Seagate CFO Gianluca Romano openly talked about the company’s HAMR disk drive capacity point schedule at a Bank of America 2023 Global Technology conference.

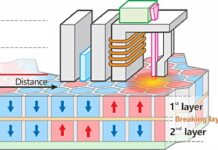

He revealed actual capacity points, timing and other aspects in details we haven’t encountered until now. HAMR (Heat-Assisted Magnetic Recording) is Seagate’s follow-on technology to conventional Perpendicular Magnetic Recording (PMR), which is approaching the limit of its ability to decrease bit size on a disk platter before the written bits lose stability and flip from zero to one and vice versa.

HAMR uses a more stable recording medium that needs heating before writing a bit which is then stable at room temperature. Seagate hopes to get a capacity jump on its competitors who are delaying their use of the technology.

Romano said: “HAMR is growing very well. It’s growing actually a little bit faster than what we were expecting just a few months ago. So we are starting to ship already last quarter and this quarter for qualification … Probably you will see a good volume from HAMR that can start to impact our P&L, I would say, in three to four quarters from now.”

He said that, with HAMR “you can grow in capacity per unit without increasing the bill of materials.” That’s because the drives, at the top capacity point, keep a 10-platter, 20-head configuration as capacity increases in a stepped way. With PMR, the recent drive capacity increases have come from upping the platter count from 8 to 9 to 10 with the current 20TB PMR drives, limiting the $/TB cost decrease. That restriction goes away with HAMR.

The first HAMR drives will have a 32TB capacity level. Romano said: “The following product will be a 36-terabyte and will still be based on 10 disks and 20 heads. So all the increase is coming through areal density.

“The following one, 40TB, still has the same 10 disks and 20 heads. And also the 50, we said at our earnings release, in our lab, we are already running individual disk at 5 terabytes [per platter]. So we can increase capacity by a lot without increasing the cost per unit because it’s the same bill of materials.”

The sequence then is 32TB, 36TB, 40TB and 50TB. The time interval between these capacity levels is longer than with PMR drives. Romano said: “With PMR, we were able to have a new product basically every 12 months, 15 months, and maybe take a little bit longer, but not much longer. So I would say probably every 18, 20 months. So a little bit longer [for HAMR], but of course, increased capacity is much bigger.”

What about the PMR drive progression? “We are not developing any PMR after the 24TB. So we have a 24TB coming out soon, next few months … That is the last PMR product” at a high capacity point apart from a 28TB shingled drive. The high capacity drives have a limited set of customers. “I think all the cloud guys will focus on the high capacity. They will want to have an HAMR 36 terabytes compared to a PMR 24, to me [that] makes a lot of sense.”

Lower capacity PMR replacement by HAMR

One of the great advantages of HAMR technology is the opportunity to replace lower-than-32TB capacity PMR drives with HAMR ones at the same capacity point – but with fewer platters and heads. This would lower the cost of making them, the bill of materials. For example, a 10-platter 20TB PMR drive for the video surveillance market could be replaced by a 5-platter HAMR drive with 50 percent fewer heads and platters.

Romano said: “It’s a huge difference in bill of materials, a huge difference in cost.”

Seagate anticipates passing some of that lower cost to customers in terms of a lower purchase price but would keep the the bulk to itself and so increase its profit margin per drive. “It’s not that we need to give all that cost to customers. We give a little bit of that cost benefit to customers and the rest of the benefit should stay with Seagate … improving our gross margin at very different capacity points using the new technology,” said Romano.

“That is the main focus, the main strategy of the company and why we’ve spent so much money in developing HAMR in the last more than 10 years.”

Of course HAMR technology has to deliver these benefits to Seagate. If it goes as planned, Toshiba and Western Digital will be unable to keep up with Seagate’s 4TB per HAMR generation capacity increments and also have a higher bill of materials at the lower capacity points, giving Seagate pricing headroom.

If HAMR technology fails to yield these benefits, Seagate has no ability to use the intervening ePMR and MAMR technologies being used by Toshiba and Western Digital. A failed HAMR future would be a potential problem for Seagate.