South Korean memory semiconductor supplier SK hynix will pay $9bn to buy Intel’s NAND foundry and SSD business, it has been confirmed.

SK hynix is paying 208 trillion won (about $9bn) for the bulk of Intel’s Non-Volatile Solutions Group (NSG), meaning the Dalian fab, the NAND wafer and components operations, NAND IP and staff, and the SSD business, leaving the group with its 3D Point operations.

Bob Swan, Intel’s CEO, offered a canned statement: “I am proud of the NAND memory business we have built and believe this combination with SK hynix will grow the memory ecosystem for the benefit of customers, partners and employees. For Intel, this transaction will allow us to further prioritize our investments in differentiated technology where we can play a bigger role in the success of our customers and deliver attractive returns to our stockholders.”

Those attractive returns have been lacking from Intel’s NAND business. Swan may be proud but Intel is walking away from a business that couldn’t deliver the return on investment it wanted.

SK hynix CEO Seok-Hee Lee also issued a statement: “By taking each other’s strengths and technologies, SK hynix will proactively respond to various needs from customers and optimize our business structure, expanding our innovative portfolio in the NAND flash market segment, which will be comparable with what we achieved in DRAM.”

Lee’s company is getting an SSD product line including NVMe interface SSDS using QLC flash. Intel is retaining its Optane 3D Point non-volatile memory business. It sold its interest in 3D XPoint manufacturing to Micron in late 2018, and its Optane business could have entered profitability after a lot of investment since its July 2015 announcement.

Analyst Mark Webb told us: “Intel Optane Persistent memory is the big strategic item and it is managed by DCG (Data Centre Group), not NSG.”

The two companies will seek government approvals and this could be obtained by the second half of 2021. The deal is structured in two stages. In phase one, and consequent on government approval, SK hynix will pay Intel $7bn and get the NAND SSD business (including NAND SSD-associated IP and employees), as well as the Dalian facility.

A second phase will see SK hynix paying Intel $2bn and acquire IP related to the manufacture and design of NAND flash wafers, R&D employees, and the Dalian fab workforce. This is planned to take place in March 2025. Until then Intel will continue making NAND wafers at Dalian and retain all IP related to the manufacture and design of NAND flash wafers.

SK hynix will use the acquisition to grow its NAND chip and SSD businesses, particularly its enterprise SSD business, with a focus on higher-value SSDs.

It said that, in the six months ended June 27, 2020, Intel’s NSG earned $2.8bn revenues from its NAND business, which provided $600m operating income.

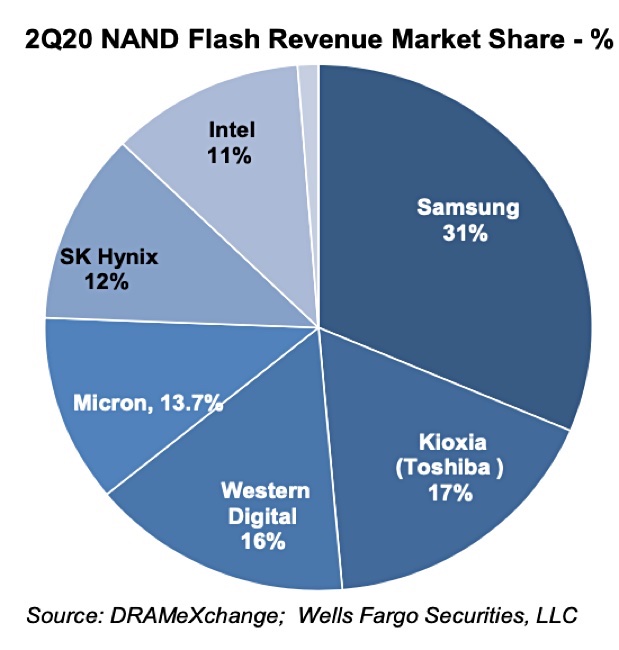

The deal will see the SK hynix – Intel combination having a 23 per cent NAND market revenue share, second only to Samsung with 31 per cent. As Kioxia (17 per cent) and Western Digital (16 per cent) jointly operate a NAND foundry complex their combined share is 33 per cent. Micron at 13.7 per cent is someway behind.

Industry research outfit TrendForce said that, in terms of product competitiveness: “SK hynix has an advantage in the mobile market, including eMCP and eMMC products, accounting for more than 60 per cent of SK hynix’s total NAND Flash revenue in 2019. On the other hand, Intel has been performing superbly in the enterprise SSD market. Not only is Intel on par with Samsung in enterprise SSD, but it has also captured more than 50 per cent of the Chinese market. Enterprise SSD yields the highest profitability among the entire range of the company’s NAND Flash end-products.”

Webb does not believe that mooted industry consolidation benefits will be very meaningful: “This is not as great for NAND consolidation as one might think. Intel sells very little open market NAND to mobile or card/USB market. Intel sells SSDs and raw memory to enterprises (Google, Amazon, Oracle, etc).

“As such, if this were to move to Hynix, it will not change the pricing competition in the card market and mobile market which along with consumer SSDs are the most competitive. Intel is a small player outside of enterprise SSDs.”

Intel will use the overall $9bn proceeds to build up its artificial intelligence, 5G networking and intelligent, autonomous edge offerings.

Webb said: “I believe Intel is still not allowed to make announcements during its quiet period (30 days before earnings). I expect [an] announcement on Thursday,” when Intel announces its Q3 2020 earnings.