An HPE Securities Analyst Meeting presentation provided a good look into the AI strategy differences between HPE and its closest competitor, Dell.

Update: Note about Dell and supercomouters added as Bootnote 2; 25 Oct 2023.

Both rate AI as the biggest driver of IT infrastructure revenue growth in the next few years and both have a strategy that extends across edge sites and hybrid cloud datacenters. Both see x86 servers doing AI inferencing, but Dell’s strategy extends its AI inferencing down to PCs, which it makes and sells but HPE does not. HPE’s strategy extends upwards into supercomputers at the Cray level, which it makes and sells but Dell does not.

That means Dell customers need access to Nvidia GPU server systems for large-scale AI training while HPE has its Cray systems for that. An HPE statement said it “believes it is differentiated from its competition in the ability to capture significant value from the growing AI market through its IP, trusted expertise, and long-term sustained market leadership in supercomputing.”

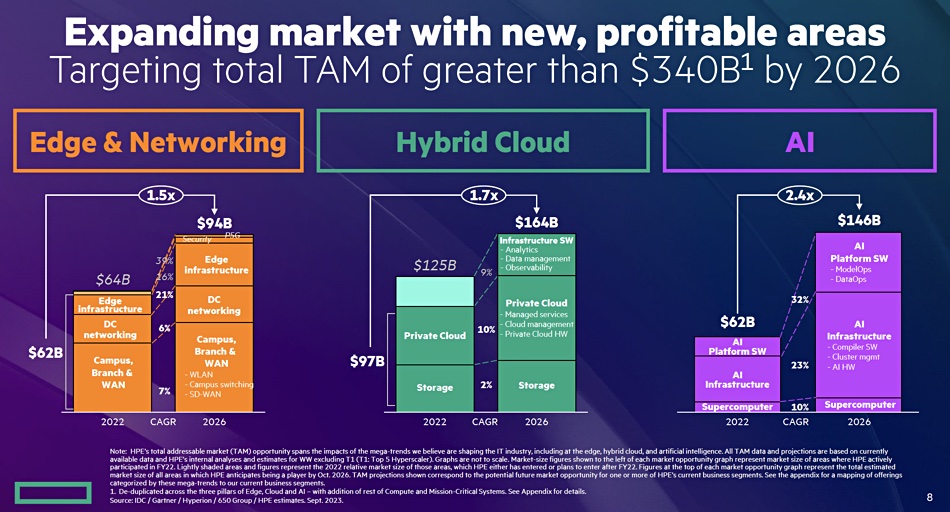

HPE president and CEO Antonio Neri set the scene by saying HPE has a growing total addressable market (TAM) with three components:

- Edge and networking growing 1.5x from $62 billion in 2022 to $94 billion by 2026

- Hybrid cloud growing 1.7x from $97 billion in 2022 to $164 billion

- AI growing 2.4x from $62 billion in 2022 to $146 billion in 2026

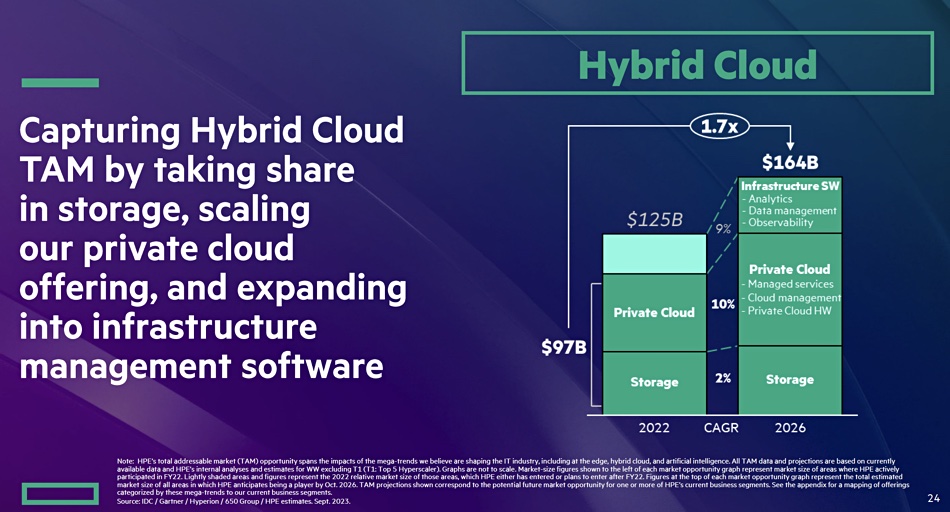

Within hybrid cloud, storage has a 2 percent constant currency compound annual growth rate (CAGR) between 2022 and 2026. A year ago it had told analysts there was a -3 percent storage infrastructure CAGR from 2022 to 2025. Dell does not predict revenues in constant currency and due to inflation, HPE’s constant currency numbers generally translate into lower real-world currency numbers.

