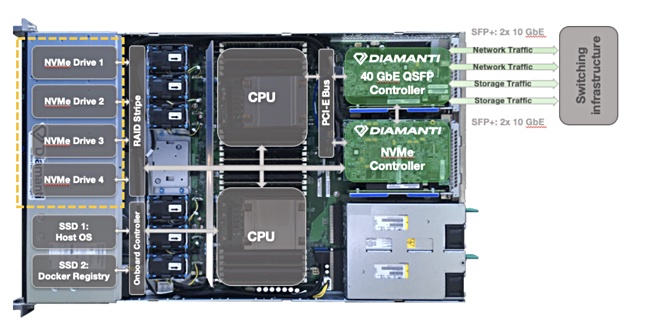

NetApp is developing its hyperconverged platform to deliver an automated Kubernetes facility. The storage giant has told us to expect a “significant announcement in the Spring”.

Longer term, NetApp will develop cloud-like products for file storage on-premises, based on NetApp HCI.

The company last week announced its decision to close NetApp Kubernetes Service (NKS), with effect from April 20. This week a spokesperson told Blocks & Files that it will subsume NKS technology into new offerings.

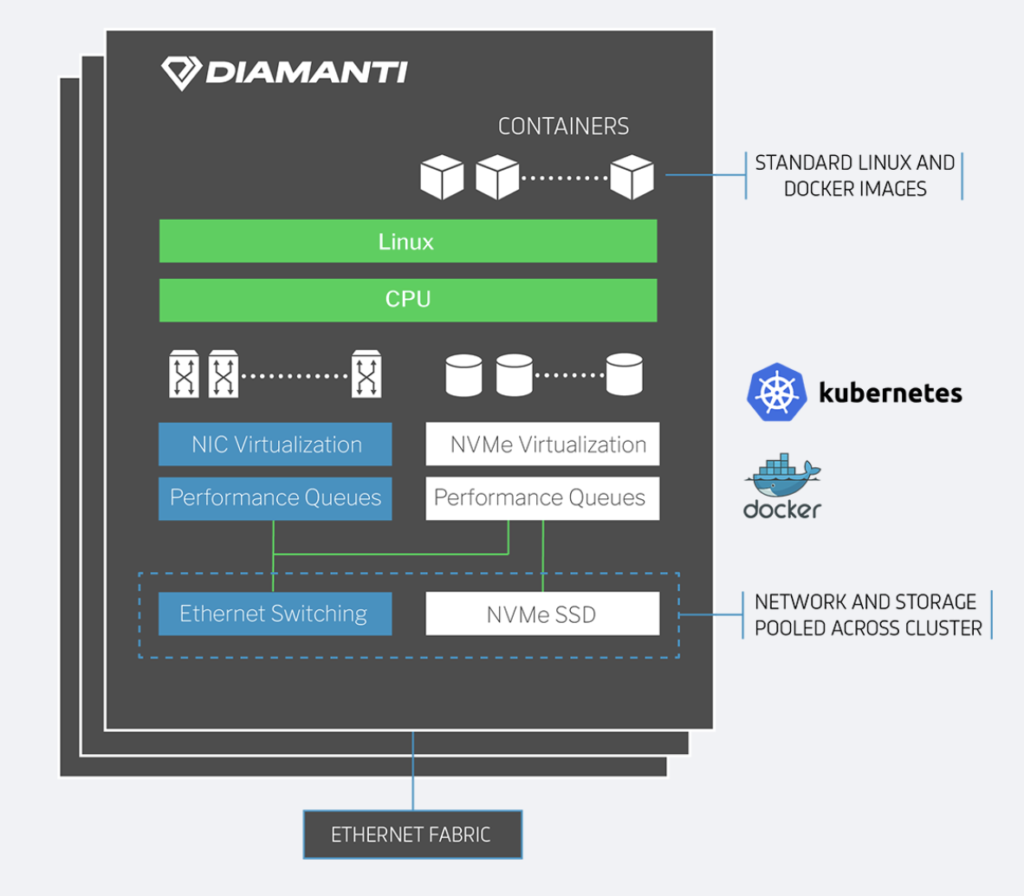

NKS enables customers to orchestrate a set of containers, but was focused too high up the Kubernetes stack, according to NetApp, which will swim downstream to provide lower-level support for many Kubernetes distributions. These may include Red Hat CoreOS, Canonical, Docker, Heptio, Kontena Pharos, Pivotal Container Service, Rancher, Red Hat OpenShift, SUSE Container as a Service and Telekube.

