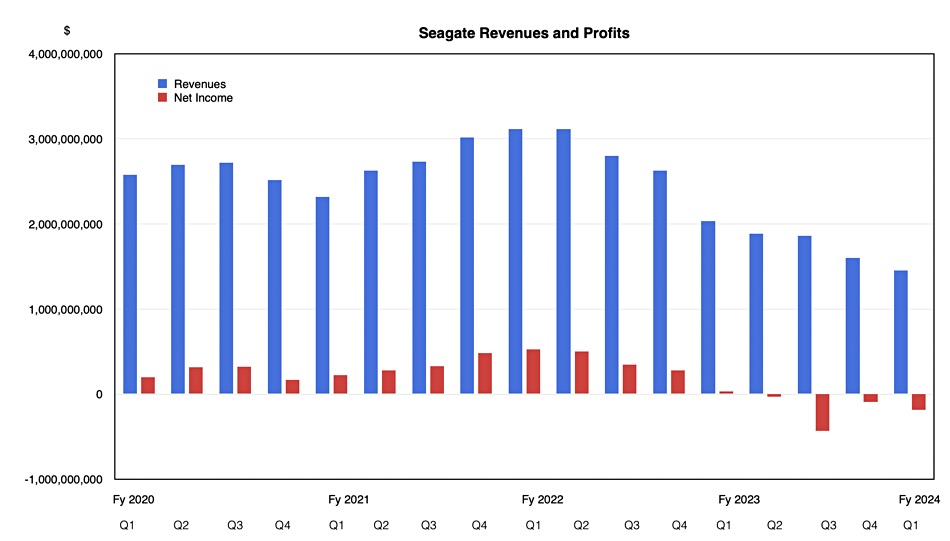

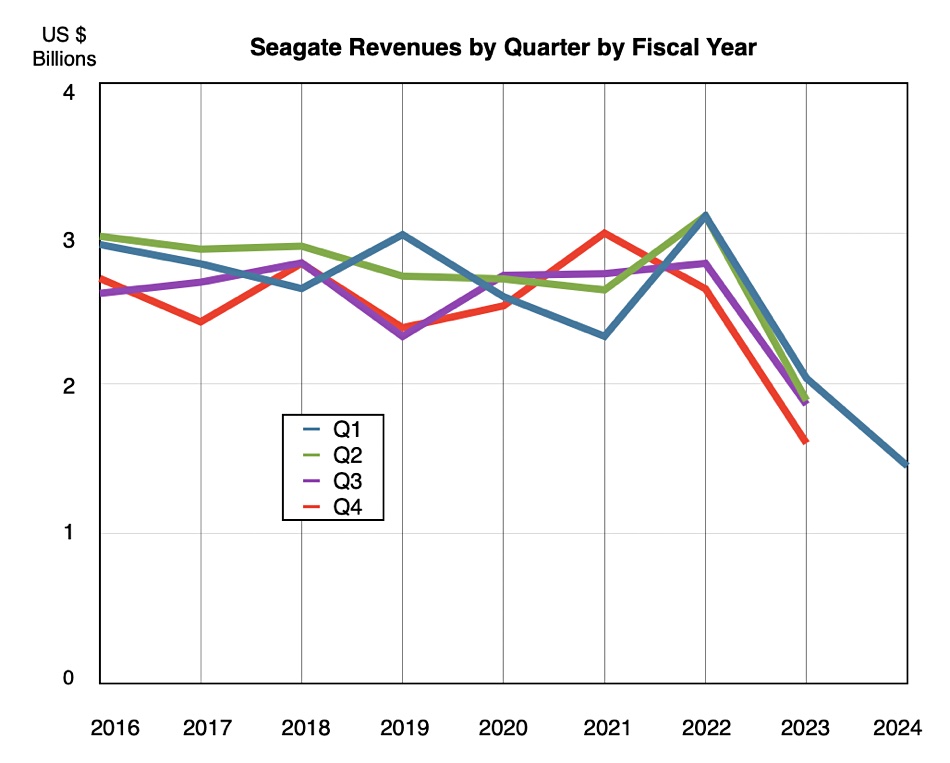

Revenue declines continue at Seagate – first quarter fiscal 2024 earnings were 29 percent lower than a year ago, when they were 35 percent down on the year before that.

Seagate’s customers haven’t been buying enough high-capacity disk drives for the company to make a profit for four quarters in a row. Turnover in the quarter ended September 29 was $1.54 billion, compared to $2.04 billion a year ago. It reported a loss of $184 million in contrast to $29 million profit a year ago.

We’re used to Seagate making profits in the hundreds of millions, but that was a year and a half ago.

CEO Dave Mosley was not upbeat in his statement: “Seagate’s first quarter results were in line with our revised expectations. During a longer-than-typical downcycle we have prioritized financial discipline, positive free cash flow generation and execution on our HAMR product roadmap, which will extend our industry leadership in areal density and improve the total cost of ownership for our customers.”

