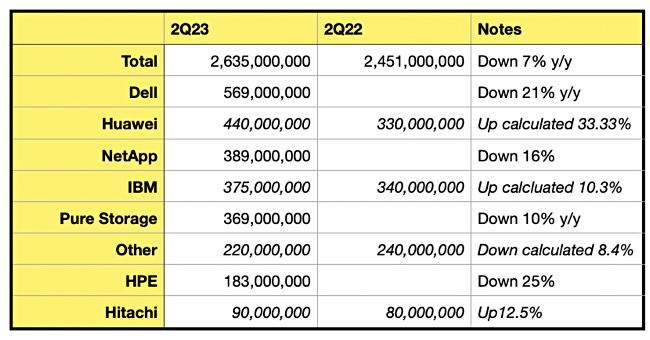

Gartner’s latest external storage market numbers show the total all-flash array market is down 7 percent annually to $2.635 billion, with Huawei up 33 percent – placing it second behind leader Dell, whose share reduced by 21 percent.

Gartner’s analysis of the second 2023 quarter – a summary of which we have seen thanks to Wells Fargo analyst Aaron Rakers – suggests total external storage revenue dropped 14 percent annually to $5.029 billion. Primary storage sank 15 percent, secondary storage decreased 7 percent, and backup and recovery slid 20 percent.

HDD and hybrid revenues were down 21 percent and accounted for 47.6 percent of the market – flash arrays have taken over from disk. Rakers selectively summarizes Gartner’s numbers. We haven’t seen the table of suppliers’ revenues and market shares, but we have made an attempt to fill in the missing numbers by referring to a Gartner/Wells Fargo chart:

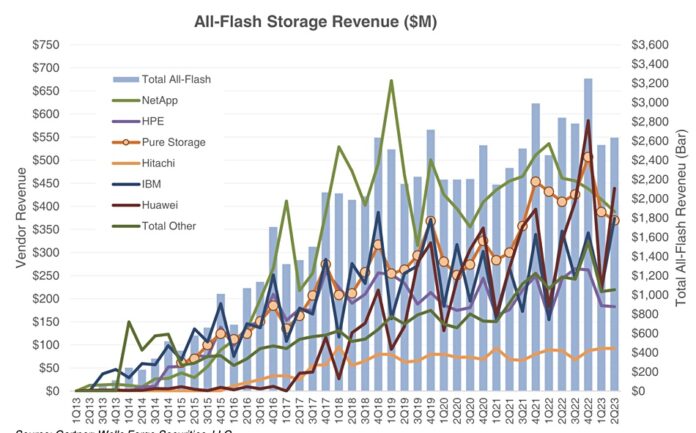

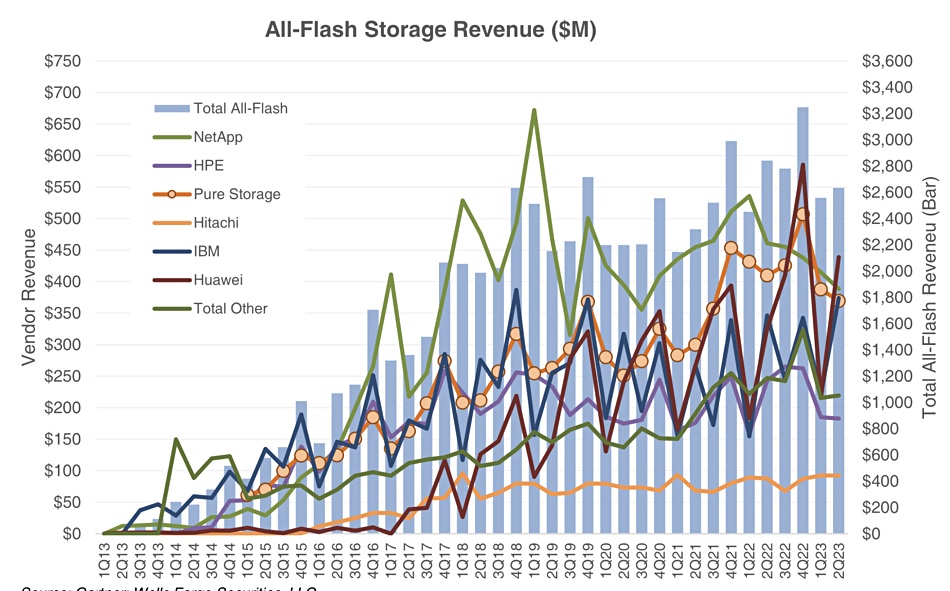

This chart shows the dramatic rises in Huawei and IBM’s all-flash array revenues with Huawei eclipsing NetApp and Pure. Dell is not shown on the chart but Gartner says it’s the market leader with $569 million in revenue, 21 percent down on the year. Our table has italicized entries for calculated and estimated numbers:

