Solidigm has unveiled its latest product, the D5-P5336, featuring storage capacity of 61.44TB. This drive is currently the largest capacity PCIe drive available on the market and utilizes QLC (4bits/cell) flash technology while delivering performance comparable to TLC (3bits/cell) drives.

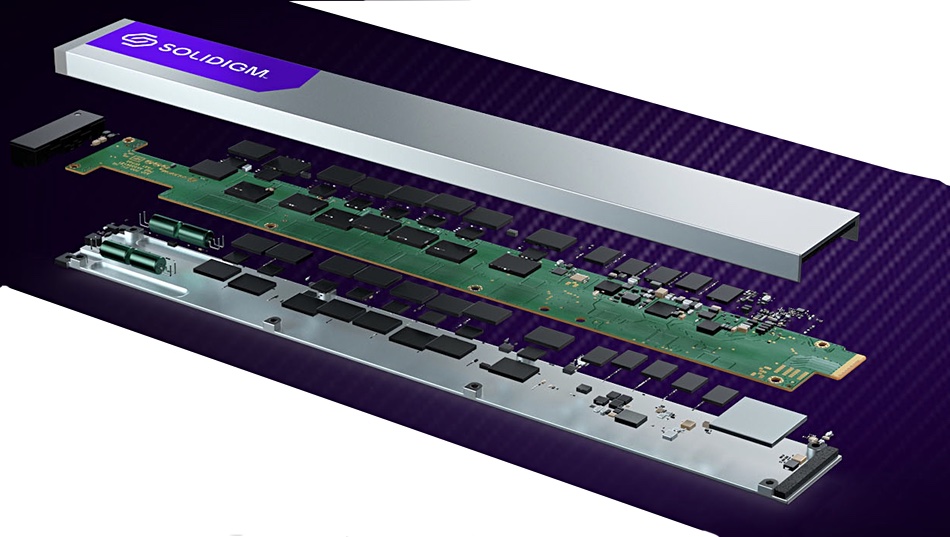

Building on its predecessor, the D5-P5430, the D5-P5336 is designed as a value endurance read-intensive product. The D5-P5430 remains a mainstream read-intensive drive, topping out at 30.72TB. Both drives are available in U.2, E1.L, and E3.S formats, built on 192-layer 3D NAND technology. The D5-P5336 incorporates a 16KB indirection unit, an upgrade from the previous 4KB unit, resulting in faster read operations through logical block address to physical block address mapping.

Greg Matson, VP of Strategic Planning and Marketing at Solidigm said: “Businesses need storage in more places that is inexpensive, able to store massive data sets efficiently and access the data at speed. The D5-P5336 delivers on all three – value, density and performance. With QLC, the economics are compelling – imagine storing 6X more data than HDDs and 2X more data than TLC SSDs, all in the same space at TLC speed.”

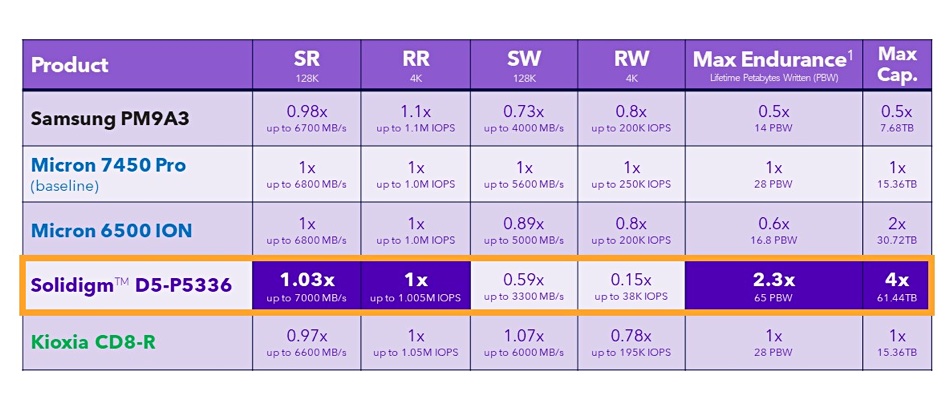

The drive in U.2 format starts with a 7.68TB capacity, doubling its capacity in three steps to 61.44TB. The physically smaller E3.S format has a 7.68TB to 30.2TB range while the physically larger E1.L ruler format starts at 15.36TB, maxing out at 61.44TB like the U.2 product. This PCIe gen 4-connected drive boasts maximum speeds of 1,005,000/43,000 random read/write IOPS, 7GBps sequential read bandwidth, and 3.3GBps sequential write bandwidth, making it ideally suited for read-intensive workloads, particularly when contrasted with the D5-P5430, which delivers 971,000/120,000 random read/write IOPS, 7GBps sequential read and 3GBps sequential write bandwidth.

