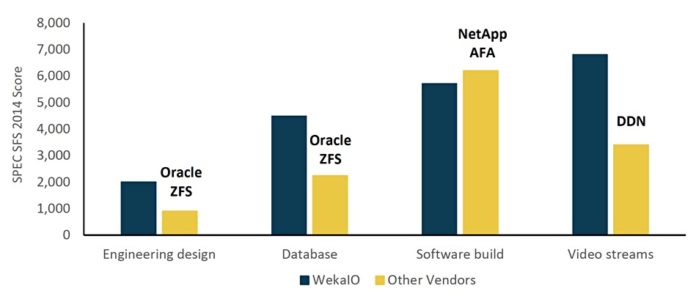

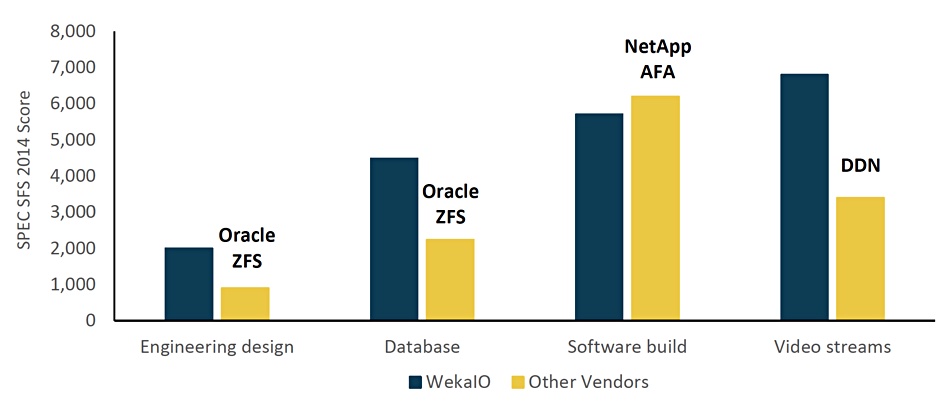

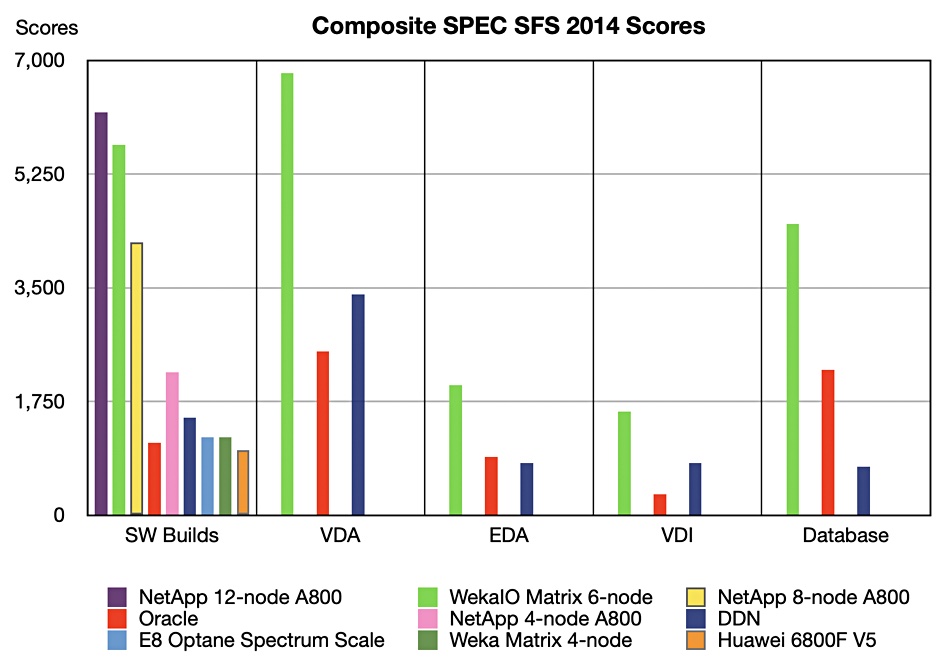

NetApp has bumped up performance for FAS and AFF arrays at the entry level, with end-to-end NVMe flash drive support, to “leave rivals in the dust”.

The refresh provides extra capacity and performance oomph to NetApp’s ONTAP products and enables the data storage veteran to compete more aggressively with new QLC-using suppliers like StorONE and VAST Data, as well as long-term rivals Dell and HPE.

NetApp sells two ONTAP external array product lines – the All-Flash FAS (AFF) and the Fabric Attached Storage (FAS) variants. Both are dual-controller external arrays used by ONTAP to present concurrent block and file access to data.

The FAS arrays are optimised for mix of performance and capacity and, until now, consist of hybrid flash-disk systems while the AFF line is optimised more for performance and uses all-flash media.