Blocks & Files asked NetApp for more details about the demise of NKS and Cloud Volumes services (CDS) on its hyperconverged platform. Here are the company’s replies.

Blocks & Files: Does this mean the NetApp HCI product goes away?

NetApp: Absolutely not. NetApp has every intention to stay in the HCI space as it is a fast-growing market segment. NetApp HCI offers a unique value proposition for customers looking for cloud-like simplicity in an integrated appliance. With the added differentiation of NetApp’s data fabric strategy and integration, we believe we have a very competitive product.

In the future, we will be investing in NetApp HCI to become a simplified and automated infrastructure solution for on-premises Kubernetes environments. We will share more about our strategy in the Kubernetes market in the Spring.

Blocks & Files: What does a distribution-agnostic approach to Kubernetes mean?

NetApp: Distribution agnostic means we will work with all flavors of Kubernetes, currently there are more than 30 different distributions. Our storage needs to work with as many as customers demand.

Blocks & Files: How is the NKS offering not distribution-agnostic?

NetApp: NKS has been very much upstream-Kubernetes based and spins up an upstream-Kubernetes cluster. At the same time, customers may want to pick a different distribution of Kubernetes curated by a vendor. Being distribution-agnostic just means allowing more than upstream like an OpenShift.

Blocks & Files; Why is the NKS offering not being evolved into a distribution-agnostic one?

NetApp:The change in direction is an evolution to our approach to help customers simplify the Kubernetes environments. NKS is being consumed into new NetApp projects specific to Kubernetes, we have more than quadrupled the investment in our Kubernetes plans – stay tuned for more on this soon.

Blocks & Files: Is the StackPointCloud technology being discarded?

NetApp: Absolutely not. The StackPoint technology and team are a central part of our investment in Kubernetes development and tools that will continue working on a focused set of solutions at NetApp to bring innovation and new capabilities to the Kubernetes ecosystem. Again, stay tuned.

Blocks & Files: Are the Cloud Volumes services on HCI, on-premises, AWS, Azure and GCP now all finished?

NetApp: Absolutely not, we have so much demand for CVS and Azure NetApp Files we have to allocate more of our resources and more of our infrastructure to Azure, Google and AWS. We have changed course for Cloud Volumes Service on premises and HCI to meet the demand on the three public clouds and focus our on-prem services with new investment areas.

For Cloud Volumes on HCI, in the near-term the service will be replaced by ONTAP Select included in the cost of the NetApp HCI appliance. Long-term, NetApp will use the feedback from the Cloud Volumes on NetApp HCI preview and develop new, innovative cloud-like products for file storage on-premises on the NetApp HCI platform.

Blocks & Files: Are we looking in the future to a single replacement software product for NKS and the Cloud Volumes Service that covers the on-premises, AWS, Azure and GCP worlds with hardware supplier-agnostic on-premises converged and hyperconverged hardware?

NetApp: As we shared with our customers, NetApp’s goal in Kubernetes market will be to make applications and associated data highly available, portable, and manageable across both on-premises and clouds through a software-defined set of data services. Please stay tuned for announcements this Spring.

Blocks & Files: Does that hyperconverged hardware include standard HCI offerings such as VxRail, Nutanix and HPE SimpliVity?

NetApp: NetApp’s goal is to continue investing in our converged and hyperconverged solutions, including NetApp HCI. Our investment is focused on continuing to offer a unique NetApp HCI solution with a focus on simplifying Kubernetes solutions while continuing to support our partners like VMware, Google, (Red Hat), and others through offering support for their software running on NetApp HCI. However, we do not have plans at this time to offer VxRail, Nutanix, or HPE HCI products.