Pavilion Data, provider of the claimed fastest storage array in the universe, appointed a new CEO in July as its VC backers are trying to a grip on the company, which lost its way after a promising start.

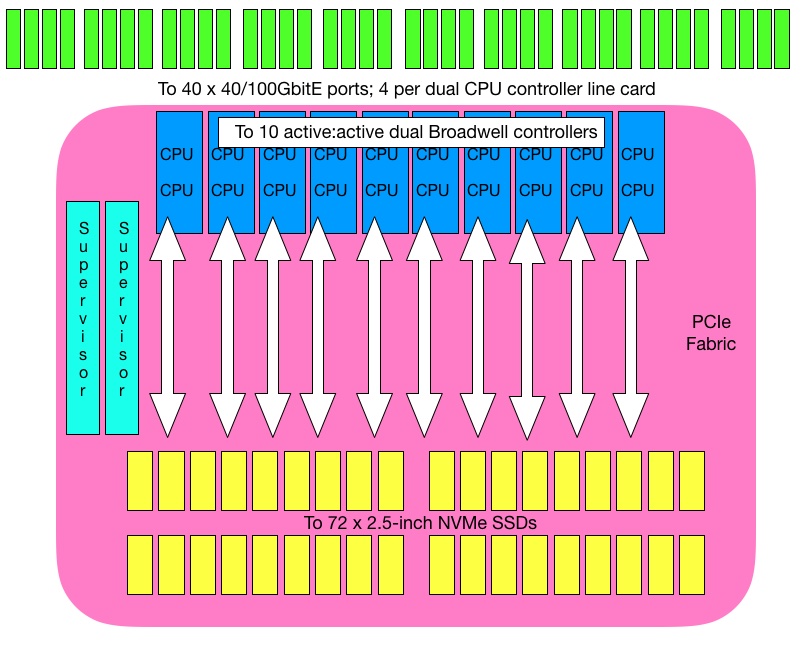

Founded in 2014, Pavilion Data developed a proprietary storage array design based on a network switch with massively parallel design features. In November 2018 its RF100 array had up 20 controllers talking to 72 flash drives across a PCIe fabric inside a 4U chassis. Host access was by RoCE and NVMe/TCP.

The performance was remarkable — average read latency of 117μs, up to 120GB/sec read bandwidth, 60GB/sec write bandwidth and 20 million 4K Random Read IOPS. Since then the HyperOS software has been developed, gaining file and object capabilities in 2019, and global file and object namespace in 2021 along with multi-chassis scale-out, a CSI plug-in and more. The performance has been boosted with HyperOS v3 on the block side offering 20 million read IOPS, five million write IOPS, 100μs read latency, 25μs write latency, 120GB/sec read and 90GB/sec write bandwidth.

But the array hardware and software has not fulfilled its potential. Three years later, it has just 20–25 customers (apparently concentrated in the US federal sector), relatively few channel partners, and a funding history more indicative of financial starvation than generous growth funding.

Some history

There were plentiful funding rounds during product development, with $21 million in a two-part A-round in 2016 and 2017, then an $11 million B-round in 2018, followed by a $25 million C-round in 2019 and then … nothing, giving a total of $58 million. Compare that to Qumulo, a scale-out filer startup founded in 2012 which has received $351 million in funding — more than six times as much.

Software-based scale-out parallel file system startup WekaIO has received $66.7 million. Hardware/software-based VAST Data has received $263 million — more than 4x Pavilion’s total. Pavilion is a hardware-based startup that has been funded more like a software-based one.

It has suffered a little founder and CEO attrition as well. The original founders were CEO Kiran Malwankar and VP Software Engineering (now Chief Development Officer) Sundar Kanthadai. VR Satish joined as CTO in December 2015 from Symantec/Veritas and contributed so much he is classed as a co-founder too.

Malwankar was replaced as CEO by Shri Dodani in 2016, became VP Hardware Engineering and then quit in January 2018 — first to join another startup and then CPU developer Tachyum. Dodani went in April 2017, replaced by Gurpreet Singh who came from being VP Product management at Pure Storage via an intervening 11-month stint as CEO and co-founder of Dynamix IO.

Some of the early marketing and product strategy was bizarre. Customers could buy an unpopulated array and fill it with their own SSDs — supposedly as a way of highlighting the great price/performance, but hardly suitable for an enterprise customer.

The picture here is of a high technology company run by two CEOs who were not effective in growing the company at all. They misunderstood its place in the market, and failed to get the funds needed to build up an effective route to customers.

Which brings us up to speed

That was why the board — the investors in other words — replaced Singh with Dario Zamarian and tasked him with getting the company back on track. How does he plan to do it? He says that Pavilion so far has secured customers in Life Science, Media & Entertainment, Financial Services, and other high-performance computing applications.

It isn’t selling into a horizontal market, but segments that require low latency and high IOPS and throughput performance. His first quarter in the big chair has seen Zamarian grow the business and improve its focus. He is pursuing more funding and seems hopeful he might be able to announce big ticket news in a few months.

We expect to her about more focus on channel partners in the future. Marketing firepower should be concentrated in target niches that need Pavilion’s low latency and high IOPS/bandwidth numbers in mixed and scale-out block, file and object workloads. Zamarian cannot go head-to-head across the overall storage market with VAST Data, Dell EMC, NetApp, Pure Storage and and HPE.

But it must find market niches that give it growth — not least so that it can avoid the fate of Violin and Vexata, now resident in the low-growth area of the storage business. Come on VCs — put your hands in your wallets and feed this financially starved company. It’s the only way it will fullfil its potential and give you an exit that will make you smile.