Purpose-built backup appliance (PBBA) vendor ExaGrid had claimed a record-breaking second quarter, saying its customer numbers are heading to 4,000 and that it pulled in $19 million from new clients.

Update: ExaGrid new customer revenue number updated. July 12, 2023.

The privately held company did not provide profit and loss figures.

ExaGrid’s PBBA tiered storage products store incoming backup data in a so-called Landing Zone for fast restoration closely following backup, and then deduplicates the backup data for longer term storage in the device. Competing PBBAs dedupe on backup ingest, lengthening ingest time and making rehydration (reversing deduplication) necessary for all restore jobs.

CEO and president Bill Andrews said: “ExaGrid is continuing to expand its reach and now has sales teams in more than 30 countries worldwide and customer installations in over 80 countries. We will hit 4,000 active customer installations in Q3. We have achieved our top-line goals for Q1 and Q2. ExaGrid is cash, P&L, and EBITDA positive for the 10th quarter in a row. Outside of the United States, our business in Canada, Latin America, Europe, the Middle East, Africa, and Asia Pacific is rapidly growing and is now 45 percent of the business.”

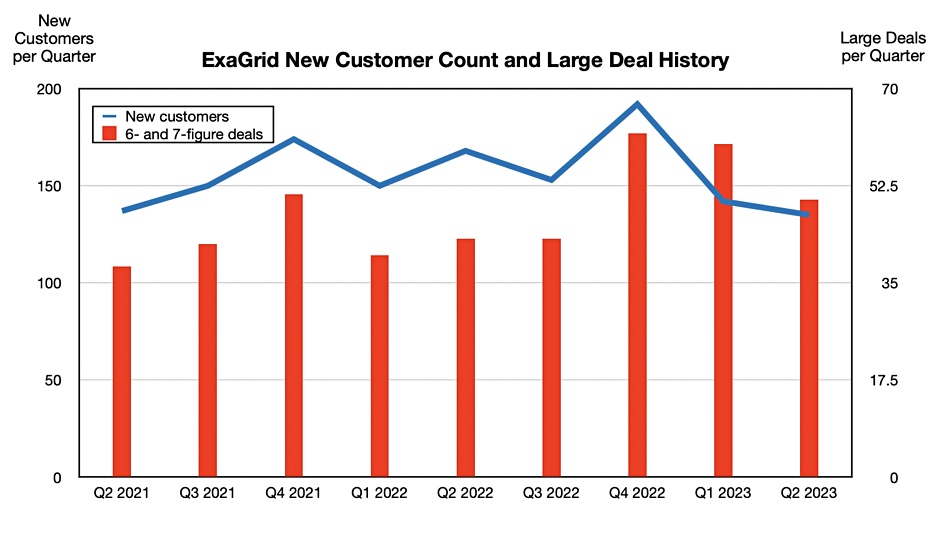

ExaGrid revenues grew 27 percent Y/Y and there were 135 new customers with an ASP rising to $119,000. There were 50 six and seven-figure deals. The total customer count went past 3,900. The company has a 95 percent net customer retention rate, with 99.1 percent of customers on yearly maintenance and support, and 94 percent having its Retention Time-Lock for Ransomware Recovery feature (immutability) turned on. The company has an NPS score of +81.

We calculated it pulled in $16 million from new customers, multiplying the new customer number, 135, against the ASP of $119,00. But CEO BIll Adrews subsequently told us: “The actual new customer bookings number, in the quarter, was just over $19million.”

Competition

In the PBBA market ExaGrid competes with Dell EMC’s PowerProtect, HPE’s StoreOnce, Quantum’s DXi and Veritas’s NetBackup Flex product. We don’t know the specific sales figures for Dell EMC, HPE or Veritas’ products. That makes comparing sales of difficult.

Update: Quantum earned revenues of $46 million from sales of its ActiveScale (object storage), DXi, and Scalar tape systems in the first calendar 2023 quarter. The proportion of DXi sales is not known. Quantum did say it had an incredible year of hyperscale sales, meaning tape, with 2x revenue growth Y/Y. Splitting the $46 million three ways with Scalar tape taking the largest share gives an indication of possible DXi revenues. Ignoring that, an equal third share would give DXi $15.33 million revenues in the quarter.

With ExaGrid earning $19 million from new customers plus whatever it made from its existing customers we think it highly likely ExaGrid outsold Quantum’s DXi products in its second 2023 quarter. Bill Andrews told us: “We crossed the $100M million [run rate] 2 years ago. Our existing repeat order business in the quarter was higher than the new logo business.”

That means ExaGrid pulled in at least $38 million in the quarter, indicating a minimum $152 million run rate. Our thinking, after talking with Andrews, is that the suppliers in ExaGrid’s market are ranked (1) Dell EMC and a long way behind, (2) Veritas FlexScale appliance – for Veritas NetBackup only, and HPE StoreOnce may be #3 or ExaGrid may be #3; it is really close. Quantum with DXi trails some way behind.

Competition also comes from all-flash array suppliers like Pure Storage (FlashBlade) and VAST Data offering fast restore from QLC flash-based systems with claimed disk-level TCO. As backups tend to be large, restore speed is more affected by bandwidth than latency and ExaGrid’s ability to restore from a non-deduped landing zone could nullify any SSD speed advantage over disk.

We note that ExaGrid could use QLC flash media as well in future products.

Another competitive trend is the use of direct-to-object storage backups with Veeam v12 sending data to ObjectFirst, Pure Storage, VAST Data, Cloudian, MinIO, Scality and Zadara as an example.

We understand that ExaGrid could add an S3 interface and join in as well.