IBM reported 4.6 percent revenue growth for Q3 2023, ended September 30, and banked $1.7 billion in profit – a radical turnaround from the $3.2 billion loss a year ago.

In prepared remarks, chairman and CEO Arvind Krishna said: “In the third quarter, we had solid growth across revenue, profit, and free cash flow while delivering innovations and positioning our business to capture future opportunities.”

From his vantage point: “We see both tailwinds and headwinds to overall spending. Nearly every business we talk to wants to leverage technology to offer better services, scale more quickly, and fuel growth without increasing their footprint. This has been driving demand for technologies that boost productivity and competitiveness, like hybrid cloud and artificial intelligence. Overall, we believe the tailwinds outweigh the headwinds, and technology spend will continue to outpace GDP.”

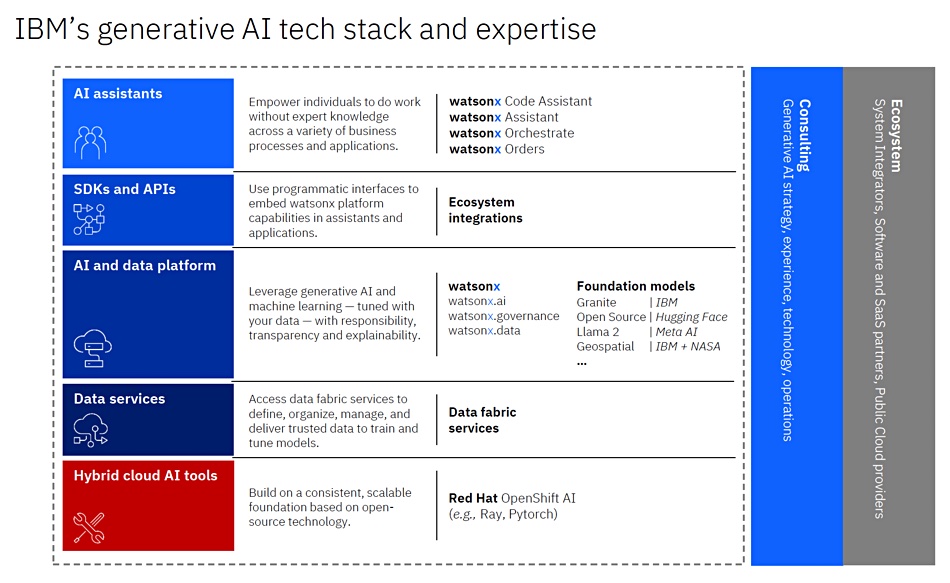

He spoke a lot about generative AI and IBM’s watsonx products. GenAI will be multi-modal and the “software stack starts with Red Hat OpenShift, which serves as the foundation that allows clients to operate in a hybrid environment,” Krishna said.

Yesterday Dell announced a validated design for Red Hat OpenShift AI on APEX Cloud Platform – meaning Dell PowerEdge server hardware and PowerFlex storage software.

Krishna talked about a flood of watsonx AI products and data+GenAI consultants, more than 20,000 of them.

He told the earnings call that AI would enhance productivity without causing developer layoffs. But the same couldn’t be said for other areas. “When you go to customer service, there is a cost takeout aspect, but it’s not 100 percent. But there is probably a 20 percent to 30 percent. If you can have more calls, more chats answered by AI, that means you can have much more volume with a smaller number of people. So there’s both.”

He added: “AI does not get tired. It doesn’t get angry. It doesn’t get upset. So there is an NPS improvement to get along with it.”

Financial summary

- Gross Profit Margin: 54.4 percent vs 52.7 percent a year ago

- Operating cash flow: $3.1 billion, up $1.2 billion year-over-year

- Free cash flow: $1.7 billion, up $0.9 billion year-over-year

- Cash & marketable securities: $11 billion, up from $2.2 billion at end of 2022

- Debt: $55.2 billion, up $4.3 billion since end of 2022.

Storage revenues are spread across the Software reporting line and the Infrastructure (hardware) reporting line. In the Infrastructure segment, with $3.27 billion in revenues, IBM noted that there are two sub-segments:

- Infrastructure support: $1.3 billion, down 7 percent year-over-year

- Hybrid Infrastructure: $1.9 billion, flat year-over-year

Within hybrid infrastructure, zSystems (mainframe) was up 9 percent year-over-year while distributed infrastructure was down 6 percent, reflecting Power10 server growth offset by storage declines.

Teasing out storage revenue from the Software segment is near-impossible. IBM software revenues of $6.3 billion were split between transaction processing ($1.8 billion; up 5 percent year-over-year), Hybrid Platforms and Solutions ($4.5 billion, up 7 percent), and four sub-segments with no identified revenue amounts:

- Red Hat – up 8 percent year-over-year

- Automation – up 13 percent

- Data & AI – up 6 percent

- Security – down 3 percent

In the Data & AI area, CFO and SVP Jim Kavanaugh said: “Growth areas include Data Fabric and Customer Care as enterprise clients are both preparing for and adopting generative AI solutions, leveraging watsonx.”

In a Wells Fargo-moderated Gartner report, IBM’s all-flash array revenues in the second 2023 quarter were calculated to be around $375 million, ahead of Pure, HPE, and Hitachi, and trailing Dell, Huawei, and NetApp. Add storage software to that and IBM could make a song and dance about its storage revenues if it wanted to, but prefers to say virtually nothing.

The outlook for the final quarter of IBM’s fiscal 2023 is revenue growth of 3-5 percent at constant currency.