Compared to some datacenter TLC drives, the D5-P5336 excels in read-intensive performance, even though TLC flash is generally faster than QLC NAND. For example, the SK hynix PE811, a PCIe gen 4 drive utilizing 128-layer TLC NAND, outputs 700,000/100,000 random read/write IOPS and 3.4/3.0 GBps sequential read/write bandwidth.

Solidigm conducted a comparative analysis, normalizing to Micron’s 7450 Pro:

The five-year endurance is up to 0.58 drive writes per day (DWPD), varying with capacity: 7.68TB – 0.42; 15.36TB – 0.51; 30.72TB – 0.56; and 61.44TB – 0.58 DWPD.

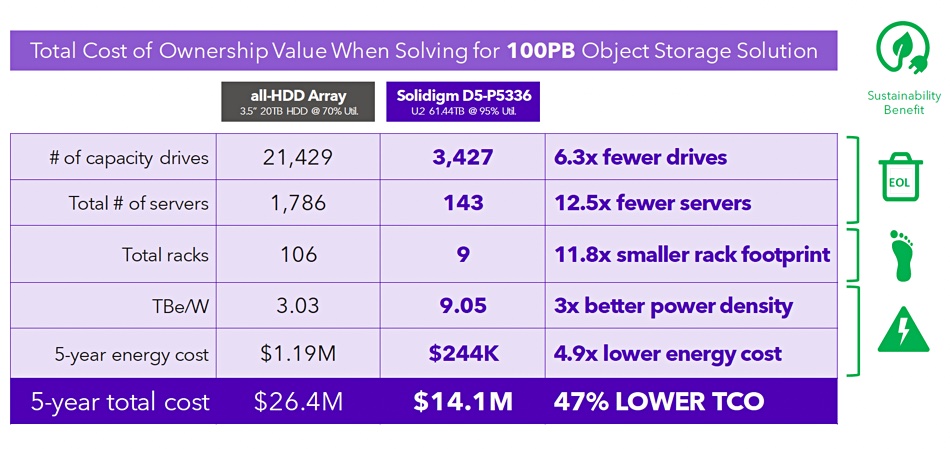

Given the speed, endurance, and pricing information, Solidigm created comparison grids for 100PB object storage disk and TLC flash arrays against its D5-P5336. The results indicated a significant cost advantage for the D5-P5336, offering a 47 percent lower 5-year total cost of ownership (TCO) when compared to an all-disk setup with 106 racks of 20TB HDDs. Moreover, compared to a 100PB Micron 6500 ION rack, the D5-P5336 showed a 17 percent lower cost.

The results are based on Solidigm’s own testing and we cannot independently verify the figures.

The D5-P5336 is shipping now in the E1.L form factor, supporting up to 30.72TB, with plans to extend the product line to U.2 and E1.L formats up to 61.44TB later this year. Furthermore, Solidigm intends to introduce E3.S form factor drives, featuring capacities of up to 30.72TB, in the first half of 2024.

Comment

Given the D5-P5336’s reported cost-effectiveness, high performance, and adoption by OEMs such as VAST Data, we suspect that other SSD manufacturers will likely follow suit and introduce their own 60TB-class drives in the next six months. This move will enable OEMs to compete at a drive capacity level and narrow the gap between current SSD offerings, which max out at 30TB, and Pure Storage’s 75TB Direct Flash Modules.

It will be interesting to see how costs compare between Solidigm’s D5-P5338 object storage array and equivalent HDD arrays at lower capacities, such as 75PB, 50PB, and 25PB. The potential shift to 30TB+ HAMR drives may also play a crucial role in influencing this landscape. The HDD suppliers are expected to closely scrutinize these factors and share relevant information in response.