HCI is a fairly mature market and we think it should be simple enough for tech analysts to agree on what vendors to classify as HCI vendors. Not so fast.

Forrester has published a Wave report looking at hyperconverged infrastructure (HCI) systems, with Nutanix top of the HCI pops, VMware second and Cisco in third place. However, it disagrees with Gartner and Omdia on who the HCI suppliers are.

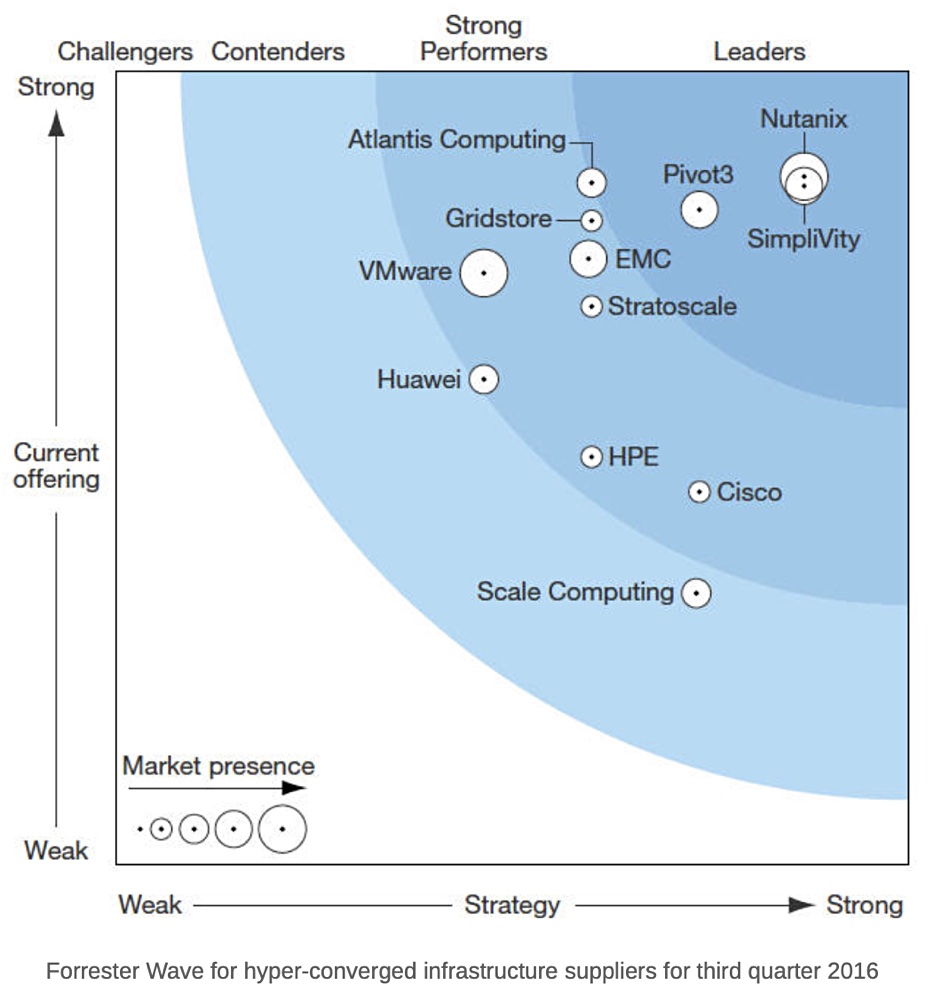

Forrester defines HCI vendors as Challengers, Contenders, Strong Performers, and Leaders. Here is its HCI Wave chart, in which the size of vendor circle represents market presence.

Nutanix, VMware and Cisco occupy the Leader’s quadrant. HPE leads the Strong Performer groups, with Huawei next, followed by Microsoft (Azure Stack), Scale Computing, and Pivot 3.

DataCore is a Contender, close to the boundary with Strong Performers, followed by Red Hat.

Analyst HCI confusion

There are big differences between the Forrester HCI and the recent Omdia Decision Matrix for HCI. Omdia left out Nutanix and Huawei, which were asked to – but didn’t – contribute data, and Microsoft. Omdia includes Fujitsu, Hitachi Vantara, and Lenovo.

Gartner’s HCI Magic Quadrant is at odds with both Forester and Omdia. The analyst firm omits NetApp, while including Huayun Data Corp, Sangfor Technologies, StarWind and StorMagic as ‘Niche Players’ (which is the Forrester equivalent of ‘Challengers’).

A blast from the recent past

We have unearthed a 2016 Forrester HCI Wave for IT history buffs.

It shows EMC and VMware separately, and also SimpliVity and HPE as separate vendors. Atlantis Computing, GridStore and Stratoscale have exited the market since then and NetApp had no HCI presence in 2016.

SimpliVity was almost up with Nutanix but now, in the arms of HPE, has fallen back. The EMC-VMware-Dell combo has progressed to second place, with Cisco rising to third. Buying Springpath was a good move for the networking giant.