MediaFlux supplier Arcitecta has announced Scale-Out ZFS with Mediaflux, which it reckons “overcomes the scalability limitations of traditional scale-up ZFS systems and empowers customers to handle exponential data growth easily and achieve up to a 10:1 reduction in storage costs.” Mediaflux provides a unified view of data across multiple ZFS servers, enabling organizations to easily scale storage capacity and performance by adding more servers to the cluster. Arcitecta says Scale-Out ZFS with Mediaflux offers intelligent data placement, easy administration, superior data protection and performance, and a global namespace across multiple ZFS storage servers to enable simplified data management. Users and administrators can view and manage data spread across multiple ZFS storage servers as if it were in a single directory structure. Read a solution brief here.

…

Aerospike has released its recently announced graph database on Google Cloud and Google Marketplace. Aerospike enables developers on Google Cloud to now easily write applications with new and existing Gremlin queries. This applies to Aerospike Graph for AdTech, Customer 360, fraud detection and prevention, and other use cases that must operate at scale in real time. Aerospike Graph delivers millisecond multi-hop graph queries at extreme throughput across billions of vertices and trillions of connections. Benchmarks show a throughput of more than 100,000 queries per second with sub-5ms latency – on a fraction of the infrastructure.

…

Data security supplier Comforte AG is partnering with AWS to offer joint customers its end-to-end data security offering. This privacy-preserving protection for sensitive data elements includes personally identifiable information (PII), data discovery, and classification features specifically designed to scan for sensitive data elements within AWS environments.

…

No-code data integration platform Dataddo has been recognized as a Google Cloud Ready solution for automating connections between online services and BigQuery, AlloyDB, and Cloud SQL. Dataddo says its ETL, ELT, and reverse ETL capabilities, together with its portfolio of 250+ connectors, let mutual customers synchronize any business data from online sources to BigQuery, AlloyDB, and Cloud SQL, as well as from this storage to other databases and operational applications.

…

EnterpriseDB (EDB) today announced GA of EDB Postgres Distributed on EDB BigAnimal fully managed Postgres-as-a-Service. It says that it can help enterprises meet the needs of a globally distributed customer base and improve business continuity across multiple datacenters while protecting against unplanned outages that cause downtime, with up to 99.995% availability.

…

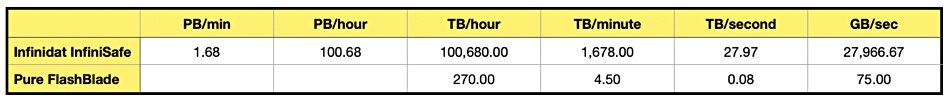

The Detroit Pistons team of the National Basketball Association (NBA) has selected Infinidat’s InfiniBox for its enterprise storage needs. This was a straight commercial deal with no sponsorship elements. The Detroit Pistons are consolidating the applications and workloads from three different vendors onto their InfiniBox platform. Going forward, InfiniBox will provide the storage capacity and advanced capabilities for VMware environments, SQL database environments, and various file applications and workloads, such as data stores, video, and file archives. By making this transition, the Pistons will be able to save significantly on capital expenditure and operational expenditures. Infinidat partner Mainline Information Systems was heavily involved in the deal.

