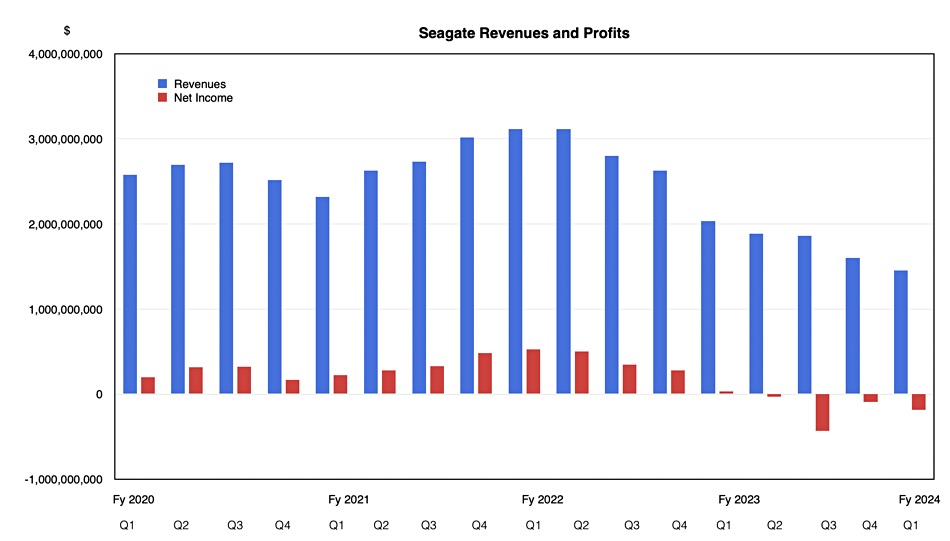

Western Digital has concluded its strategic review and intends to separate its existing hard disk drive and flash/SSD businesses into two separate publicly listed companies by the second haf of calendar 2024.

The strategic review was announced in June last year following input from Western Digital shareholder and activist investor Elliott Management, which calculated the flash and SSD part of the business was under-valued and overshadowed in investor sentiment terms by the HDD division. The message was loud and clear: a standalone flash and SSD business would have a higher value, and WD shareholders would benefit from this.

WD CEO David Goeckeler confirmed the decision: “Separating these franchises will unlock significant value for Western Digital shareholders, allowing them to participate in the upside of two industry leaders with distinct growth and investment profiles.”

He added that both the HDD and flash/SSD markets are emerging from a long downcycle: “Moving forward, as we progress through fiscal year 2024, we see an improving market environment in both businesses, and we will remain open to strategic opportunities that unlock further value in both our HDD and Flash investments and assets.”

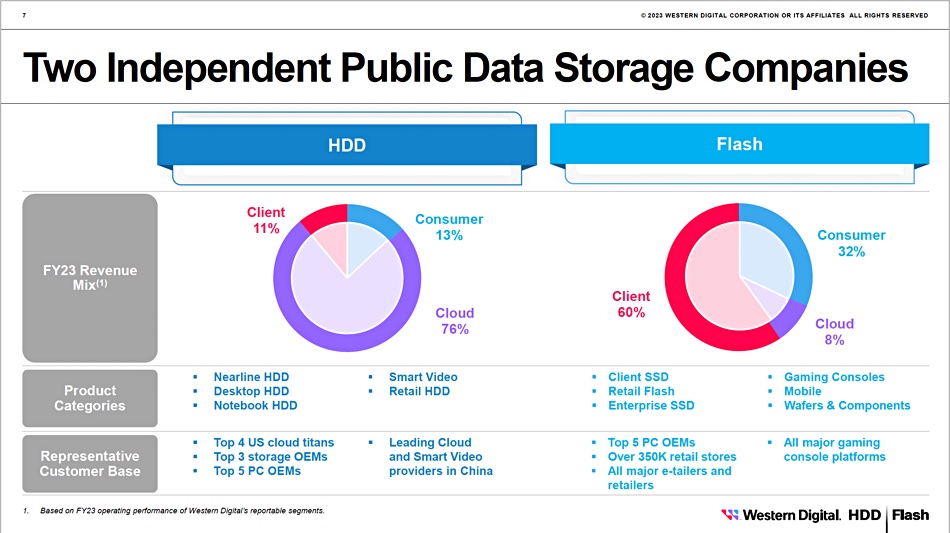

The HDD business will be called Western Digital, and the to-be-spun-out flash and SSD business has yet to be named. In WD’s first quarter for fiscal 2024, ended September 29, revenue generated by the flash/SSD division was $1.56 billion versus the HDD business unit’s $1.19 billion.

