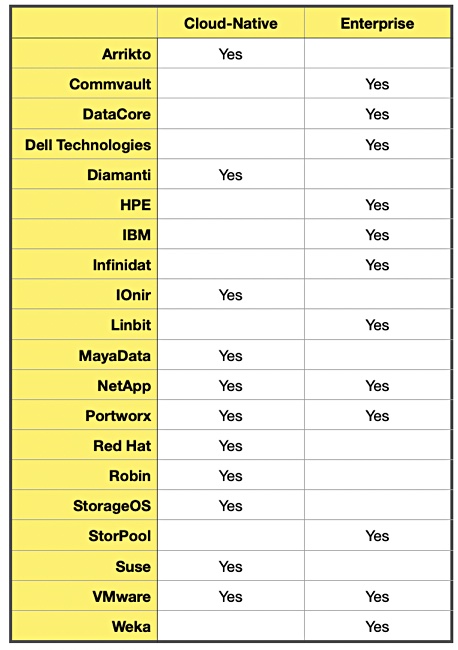

GigaOM has produced two Radar reports for cloud-native and enterprise Kubernetes data storage, showing a clear divergence between suppliers – only two are in both camps.

Back in July last year GigaOm published its GigaOm Radar for Data Storage for Kubernetes v1.1 Report covering 20 suppliers and both the general purpose and enterprise markets. The v2.0 report is actually two separate reports – looking at the cloud-native and the enterprise markets, with 11 and 12 suppliers respectively.

Only three suppliers are present in both camps: NetApp, Pure Storage (Portworx) and VMware.

Enterprise vs cloud-native Kubernetes storage

Report authors Enrico Signoretti, Arjan Timmerman and Max Mortillaro write: “enterprises want the freedom to decide where applications and data should run”. They have two deployment models: traditional enterprise storage arrays with a CSI (Container Storage Interface) plug-in; and software-defined storage with container optimisations.

They point out that “A major challenge facing traditional storage, however, is the sheer number of backend operations taking place in container environments, which are very dynamic and involve many resource allocation/deallocation operations as containers are created and destroyed. Traditional systems designed for mostly static, stateful, and persistent provisioning may face performance and queuing issues and not be able to keep up with the large volume of operations.”

The cloud-native Kubernetes storage suppliers have a different approach. Their storage offerings “are tightly coupled with the container orchestrator and are container-aware, so that when the orchestrator spins up or destroys a container, it also handles storage provisioning and de-provisioning. Storage operations in this scenario are automated and invisible to the user.”