FAS500f

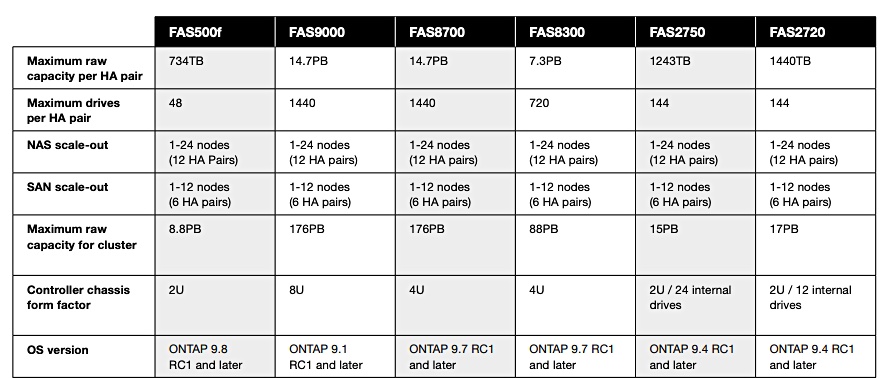

There are four FAS model groups: the FAS2600, FAS2700, FAS8200 and FAS9000 Series. NetApp has added the first all-flash product to this quartet with the FAS500f, which uses the slowest and cheapest SSDs – ones using QLC NAND. The existing FAS arrays use TLC SSDs, which are faster to access and have a longer life than QLC NAND.

NetApp suggests the FAS500f is positioned for workloads such as backup consolidation, and database and VM copies for testers and developers. Put another way, NetApp says the FAS500f is for customers with demanding application performance objectives in a cost-effective, high capacity system.

The new array supports end-to-end NVMe access and will run faster than the hybrid FAS models, while remaining slower than the AFF series.

The FAS500f has a 2 rack unit chassis and supports 24 drives or 48 in a high-availability pair. It has a much lower maximum capacity, at 8.8PB, than the other FAS arrays with their 15PB to 176PB range. The FAS2750 and FAS2720 also have a 2RU x 24 slot controller chassis and support 144 drives per HA pair.

AFF refresh

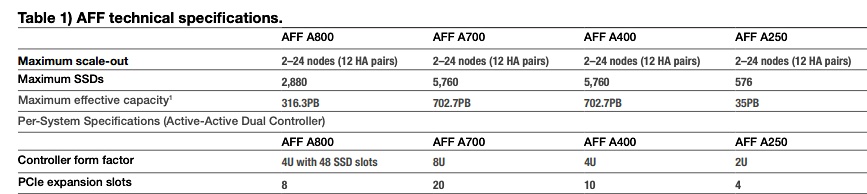

The AFF systems use SAS and NVMe SSDs, and provide an end-to-end NVMe design for maximum in-array and to-array (NVMe-over FC) data access speed and the lowest latency.

The new low end A250 AFF, which will supersede the A220, delivers “45 per cent more performance and 33 per cent more storage efficiency,” than the A220, according to NetApp product manager Saurabh Modh, “and it leaves our competition in the dust”. There is no price increase for the A250 over the A220.

Modh suggests using the A250 for “virtualization and consolidation of mainstream enterprise applications (such as Oracle, SAP HANA, and Microsoft SQL Server). It also provides an attractive starting price for emerging workloads such as artificial intelligence, machine learning, real-time analytics, and MongoDB.”

The A250 comes in a mini box, just 2RU in size, with 24 x 2.5-inch NVMe drive bays and supports expansion to 576 SSDs

This A250 is a lower-cost entry-level AFF array. It supports up to 24 x 32Gbit/s Fibre Channel ports, 4 x 100GbitE and 28 x 25GbitE ports plus a pair of 10GbitE management ports. The controllers use a 24-core Xeon processor and this controls access to the 15.3TB or 30.2TB SSDs.

The latest version of ONTAP, v9.8, is required for the A250.

A700 upgrade

With the latest refresh NetApp has added NVMe SSDs to the A700. The array already supports NVMe-oF, and the update givess it end-to-end NVMe capability for low latency and high speed data access.

NetApp senior product manager blogger Mukesh Nigam says: “In tests using a 100 per cent random read Oracle SLOB workload, an end-to-end NVMe AFF A700 system is 85 per cent faster at 500 microsecond latency than AFF A700 system with FCP/SAS storage.” That’s quite the performance jump.

In 2018 there were five AFF variants, starting with the A220 at the low end in a 2RU x 24 slot chassis, and ranging through the A300 (3RU chassis), A700 (8RU), A700s (4RU) and A800 (4RU).

There are now four AFF model groups listed by NetApp – the new low end A250, the mid-range A400 and A700, and the all-NVMe high-end A800. The A220 and A300 are absent from the current AFF datasheet, which indicates that they will soon move into end-of-life status.

The A440 and A800 have 4RU controller enclosures while the A700 employs a larger 8RU chassis. The A800 scales to 2,880 drives and the A400 and A700 scale to 5,760 drives. This results in a huge difference in effective capacity terms; 35PB for the A250 vs 793.7PB for the A400 and A700 and 316.3PB for the A800.