Backup target array supplier ExaGrid has notched up another record-breaking quarter with bookings and revenue highs set in the USA, Canada, Latin America, EMEA and APAC regions.

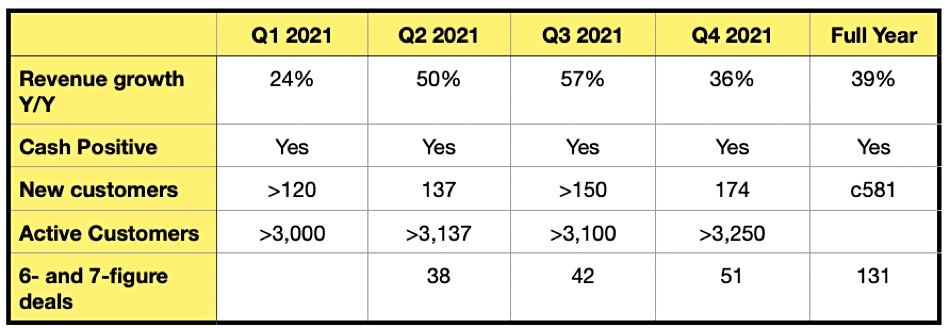

It brought on 174 new customers in the quarter ended December 31, 2021, with 49 six-figure new customer deals and two seven-figure ones. The total active customer count has passed 3,200 and the company, founded in 2002, has been cash-positive for the last five quarters. It says its competitive win rate is 75 per cent, which must make for some unhappy competitors. Also 40 per cent of its revenue is due to ARR (Annual Recurring Revenue).

Bill Andrews, ExaGrid’s President and CEO, is clear about why the win rate is high: “ExaGrid reduces the cost of backup storage while maintaining performance and scalability. All of the first-generation deduplication appliances such as Dell EMC Data Domain, HPE StoreOnce, and Veritas 5340, are slow for backup, slow for restores and don’t scale well.

“Low-cost primary storage disk is too expensive for long-term backup storage. You need to have an integrated approach that brings the performance of backing up to disk but also data deduplication for efficient long-term retention backup storage. ExaGrid’s Tiered Backup Storage provides the best of both worlds.”

The Tiered Backup Storage refers to scale-out ExaGrid’s non-deduplicated landing zone for new backup datasets providing the fastest restores. Then the data in the sets is deduplicated using a global index, not one restricted to the local array, and moved to a non-network-facing repository for longer-term storage.

We have tabulated ExaGrid’s growth numbers for 2021:

The 39 per cent full-year revenue growth rate from 2020 is a good number and we doubt if it will be matched by competitors Dell EMC (PowerProtect), HPE (StoreOnce), Quantum (DXi), and Veritas. ExaGrid is looking to hire another 60 inside and field sales heads because it is growing so quickly.

Comment

As SSDs and the public cloud come to dominate enterprise IT, we see these things as potential opportunities for ExaGrid. For example, its disk-based landing zone could expand to include QLC (4bits/cell) SSDs, possibly deduplicated to lower the cost, and so enable faster restores still, with a view to responding to Pure Storage’s FlashBlade and also to VAST Data.

Bill Andrews is not a fan of using SSDs though. He tells us “It is very expensive and drives the cost of backup storage through the Moon. Very few organisations can afford SSD for backup.” Also “Customers are blown away that we are the same or faster than SSD for backup. SSD is really optimized for small writes such as database transactions. It is not optimized for extremely large backup jobs. We do side by side testing all the time.”

ExaGrid could port its software to the public cloud — meaning Amazon, Azure and GCP — and provide a multi-hybrid cloud backup environment. It all depends upon how ExaGrid sees itself: as an on-premises backup target array supplier, at which it is clearly doing very well, or as a potential hybrid and multi-cloud backup target supplier with a cloud-like business model.

Andrews said ExaGrid is adapting to the cloud. “We currently replicate from a physical onsite appliances into AWS for disaster recovery. By summer of this year we’ll replicate from physical onsite appliances into Azure for disaster recovery. Longer term (no rush as we are getting no market pressure) we will have a version of ExaGrid that runs in the clouds for data that lives and is backed up in the clouds.”