IBM’s storage revenues dipped 20 per cent in Big Blue’s third 2020 quarter, driven down by adverse mainframe cycle dynamics.

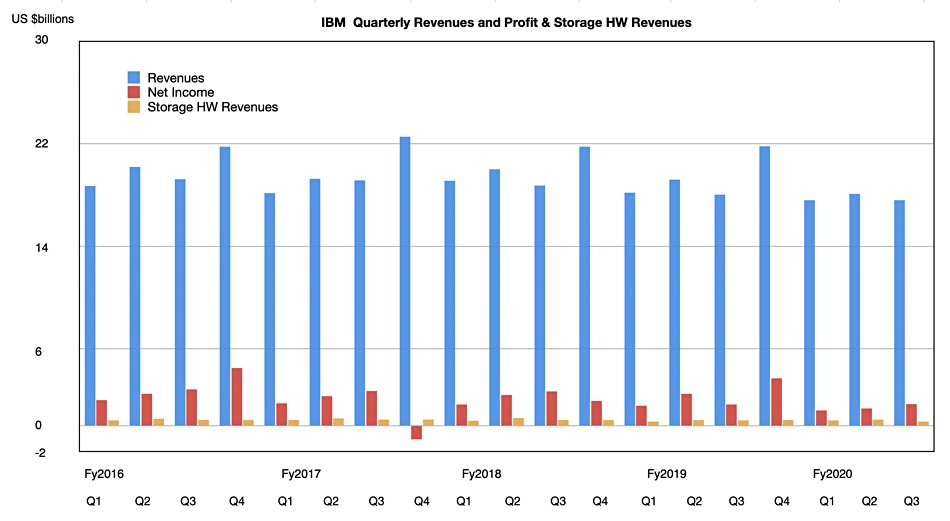

The company reported Q3 revenues of $17.6bn, down 2.6 per cent, with net income of $1.7bn, 9.7 per cent of its revenues and up 2 per cent Y/Y.

CEO Arvind Krishna’s announcement quote said: “The strong performance of our cloud business, led by Red Hat, underscores the growing client adoption of our open hybrid cloud platform.”

The segment results were:

- Cloud and Cognitive SW revenues of $5.6bn, up 7 per cent Y/Y, with Red Hat revenues up 17 per cent,

- Global Business Services revenues of $4.06bn, down 5 per cent,

- Global Technology Services revenues of $6.5bn, down 4 per cent,

- Systems revenues of $1.3bn, down 15 per cent as the mainframe cash cow delivered less milk,

- Global Financing revenues of $273m down 20% as OEM-related revenues fell.

Quick overall summary:

- Free cash flow of $1.1bn

- Cash balance of $15.8bn, up $6.7bn since year-end

- Gross profit margin of 48 per cent, up 1.8 per cent

- EPS of $1.89

CFO Jim Kavanaugh’s prepared remarks included this: “Turning to Systems, revenue was down 16 percent, driven primarily by product cycle dynamics. … IBM Z revenue was down 20 per cent. … These cycle dynamics impacted our storage revenue as well, with performance driven by declines in high-end storage.”

The pandemic was a factor but mainframe cycle dynamics counted for more. The z15 was launched towards the end of Q3 in 2019. Kavanaugh said: “This pandemic has impacted our historical IBM Z cycle dynamics, which is playing out differently by industry. This platform has proved invaluable to our clients in areas like banking and financial markets … [and] these clients accelerated their adoption of z15 within the cycle.

“That said, in many other industries, clients remain focused on cash preservation during this pandemic. This dichotomy in client buying behaviours impacted our performance in the third quarter.”

Within the Systems business unit, systems hardware revenues declined 19 per cent Y/Y at constant currency, operating systems SW went down less with an 8 per cent fall, and storage declined the most with a 20 per cent drop.

IBM didn’t reveal actual numbers but we calculated from our spreadsheet records that storage revenues were $346.9m.