He pointed to weak demand in China, worse-than-anticipated legacy drive demand, and continued inventory digestion in the hyperscalers. Mosley did say there were “indications that demand fundamentals in certain markets are starting to improve, including a modest uptick in US cloud.” Overall Seagate saw depressed demand across its three end markets: mission-critical (10K rpm, 2.5-inch), client, and consumer. Enterprises are generally cautious in their IT spending at the moment. We note that customer organizations may be prioritizing flash over disk storage in their generative AI-led IT spending.

Mosley’s earnings call statement said: “Spending priorities for CSPs have temporarily shifted toward AI-related infrastructure, which have further slowed the pace of demand recovery for mass capacity storage.”

Financial summary

- Gross margin: 10.2 percent vs 23.7 percent a year ago

- Operating cash flow: $127 million

- Free cash flow: $57 million

- Cash and cash equivalents: $795 million vs year-ago $761 million

- Diluted EPS: -$0.88 vs $0.14 a year ago

Seagate said mass capacity HDD demand rose slightly quarter-on-quarter, led by the video surveillance market, but this was not enough to offset general market reluctance.

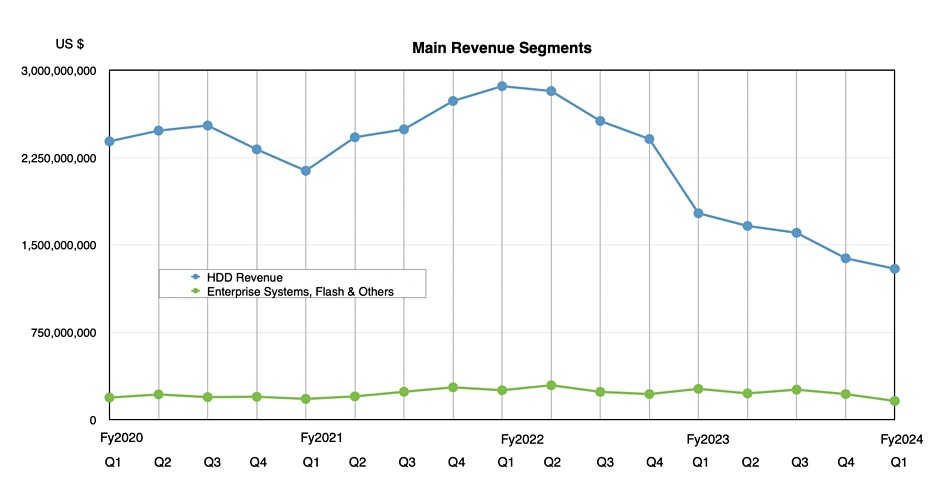

HDD revenues in the quarter were $1.3 billion, 84 percent of its overall revenues, with the nearline drives bringing in 79 percent of that, $1.02 billion, down 36 percent annually. Legacy drives (2.5-inch, PC, consumer) brought in $278 million, down 29 percent year-over-year.

It shipped 89.6 EB of disk capacity, down 24 percent year-over-year, of which mass capacity represented 79.2 EB, down 24 percent year-over-year, and within that, nearline accounted for 56 EB, down 34 percent annually. The average capacity per drive was 75 TB, down 1 percent on a year ago, with nearline average capacity being 10.3 TB, down 13 percent annually.

Systems, meaning JBODs like Corvault and SSDs, generated just $159 million, down 40 percent year-over-year and 27 percent quarter-over-quarter.

Generally speaking, it’s a blood bath in the HDD market. Seagate is managing its costs and debt, $5.57 billion vs $6.25 billion a year ago, and waiting for hyperscalers, OEMs, and system builders to start buying in larger quantities again.

Looking ahead on the technology front, Seagate said its recently announced 24 TB PMR drive is set to enter a volume shipment phase in the first half of calendar 2024 (Q3 and Q4 FY 2024). A volume ramp would also begin in that period for its 3+ TB/platter class HAMR drives, meaning 32 TB drives initially. These have up to ten platters and will have enhanced capacity shingled magnetic recording (SMR) variants.

It said 4+ TB/platter HAMR tech would be introduced within the 2024-2026 calendar years, implying 40 TB+ drives with higher capacity SMR variants again. All this should enable HDDs to keep their cost/TB advantage over QLC (4 bits/cell) SSDs. Mosley said: “Simply put, we offer customers mass data storage at less than one-fifth the cost of comparable NAND solutions on a per-bit basis. We don’t foresee that value gap closing over the next decade relative to data center architectures.”

The company’s outlook for the second quarter of fiscal 2024 is revenues of $1.55 billion +/- $150 million, 18 percent lower than a year ago at the mid-point. In the next two quarters after that, Seagate will ramp up HAMR tech disk drive production and could have a significant capacity-per-disk lead over Toshiba and Western Digital to start capturing market share.

We expect Western Digital to report similarly depressed disk drive revenues on October 30.