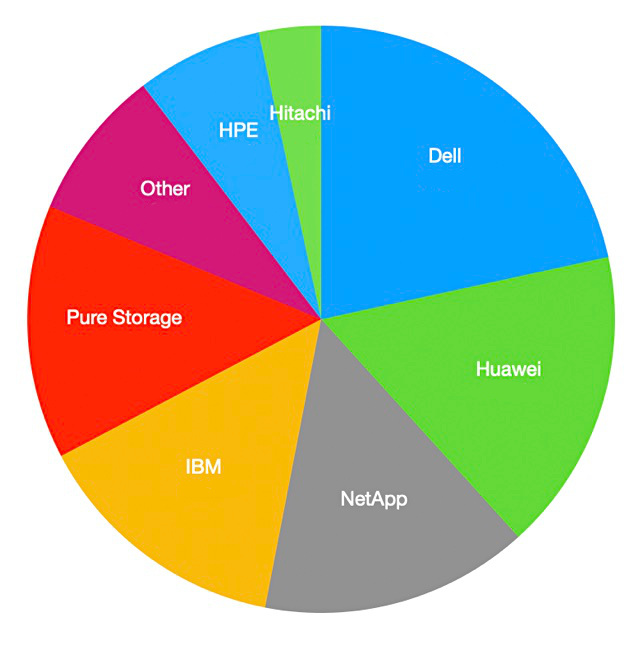

And we’ve created a pie chart from it to show the rough estimates of supplier shares based on the analysts’ charts:

Rakers writes: “Pure’s revenue share of the all-flash market fell to 14 percent, down from 15.2 percent in the prior quarter and 14.4 percent in the year-ago period.” It is the second quarter in succession that Pure has had a lower share than NetApp and Pure now has lower revenues than in 2021’s fourth quarter.

Rakers estimates Pure’s FlashArray revenues to be $283 million, down 15 percent annually, with FlashBlade bringing in $86 million, up 13 percent year-on-year.

NetApp’s AFA revenue went down more than the market average, at 16 percent annually. Its hybrid/HDD array revenue did worse, falling 47 percent. Its share of the overall storage market, Rakers claims, “fell to a… low of 9.7 percent versus 11.1 percent in the year-ago quarter – the lowest level since 2009.”

HPE’s AFA revenues fell 25 percent annually to $183 million, while Hitachi AFA revenues were, we calculate, $90 million, up 12.5 percent.

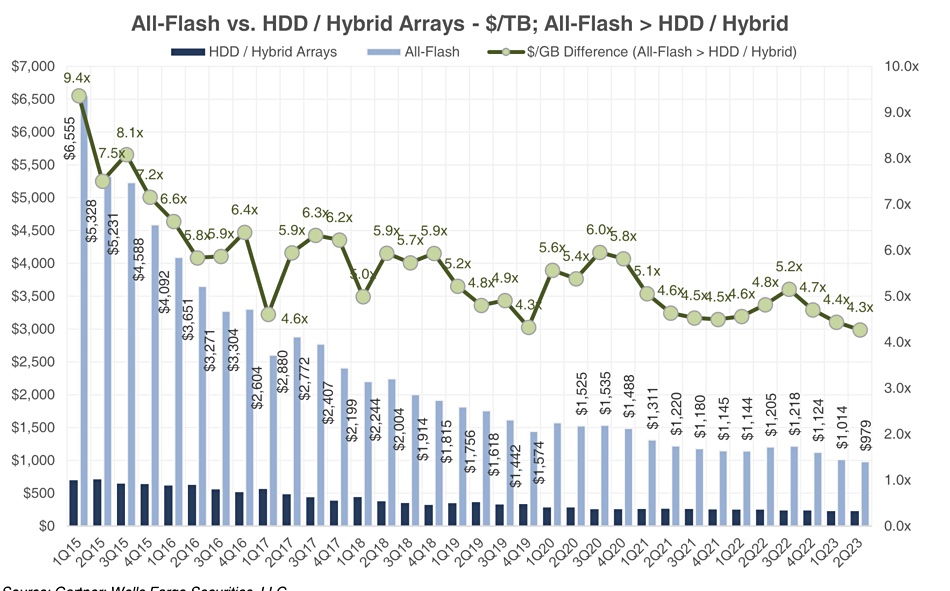

Gartner believes AFA array storage costs 4.3 times more on an ASP basis than hybrid/HDD storage down from 4.8x a year ago, and the same as it was at the end of 2019.