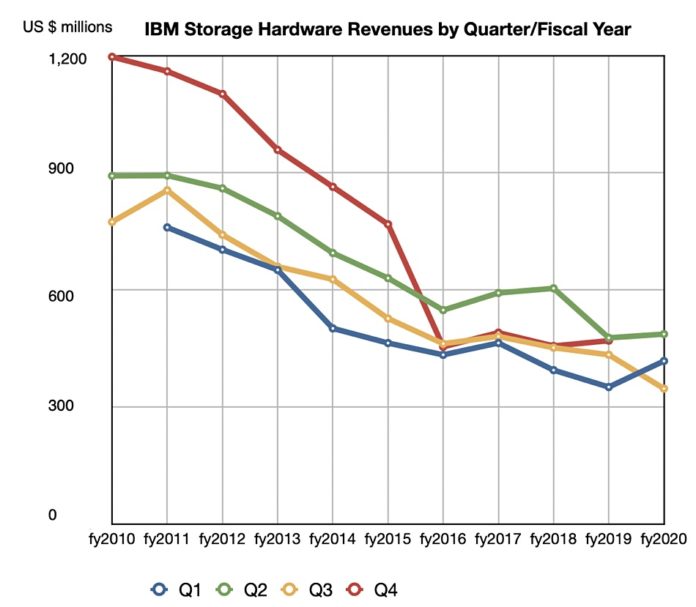

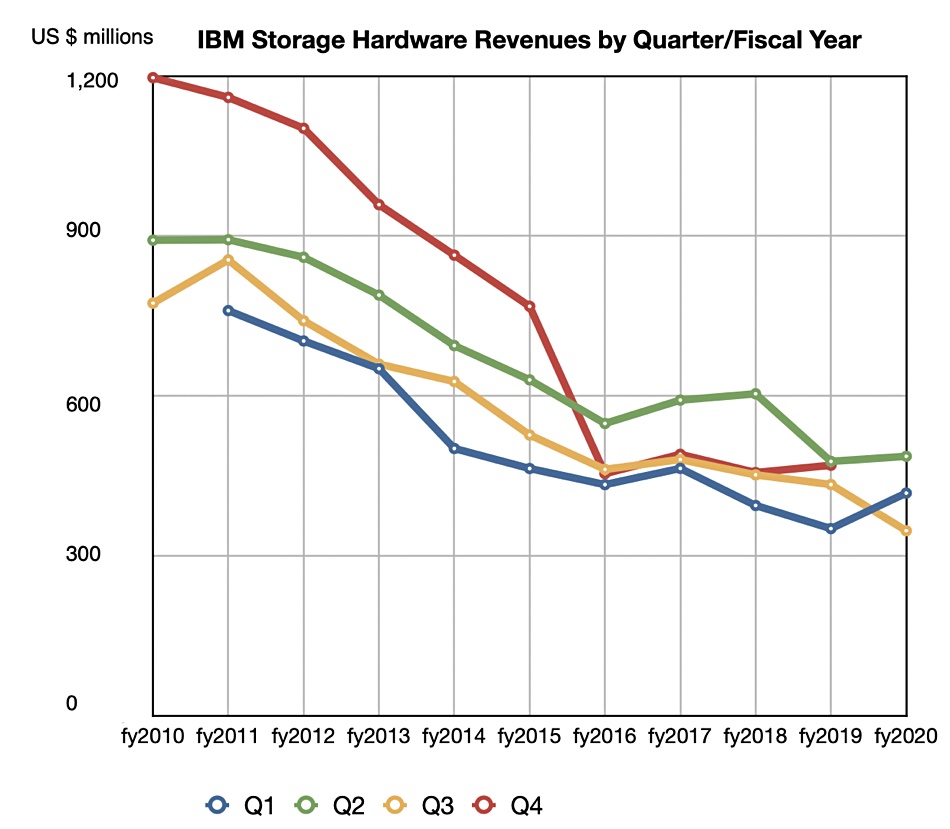

That puts an end to three successive quarters of growth (yellow line on chart). The 10-year overall decline in storage revenues raises a question about IBM’s long-term commitment to storage hardware sales, considering that it’s offloaded its networking, disk manufacture, PCs and X86 servers businesses in the past.

IBM wants to be a hybrid cloud platform and AI company and is splitting off its managed infrastructure services into a new company, temporarily called NewCo. Storage revenues represent just 2 per cent of IBM’s quarterly revenues. Their rise or fall don’t account for much in the overall IBM scheme of things, especially not when the $59bn annual revenue IBM is being split off from the $19bn NewCo.

IBM expects to deliver sustainable mid-single digit revenue growth upon completion of the separation of NewCo. Whether that translates to sustainable mid-single digit storage revenue growth remains to be seen.