Western Digital and Toshiba have promoted their advances in disk drive areal density and performance based on specific technology advances, such as bias currents, enhanced PMR using a microwave oscillator and embedded NAND in the controller — Western Digital’s OptiNAND. Yet Seagate, apart from saying its over-arching recording technology development is heat-assisted magnetic recording (HAMR) in contrast to Toshiba and Western Digital’s focus on microwave-assisted magnetic recording (MAMR) as a stage before possible HAMR, has nothing to say about such things.

This can lead commentators to think it is running out of technology advancements. We asked Colin Presley, a Senior Director in Seagate’s CTO organisation, about the recent technology advances in the HDD area — bias currents, ePMR, and embedded controller NAND. Then we had a discussion about the state of HAMR.

Bias current/ePMR

Without disputing Western Digital’s internal data, Presly doesn’t think that the use of bias current-type technology will provide an intrinsic advantage or gain. For him the changeover from longitudinal magnetic recording to perpendicular magnetic recording (PMR) provided an intrinsic gain in areal density. The bias current idea doesn’t, in his view, provide an intrinsic gain of itself.

He said: “We consider complete system optimisation for given head designs. The physics behind bias currents is well understood. … We can do it in other ways with head designs and geometry design.” Seagate could control the write field, head spacing, domain alignment and other items from the hundreds of features affecting a specific HDD design point.

According to Presly, Western Digital reached the 18TB level with ePMR and Seagate reached it without PMR, supporting his point that Seagate can reach higher incremental capacity levels without relying on any one specific technology to get there.

Embedded controller NAND

Seagate does know about shipping NAND with disk drives because: “We have shipped approximately 40 million hybrid drives with NAND on them for performance gains. It’s not really new. … It was good technology but it’s not used in today’s nearline drives.”

Western Digital says its OptiNAND embedded NAND technology provides more performance and better metadata management, leading to areal density increases.

Embedding NAND in the controller is not something that Seagate thinks is worth doing. If customers want more performance then it has its MACH.2 dual actuator technology providing two read:write channels to the drive and effectively doubling performance, not increasing it by low percentage numbers through better metadata management.

Presly said: “We don’t see any reason to put NAND in the controller for performance.” As for metadata: “There are ways of managing metadata; other ways of solving the same problem. … We just don’t see the value of adding NAND to a nearline drive.”

A NAND-enhanced controller was not needed for the 20TB PMR drives that Seagate is now sample shipping, although one such is used in Western Digital’s sampling 20TB drive. Presly reiterated Seagate’s over-arching areal density increase direction: “For capacity we’re focussed on HAMR.”

He was keen on the idea of deterministic performance gains, saying customers wanted predictable and consistent (deterministic) performance, not variable or non-deterministic performance, and that’s why it uses DRAM in its controllers and not NAND. But: “In the future, if there was a reason to do it then we could make that pivot.”

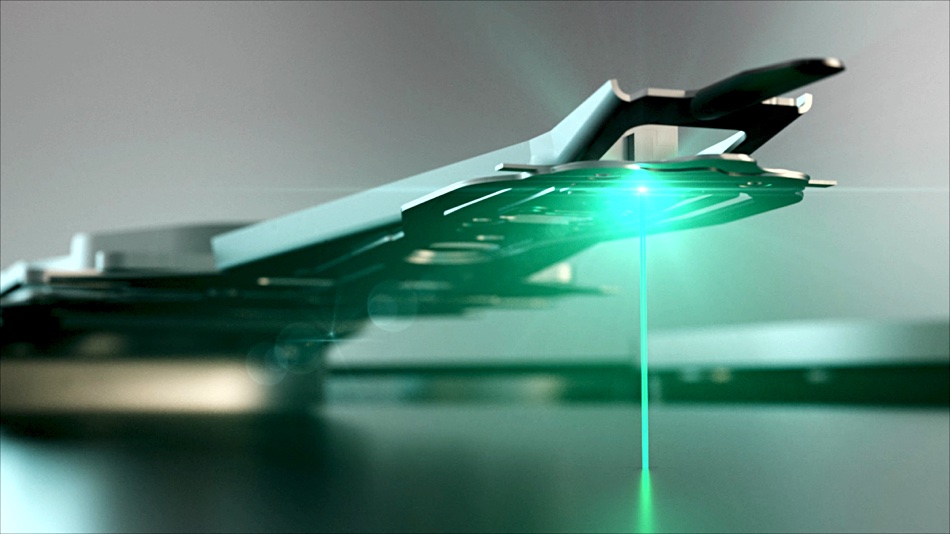

HAMR

Presly was clear about one aspect of HAMR: “[It] is really really hard technology.” Even so: “The industry across the board recognises HAMR is the road to high capacity.”

Inside Seagate: “HAMR continues to progress. We’re not ready to publish an areal density record but we are progressing. … We’re strong believers in HAMR; it is a step change.”

I asked him about the apparent capacity gap between the latest 20TB sampling drive and the coming 30TB HAMR drive mentioned by Seagate’s CFO Gianluca Romano. Presly said: “The 20 to 30TB transition is a good discussion point … but I can’t talk about that. …. We will have competitive technologies in the 20 to 30TB space. … We’ll absolutely be competitive.”

Comment

It is apparent that Seagate believes it is in pole position in the HAMR race. It is gaining customer feedback on its 20TB Gen-1 technology and also manufacturing experience. This knowledge is being fed into its Gen-2 30TB product. By the time when, and if, both Toshiba and WD make a transition to HAMR, Seagate will have several years of experience from manufacturing and shipping millions of HAMR drives.

That could give it an advantage when competing with HAMR newbies. Until then it has to stay competitive when WD and Toshiba bring out their full MAMR technology. Who knows, but we could see Seagate’s Gen-2 HAMR drive facing up against WD’s first full MAMR drive. Competitive bakeoffs will be interesting. We hope Backblaze gets its hands on both types of drives and publishes its stats on drive reliability about them.