The research firm DRAMeXchange expects memory prices to bounce in 2020, and this will open up an opportunity for next-gen memory technologies, also known as storage class memory (SCM).

Excess DRAM and NAND inventory means prices today are in the doldrums. But restocking momentum will build through a gradual recovery in demand and price flexibility, according to DRAMeXchange.

This will see a rebound in memory prices in 2020 and allow next-gen solutions such as SCM a better chance to penetrate the server market.

Memory tricks

Established memory technologies DRAM and NAND are pushing the physical limits of production processes and it is becoming more difficult to raise performance and lower costs.

SCM technologies are widely seen as a possible solution for greater performance, typically slotting in as a new tier in between DRAM and NAND in the memory hierarchy.

Intel’s Optane, for example, is based on 3D XPoint (regarded as a kind of phase-change memory or PRAM) and is available in a DIMM format that can fit easily into the memory slots in Intel’s newest Xeon servers.

This allows vendors to change server modules or Optane solutions at will to control the total cost of the completed product, DRAMeXchange notes.

However, economies of scale have yet to take effect for new memory technologies such as MRAM, PRAM and RRAM and prices are high. This has led vendors to target markets such as hyperscale data centres.

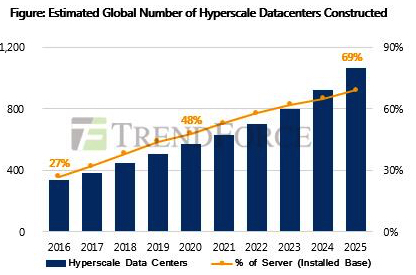

According to DRAMExchange’s parent company TrendForce, the number of hyperscale data centres constructed globally is projected to hit 1,070 by 2025, representing an annual growth rate of 13.7 per cent between 2016-2025.