Data protector and manager Cohesity just recorded its best ever results with its fourth quarter fiscal 2021 numbers, showing a $300 million run rate, leading us to ask: what’s next?

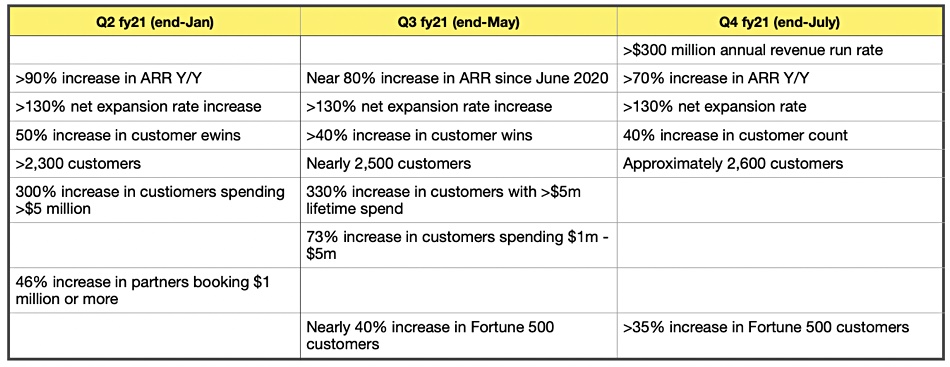

Cohesity is a startup, hence not subject — yet — to SEC reporting rules. The quarter finished on Juy 31 and it’s announced a great set of numbers, previously hinted at by a tweet from CEO and co-founder Mohit Aron. We’ve tabulated the main points and compared them to similar numbers from the previous two quarters:

CFO Robert O’Donovan put out a statement saying: “In Q4, we had our biggest day, week, month, and quarter, all resulting in our biggest year. From rapidly increasing ARR, to an outstanding net expansion rate, to strong customer growth — including impressive gains in the Fortune 500, the company is firing on all cylinders and breaking records at every turn.”

The net expansion rate number means the rate of expansion net of churn from existing customers over the last year, and it’s been consistent for three quarters. The average customer win rate per quarter is holding up in the 40 to 50 per cent area. The Fortune 500 penetration rate increase has been 35 to 40 per cent for two consecutive quarters. Cohesity customers include four of the Fortune top 10 as well as three of the top ten US banks and three of the top five US health insurers.

Aron said: “More businesses than ever trust Cohesity to manage their data in a world in which ransomware attacks are soaring, hybrid cloud is the norm, and the need to derive value from data has never been greater.” The auguries look good.

Cohesity has added three new members to its board over the past year:

- Kimberly Hammonds — previously the group COO of Deutsche Bank AG;

- Robin Matlock — joined Cohesity’s board in January, most recently CMO at VMware;

- Bask Iyer — served as CIO and Digital Transformation Officer for VMware before becoming a Cohesity Advisor.

Comment

Cohesity’s business is booming steadily, the SaaS transition is progressing well, and the board has been strengthened. What next?

In effect Cohesity has said its Q4 pulled in $75m in revenues, thus giving it the $300m run rate. Nutanix had a $74m quarter in Q4 of its fiscal 2015 year, ended July 31, 2015, and IPO’d in September 2016. Pure Storage reported a $74m Q1, ended May 2, 2015, its fiscal 2016. It IPO’d in October 2015.

We think a Cohesity IPO is rapidly becoming a foregone conclusion, with 2022 as the likely year. Get the Chief Revenue Officer replacement for Michael Cremen in place, start fiscal 2022 with another good quarter, and then file the papers with the SEC. That’s this hack’s thinking of what might happen.