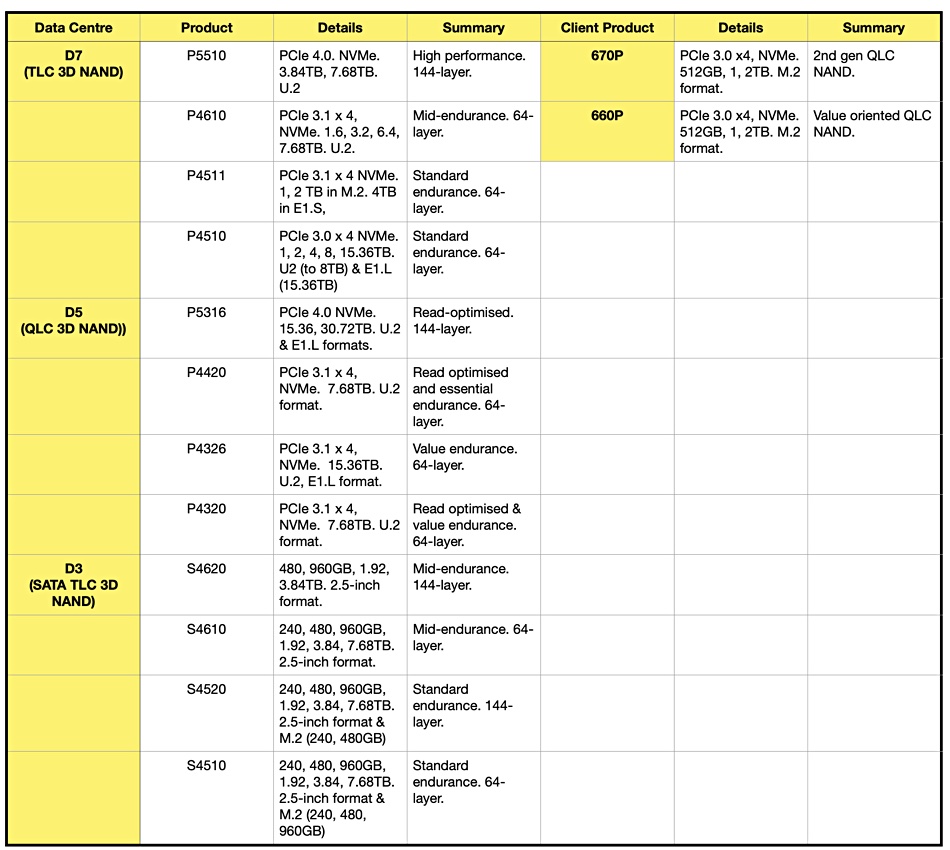

Solidigm product portfolio

According to its website there are a dozen Solidigm data centre SSD products, organised into three product groups, and just two client SSD products:

A look at the table of products suggests that the company needs to roll out its 144-later technology further across its D7, D5 and D3 products as well as extending its PCIe 4.0 capabilities.

We would expect it to be developing a greater-than-144-layer product, technology, particularly as SK Hynix is already developing 176-layer products, such as its Platinum P41 PCIe gen 4.0 gaming SSD.

We would also expect Solidigm to have PCIe gen 5.0 interface technology under development. Competitor Kioxia is active in this area as is Samsung with its PM1743 enterprise server SSD. If Solidigm really does want to revolutionise the memory storage industry then it has to get ahead of its competitors in terms of 3D NAND layers and PCIe interface technology, and have a presence in the storage-class memory area.