…

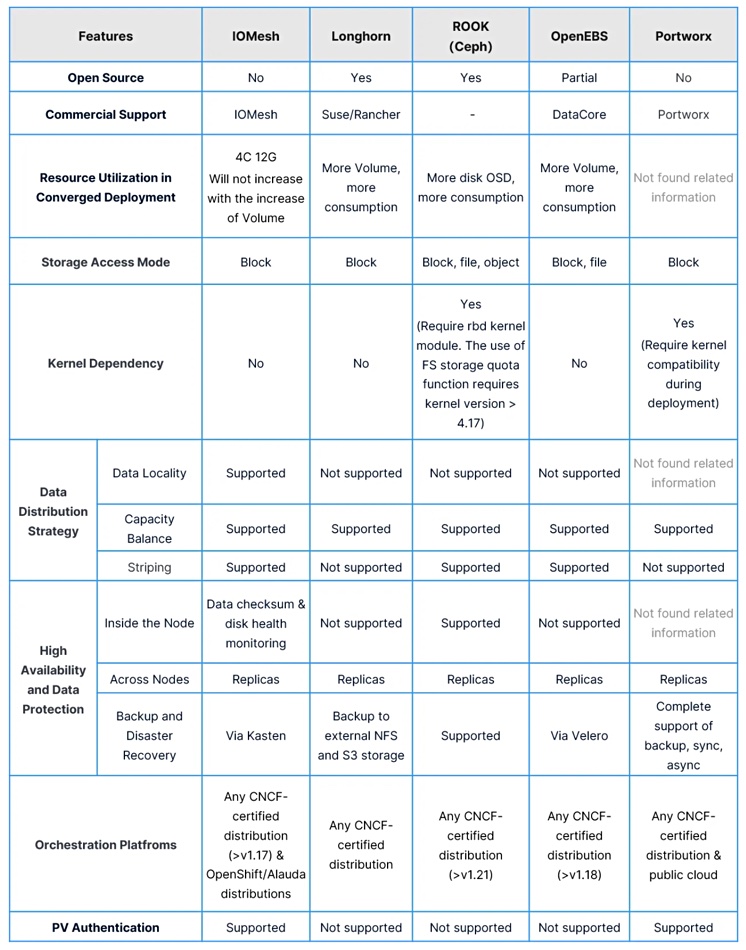

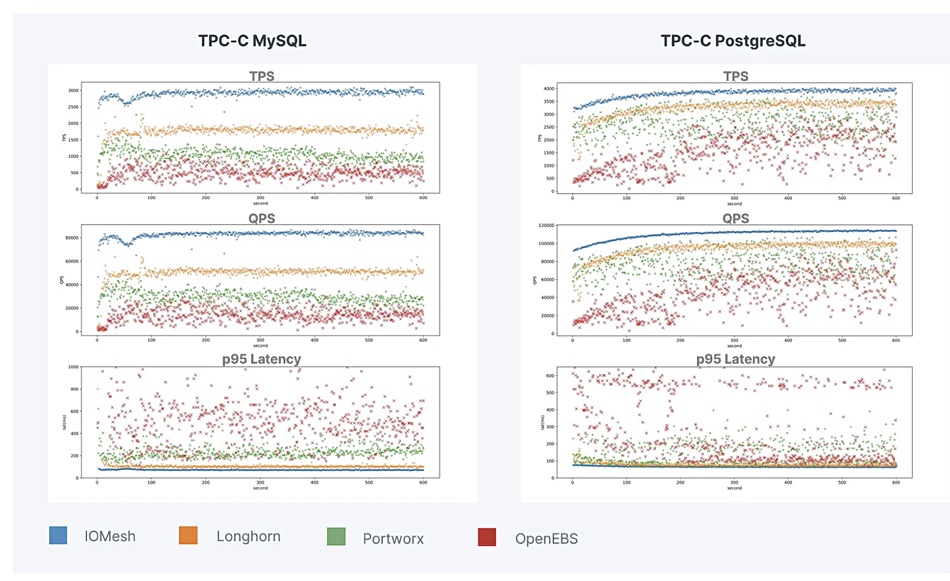

SmartX’s IOMesh shared a Make It Simple evaluation of Kubernetes storage suppliers in which it had the leading position:

It tested TPC-C MySQL and PostgreSQL performance. In terms of overall IO performance and stability, IOMesh emerged as the top performer, with Longhorn, Portworx, and OpenEBS following in that order.

…

Data management and archiving vendor Spectra Logic is announcing support for the IBM TS1170 tape drive and 50TB JF media in its enterprise-class libraries. This, according to Spectra Logic, brings unprecedented new levels of storage density and capacity to Spectra Logic TFinity ExaScale, T950, and T950v libraries. The Spectra TFinity library becomes the world’s largest tape storage system as it breaks the multi-exabyte barrier for storing uncompressed data, with up to 2.15EB of uncompressed data, and up to 6.45EB with a 3:1 compression ratio. Spectra libraries support the intermixing of IBM TS series, Oracle T10000 family, and LTO tape drives.

