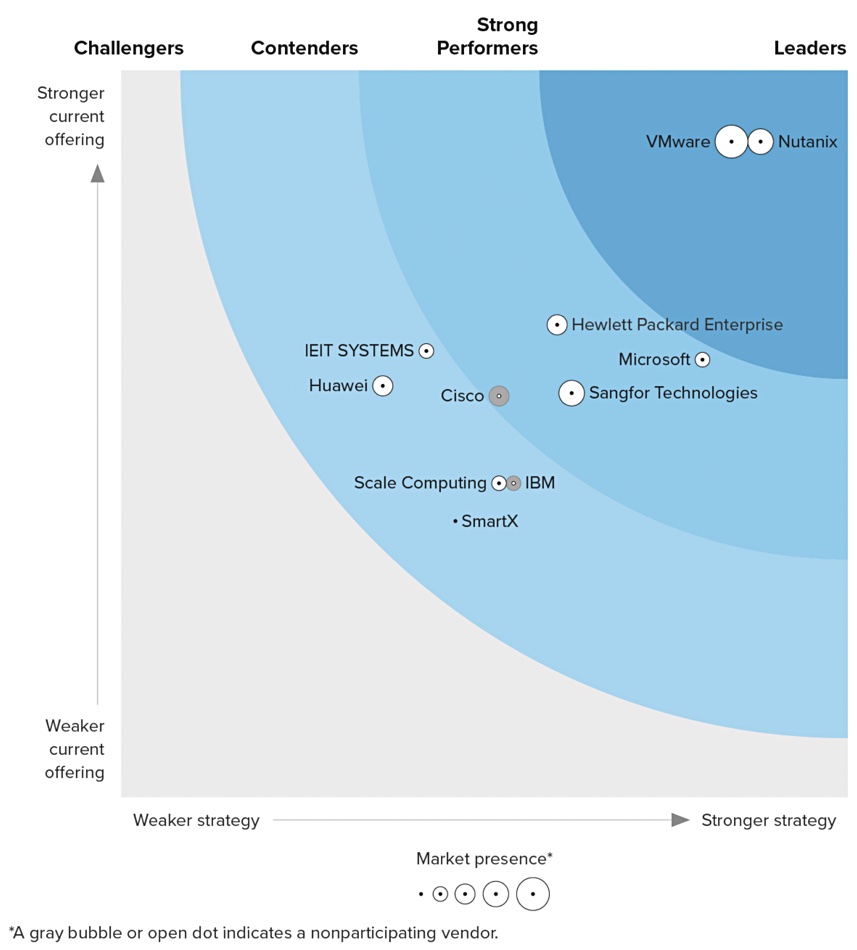

VMware and Nutanix are the only two leaders in Forrester’s Wave report on hyperconverged infrastructure (HCI) – Nutanix being slightly in front and everyone else – bar Microsoft – losing status or exiting the HCI landscape.

IT research consultancy Forrester provides so-called Wave reports on IT market segments with vendors categorized as Challengers, Contenders, Strong Performers, and Leaders. They are placed in a two-dimensional quarter circle space with a vertical weak-to-strong current offering axis, and a horizontal weak-to-strong strategy axis. Challengers, Contenders, Strong Performers, and Leaders have separate and concentric areas going from left (Challengers) to right (Leaders). The size of a vendor’s circle represents market presence.

After the two leaders comes three strong performers: Microsoft, HPE (SimpliVity), and new entrant Sangfor Technologies. There are four Contenders: Scale Computing, IEIT Systems, Huawei, and new entrant SmartX. Cisco, which has just canned its own HyperFlex product in favor of a Nutanix-powered system, did not participate, and neither did IBM with its Storage Fusion product. There are no Challenger suppliers.

When we compare this chart with the one Forrester prepared three years ago, supplier consolidation becomes quite visible:

Cisco has given up on its DIY approach. NetApp has exited the market. HPE has fallen back, as has Huawei. DataCore has exited the market. Scale Computing has fallen back. Microsoft (Azure Stack HCI) has hung in there. Pivot 3 crashed and burned, selling its assets to Quantum. Red Hat, acquired by IBM, did not participate in Forrester’s report.

Let’s see what Forrester consultant and report author Brent Ellis says about individual suppliers:

- HPE SimpliVity has new life as the HCI underpinnings of HPE GreenLake for Private Cloud Business Edition.

- Sangfor stands out in identity management, but otherwise delivers expected functionality.

- IEIT Systems’ dSAN and InCloud Rail constitute a good HCI platform, but needs further focus.

- IBM’s bare metal container HCI platform is disruptive, but OCP coupling limits adoption.

- Scale Computing scales out at the edge, but leaves scale-up workloads behind.

- Huawei has mastered scaling up and down, though it provides a mediocre HCI product.

- SmartX is gaining traction in APAC but must fill feature gaps as it grows.

Overall, Ellis says HCI suppliers should have good snapshot and replication facilities, disaggregated compute and storage resource scaling, and comprehensive virtualized network function support such that networks can stretch across cloud, datacenter, and edge environments.

Get a copy of the report from Nutanix, registration required.