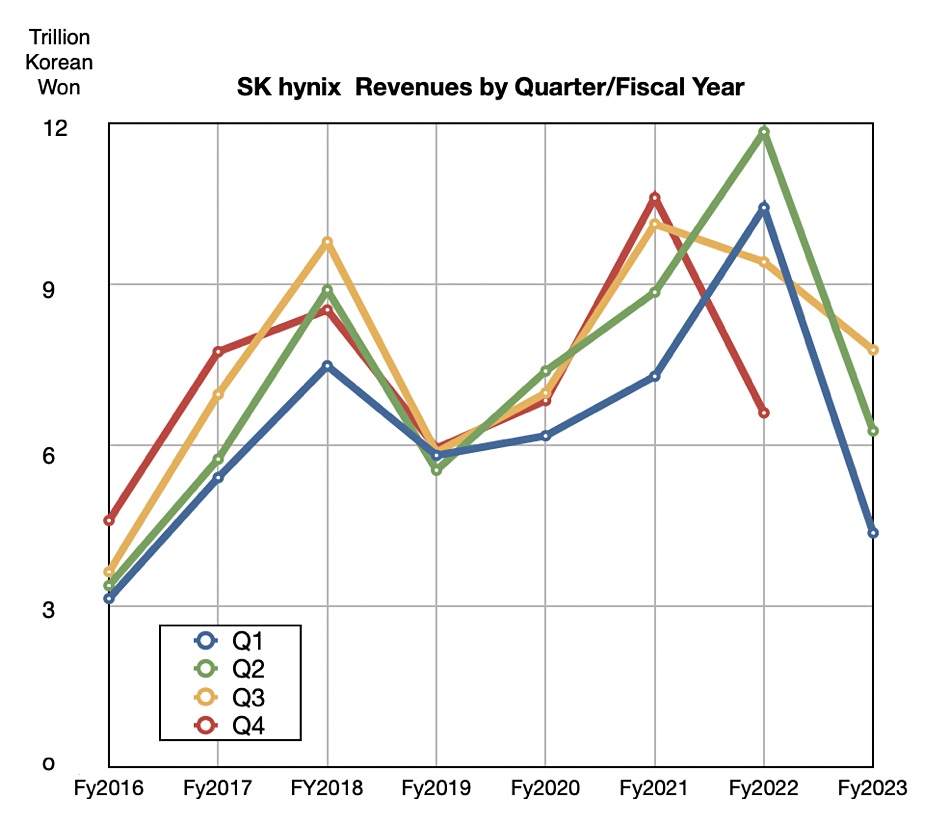

SK hynix revenues for the third 2023 quarter ended September 30 were $6.9 billion, down 16.4 percent annually, with a net loss of $1.66 billion as the memory market recovers from recession. The results were helped by demand for its HBM3 memory used by Nvidia GPUs.

Update: added note about SK hynix opposing terms of Kioxia Western Digital merger deal; added note about merger talks ending. 26 October.

The drop represents an improvement on the dive in Q2, which was a whopping 47 percent, and a narrowing of losses, which stood at $2.14 billion in Q2.

The Korean company fabricates DRAM and NAND chips, and builds SSDs. This was its second successive growth quarter, with both DRAM and NAND contributing, as well as average selling price increases. The DRAM business has turned around after two quarters of losses. SK hynix said: “Revenues grew 24 percent, while operating losses narrowed 38 percent, compared with the previous quarter, thanks to strong demand for high-performance mobile flagship products and HBM3, a key product for AI applications, and high-capacity DDR5.”

A statement from CFO Kim Woohyun said: “Our strong position as the world’s key provider of the products such as HBM and DDR5 will help us discover new markets differentiated from the past. We will work toward strengthening our position as the world’s best provider of the high-performance, premium memory products.”

DRAM shipments increased 20 percent quarter-on-quarter, with a 10 percent ASP increase, and NAND shipments also rose with high-capacity mobile products and SSDs taking the lead.

The recovery in SK hynix’s DRAM business should quicken due to generative AI technology driving GPU demand with a knock-on effect for HBM3. It’s forecasting a 60-80 percent CAGR for the HBM DRAM market over the next five years. It shipped 1 billion HBM3 samples in August. The company sees a NAND market recovery in place as well.

SK hynix plans to increase investments in high-value flagship products such as HBM, DDR5, and LPDDR5. The company will increase the share of the products manufactured from 1-alpha and 1-beta process nodes, the fourth and the fifth generations of the 10nm process, while increasing investments in HBM and TSV (Through Silicon Via) technology.

Aaron Rakers, a Wells Fargo analyst, thinks the results are an overall positive for the memory market and other players such as Micron. He calculates SK hynix DRAM revenues as ~$4.627 billion in the quarter, down 11 percent year-on-year and up 34 percent quarterly.

He estimates NAND revenues were ~$1.865 billion, down 26 percent year-on-year but up 11 percent quarter-on-quarter. He reckons ~29 percent of the company’s NAND revenue is driven by SSDs (including discrete NAND for SSDs), while the mobile market accounted for 42 percent.

Kioxia and Western Digital NAND/SSD business merger

During the SK hynix earnings call, on being asked about SK hynix opposing a mooted Kioxia merger with a spun-off Western Digital NAND and SSD business, the CFO said: “SK Hynix is not agreeing on the deal given the overall impact on the value of the company’s investment in Kioxia.”

He added: “We cannot elaborate on further specific reasons and the progress of the merger due to confidentiality, but one thing is clear: we [SK hynix] will make a decision for all stakeholders, including shareholders and Kioxia.” Korea Joongang Daily reported this news.

That’s a pretty clear viewpoint. Subsequently the Nikkei reported that the merger talks had been abandoned. Following SK hynix’ public opposition and after Bain Capital could not provide any countervailing arrangements, Western Digital ended the talks. This is only the latest turn in what has become a convoluted saga. It may not be the actual end.