Storage looks substantial, but the chart bars are indicative and not to scale. We can only conclude growth is slowing. A slide deck appendix identified the actual storage TAM as $58 billion in fiscal 2022 and $66 billion in 2026.

Storage did not feature as a separate topic in the Edge & Networking section of HPE’s presentation deck, where it noted that GreenLake has >2 EB of data under management. But it did feature in the hybrid cloud section.

Fidelma Russo, EVP for Hybrid Cloud and CTO, said HPE wanted to capture market sub-sector share in hybrid cloud, calling out storage:

She said there are three hybrid cloud challenges: transform through data, modernize IT infrastructure, and simplify hybrid cloud operations.

The transform through data concept was based on the Alletra 900, 600, and 500 series, and Alletra MP’s block and file storage platform, with file based on VAST Data’s software technology. This Alletra base provides a scalable platform with a cloud-native architecture and AIOps support.

Modernizing IT infrastructure means moving to cloud-like operations through GreenLake with hybrid cloud orchestration, private clouds, and AI-optimized infrastructure.

GreenLake for Backup and Recovery and Zerto (DR) appeared in the Simplifying Hybrid Cloud Operations section, where the overall theme was SaaS.

In the AI section of the presentation, which was given by Justin Hotard, EVP and GM for HPC, AI & Labs, HPE said its focus was on capturing growth through investing in its own IP in supercomputing and AI.

It wants high-end AI training models to run on its own Cray hardware and says the x86-based compute AI Inference TAM CAGR will be 22 percent from 2022 to 2026. Non-AI x86 compute TAM has a 2 percent CAGR in comparison.

So we have Cray hardware for AI training and x86 servers (ProLiants) with accelerators like GPUs for AI inferencing – nice and simple.

A slide shows that Nvidia GPUs are present as accelerator components throughout HPE’s AI compute portfolio, as are GPUs from AMD and Intel but to a lesser extent.

SVP and interim CFO Jeremy Cox talked about all this from the finance point of view. For the hybrid cloud storage area, he said HPE wanted to drive a portfolio mix shift to margin-rich, owned-IP offerings, which poses a potential problem for storage partners such as Scality, Weka, and Qumulo as they represent non-HP-owned IP.

Cox said HPE wanted to expand its storage portfolio into newer addressable markets such as file and object storage, and expand its SaaS portfolio, mentioning Alletra, AIOps management, SaaS data protection services, and unified analytics. This storage area will grow revenues in line with the market, which differs from Russo’s point about growing storage market share.

Overall, Cox said, HPE sees a 2-4 percent revenue CAGR from fiscal 2023 to 2026. Dell has a higher 3-4 percent long-term revenue CAGR, remembering the constant currency point made earlier that indicates Dell’s CAGR is likely to be even higher than HPE’s.

Unlike Dell, HPE has not appointed a chief AI officer, nor is it putting major effort into bringing out customizable and validated GenAI systems and services. For now, it appears that Dell is forecasting higher AI-driven revenue growth over the next few years than HPE.

Get a recording of the meeting webcast here.

Bootnote

Because of its Cray and ClusterStor technology, HPE has a unique position among the mainstream system vendors in not having to cosy up to Nvidia for GPU-based AI accelerators like SuperPod for AI training workloads. Its Alletra systems do not, for example, support Nvidia’s GPUDirect storage access protocol. This means that HPE is absent from the GPUDirect supporters club whose members include Dell, DDN, IBM, NetApp, Pure Storage, Weka, and VAST Data.

With its OEM deal for VAST Data’s Universal Storage software for file storage, though, HPE could use the GPUDirect support in this.

Bootnote 2

Dell told us industry analysts recognize HPE and Dell as the two leading providers of supercomputers/HPC systems. It said HPC-focused analyst firm Hyperion around ISC 2023 earlier this year, regarding supercomputer sales: “HPE tallied $5.1 billion in server revenue in 2022 while Dell came in at $3.6 billion. They were followed by Lenovo ($1.2 billion), Inspur ($1.1 billion) and Sugon at $600 million. Other leading HPC server vendors, in order of sales: IBM, Atos (Eviden), Fujitsu, NEC and Penguin.”

Ww did not mean to imply that Dell was not a supercomputer supplier, but wished to highlight that HP’s AI strategy spcifically includes Cray-level supercomputers while Dell’s does not.