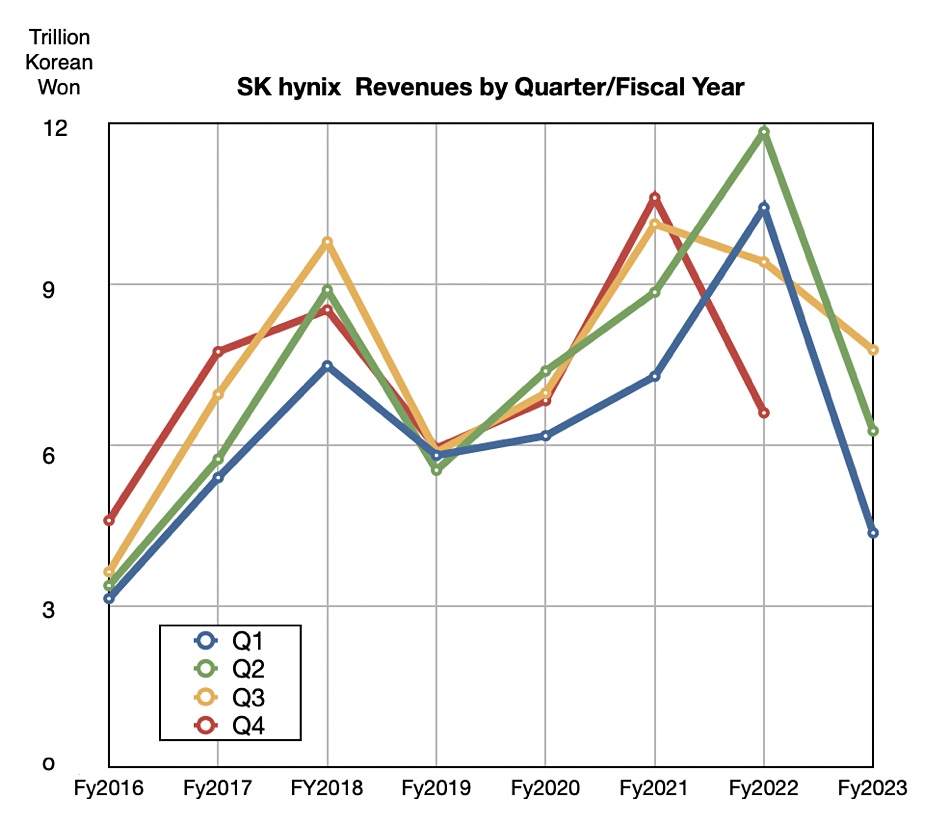

The jewel in the crown for the Flash division is the joint venture with Kioxia to fabricate NAND chips in Japanese foundries, with each company building their own SSDs using the chips. WD estimates Kioxia had an 18 percent share of the calendar 2022 NAND market, with WD having 13 percent, meaning a combined 31 percent share behind industry leader Samsung with 34 percent and ahead of SK hynix (19 percent) and Micron (12 percent).

WD got into the flash business by buying SanDisk for $19 billion in 2015. SanDisk had a NAND fab joint-venture with Toshiba, which WD obtained through this transaction. Toshiba spun off its NAND business into Kioxia in an $18 billion transaction with a Bain Capital-led consortium in September 2017.

An attempt to merge WD’s flash business with Kioxia failed a few days ago when Kioxia shareholder SK hynix objected. It would seem likely that WD execs were waiting to see what happened with Kioxia before revealing the separation plan for the Flash unit.

The final determination to separate will be subject to WD board approval, the execution of definitive documentation, and receipt of opinions or rulings as to the tax-free nature of the transaction for shareholders that are given shares in the spun-off flash business. It also needs satisfaction of customary conditions, including effectiveness of appropriate filings with the U.S. Securities and Exchange Commission, the completion of audited financials, and the availability of financing.

Western Digital said its Board remains open to considering any alternatives that deliver superior value to the proposed separation should they become available. For the time being Ellliott Management can look forward to completing another activist investor engagement.