…

Web3 decentralized storage provider Storj says it has just about doubled revenue since November 2022.

…

Swissbit has announced a U.3 format, D1200 PCIe gen4 TLC SSD for datacenter use, saying it delivers the highest sustained system performance over its lifetime. In addition, features including Full Data Path Protection, NVMe-MI for out-of-band management, Secure Boot telemetry, Persistent Event Log, and AES data encryption. Capacities are 7.68TB and 15.4TB.

It achieves bandwidths of up to 6,900 MBps for sequential reads and 7,000 MBps for sequential writes. The D1200 provides up to 1.6 million IOPS for reads and 900,000 IOPS for writes. Its endurance values are at least 1.5 DWPD (Drive Writes Per Day) when measured against a standardized workload (JEDEC Enterprise Workload) over a five-year period. The D1200 is available now.

…

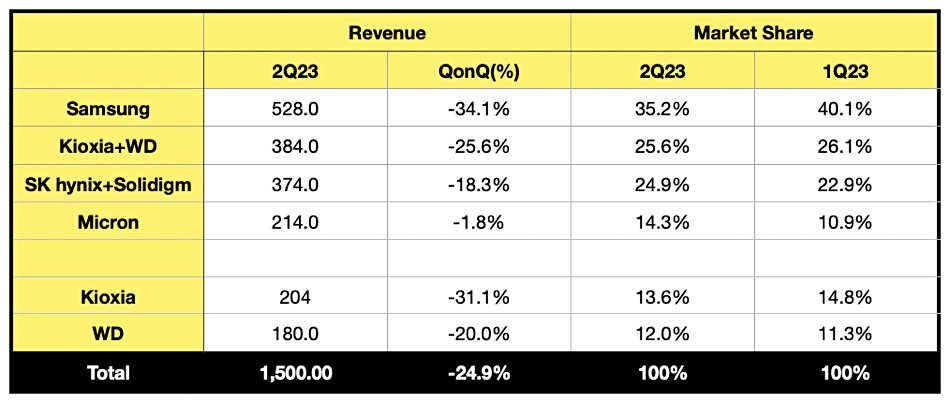

TrendForce’s enterprise SSD revenue ship numbers recorded a 25 percent sequential fall from the calendar Q1 to calendar Q2:

Market leader Samsung suffered most with a 34.1 percent fall, while Micron suffered the least with a 1.8 percent decline. SK hynix/Solidigm and Micron, also Western Digital, registered market share gains due to their sales falling slower than the market average. TrendForce attributed the overall enterprise SSD market decline to CSPs buying less product. It added: “Western Digital is also gearing up to introduce QLC SSDs… its next-generation PCIe 4.0 products are yet to reach mass production.”

…

Serverless analytics and AI app real-time search startup Rockset has raised $44 million in a Series B extension round, bringing the company’s total capital raised to date to $105.5 million. The round, which included $7 million in debt financing, was led by Icon Ventures, with participation from new investors Glynn Capital, Four Rivers, K5 Global, and existing investors Sequoia and Greylock. Over the past two years, Rockset has tripled its revenue, doubled its customer base, and replaced Elasticsearch across verticals including fintech, gaming, e-commerce, and logistics.

…

Data-in-use encryptor Vaultree has integrated its software with Google Cloud SQL and has achieved a Google Cloud Ready – Cloud SQL designation. Customers arew promised:

- Complete Data Security: With Vaultree’s encryption, data stored in Google Cloud SQL remains continuously protected, preserving its confidentiality and integrity.

- Enhanced Data Usability: Enterprise businesses no longer need to choose between security and functionality. With Fully Functional Data-In-Use Encryption (FFDUE), data remains encrypted but agile, fostering growth and AI-driven innovations.

- Global Compliance: The combined power of Vaultree and Google Cloud SQL empowers organizations to meet cross border data protection standards, fostering greater trust among partners and clients.

- Effortless Integration: Implementing Vaultree’s FFDUE with Google Cloud SQL is seamless, ensuring businesses can elevate their data security without disruption.

The integration is available now for Vaultree and Google Cloud customers.