DDN, Pavilion Data and IBM lead the 16 suppliers in GigaOm’s High-Performance Scale-Out File Storage (SCOFS) Radar report.

The SCOFS products are focussed on performance — obviously — plus scalability and Nvidia GPUDirect support, and aimed at data analytics, AI/ML/DL, and high-performance computing (HPC) workloads.

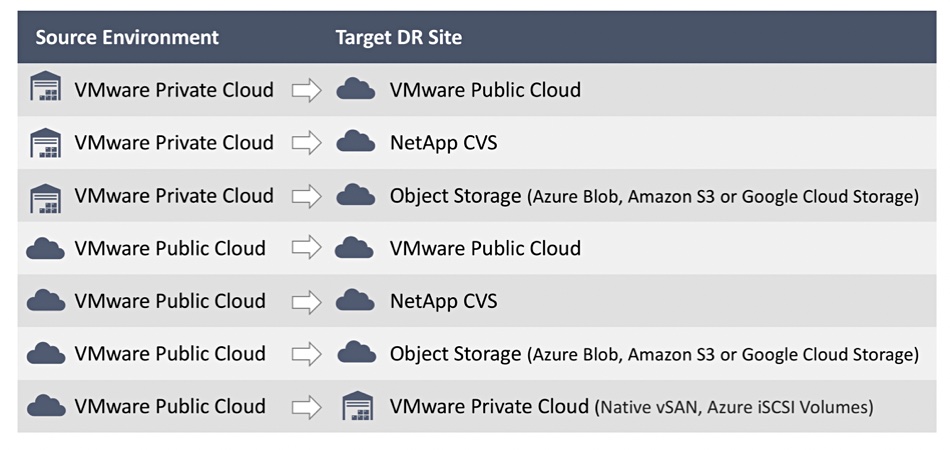

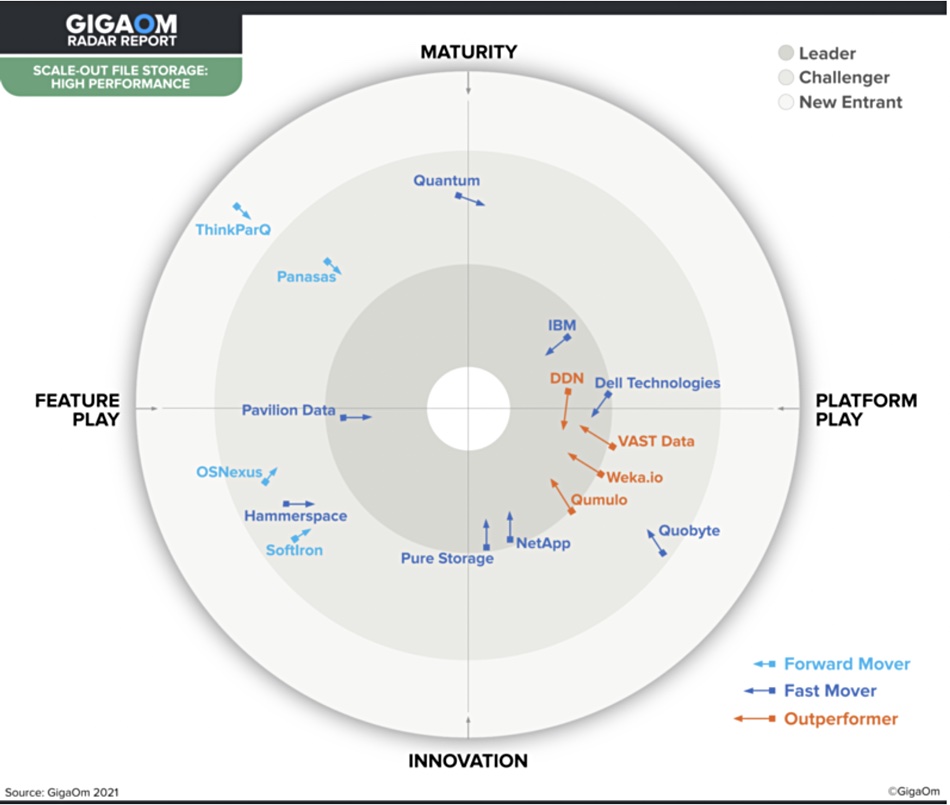

GigaOm’s Radar reports evaluate products’ technical capabilities and feature sets against 14 criteria to produce a circular graph. This is divided into concentric inner Leader, mid-way Challenger and outer New Entrant rings modified by by two orthogonal axes: Maturity vs Innovation, and Feature Play vs Platform Play. Suppliers are also rated on their forecast speed of development over the next year to 18 months.

Sixteen high-performance scale-out file storage suppliers are evaluated with a rough balance between seven feature plays and nine platform plays. Six are classed as more mature than innovative, leaving ten suppliers — including mature players DDN and Dell — moving into the innovation half of the diagram.