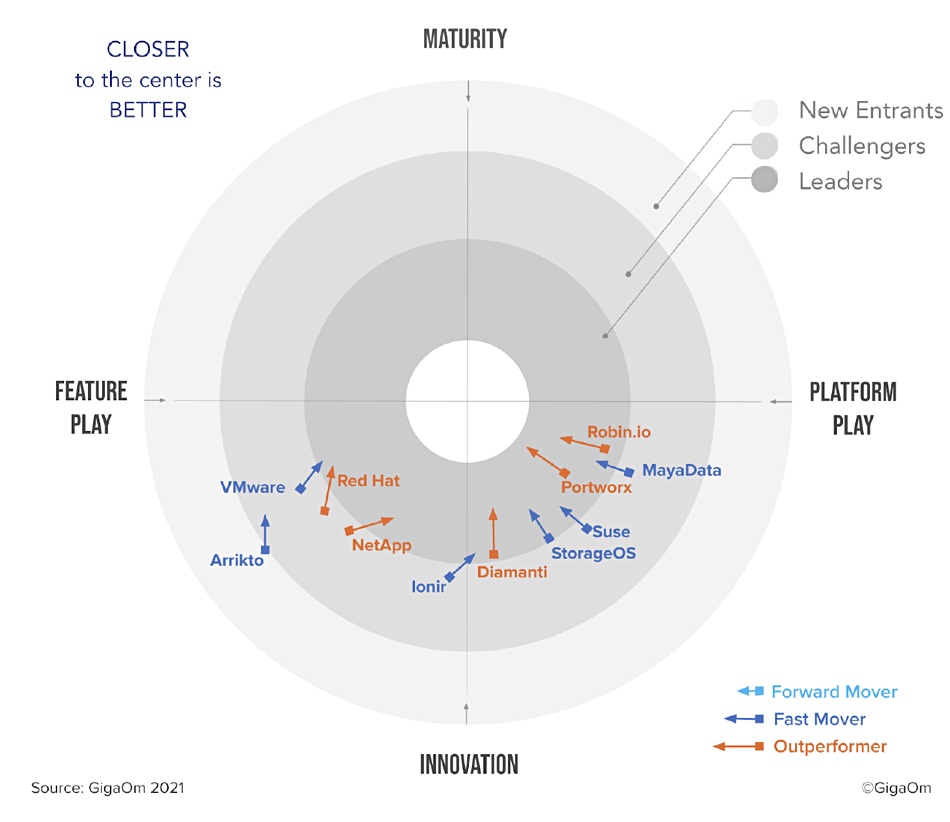

Cloud-native Kubernetes storage

A GigaOm Radar screen diagram summarises the supplier positioning in this section of the Kubernetes data storage market:

The leading suppliers are, in order: Portworx, followed by Robin.Io, and then Diamanti. All suppliers, bar Arrikto, are in or moving into the leaders ring – indicative of the intense competition as suppliers develop their new products. No suppliers are rated as being mature compared to being innovative – they are all innovative.

Six are focussed on platform plays, with one more (Ionir) moving in that direction. The other four are more focussed on features that operate on specific platforms, such as NetApp, Red Hat and VMware. But then they have platforms of their own to sell.

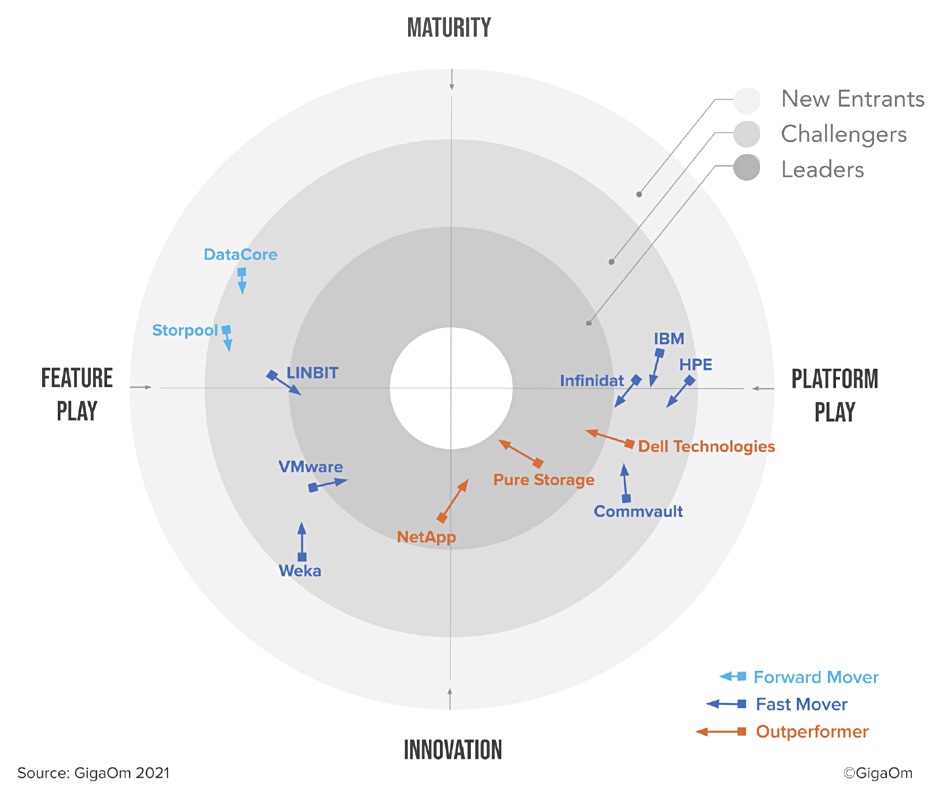

Enterprise Kubernetes data storage

The enterprise Kubernetes data storage Radar diagram is quite different to the cloud-native one in supplier distribution terms:

Five suppliers are classed as more mature than innovative: DataCore, HPE, IBM, Infinidat, Linbit and Storpool. VMware, NetApp and Weka are innovative with feature plays, while Commvault, Dell and Pure (Portworx) are innovative platform players. Infinidat, HPE and Linbit are moving into the innovative section of the chart, with IBM close behind.

Pure Storage is the clear leader in this set of suppliers as well, with NetApp second and Dell Technologies third.

The full GigaOm reports can be downloaded from its web site if you supply basic registration details.