The Leader (closest to centre) is DDN, followed by IBM and Pavilion Data, then NetApp, Dell EMC and Pure Storage. The Challengers — the majority of suppliers — are Qumulo, WekaIO, VAST Data, Pananas, Hammerspace, Quantum, OSNexus, SoftIron, and Quobyte. ThinkParQ is the sole New Entrant.

DDN, VAST Data, WekaIO and Qumulo are classed as outperformers, referring to each supplier’s product evolution over the coming 12 to 18 months, with OSNexus, Panasas, SoftIron and ThinkParQ rated as the slowest performers in that sense.

Report authors Enrico Signoretti, Max Mortillaro and Arjan Timmerman commented that:

- DDN impresses for the effort it places on evolving its platform and adapting it for new use cases and enterprise needs, showing an evolution from a mature platform play toward an innovative platform play;

- Qumulo offers a very balanced platform with excellent integration capabilities; however, the lack of GPUDirect support can become a roadblock to supporting the most demanding GPU-based workloads;

- WekaIO presents a flexible and scalable solution that can be deployed everywhere;

- VAST Data has an enviable technology stack that can really make a difference for some use cases while keeping a low $/GB ratio.

The authors add that “IBM … Spectrum Scale is a very mature architecture. It is favoured still by many organisations, delivers great value, and is more than capable of addressing the most complex requirements, putting it on par with DDN and among the leaders of this Radar.”

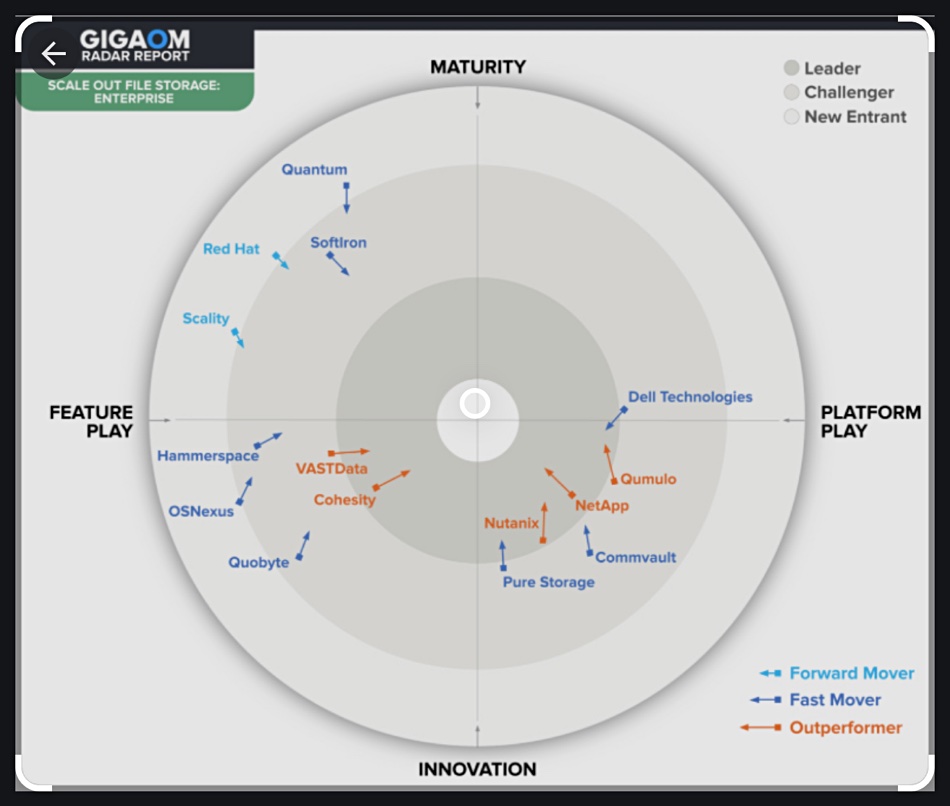

There is an overlap between this GigaOm Radar and the firm’s Enterprise Scale Out File Storage Radar:

The Enterprise SCOFS Radar report includes suppliers whose products are optimised for security, data protection with a focus on data services, flexibility and enterprise features. Many suppliers feature in both reports but DDN, IBM, Panasas, Pavilion Data, ThinkParQ and WekaIO are confined to the high-performance SCOFS Radar while enterprise SCOFS suppliers Cohesity, Commvault, Nutanix, Red Hat and Scality do not appear in the High-Performance SCOFS Radar.

The High-Performance SCOFS Radar report is available to GigaOm subscribers and accompanied by a Key Criteria report that assesses the impact that key product features and criteria have on top-line system characteristics — such as scalability, performance, and TCO — that affect purchase decisions.