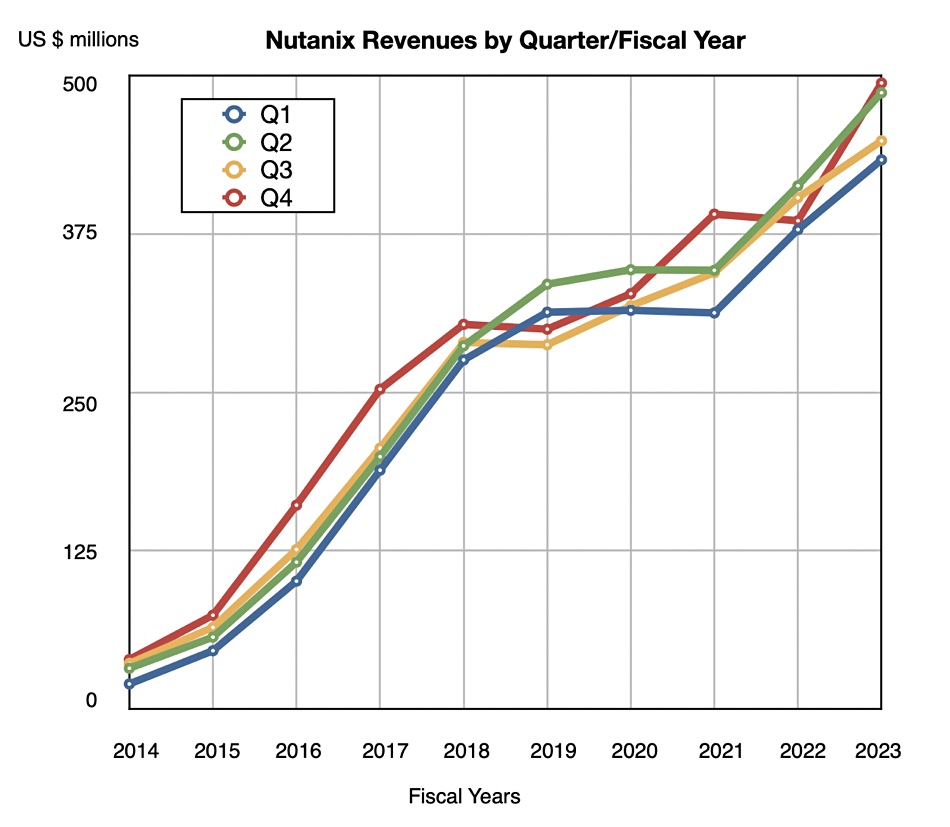

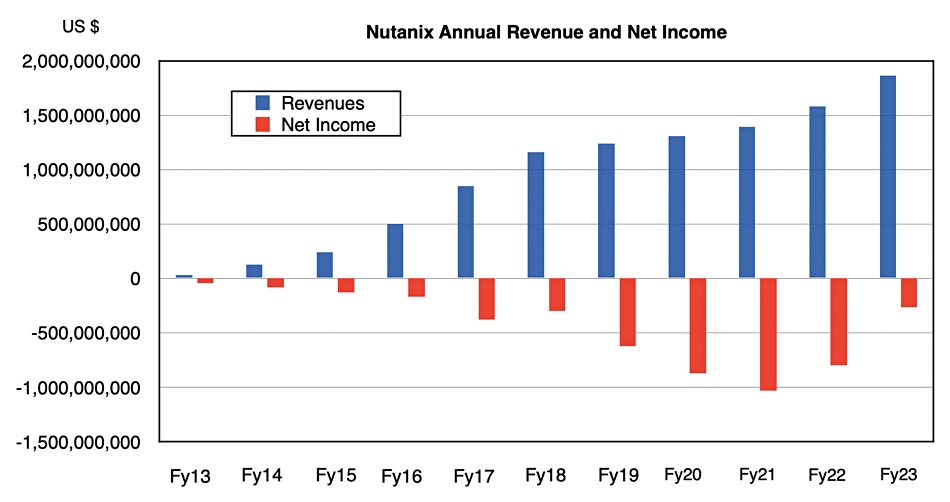

Nutanix reported revenue growth in excess of guidance for the fourth fiscal 2023 quarter with its lowest annual loss for seven years, bringing profitability within reach.

Revenues in the quarter ended July 31 for the hyperconverged infrastructure software vendor were $494.2 million, up 28.2 percent, with a loss of $13.3 million, sharply down on the year-ago loss of $151.3 million. Full fiscal 2023 revenues were $1.86 billion, 17.8 percent more than 2022, with a loss of $254.4 million, much improved from the year-ago loss of $798 million.

President and CEO Rajiv Ramaswami said: “Our fourth quarter capped off a fiscal year that showed healthy year-over-year top line growth and sharp year-over-year improvements in profitability and free cash flow.”

Free cash flow in the quarter was $45.5 million compared to $52.7 million in the preceding quarter and $23.2 million a year ago. Gross margin was 83.7 percent against 79.3 percent a year ago. The non-GAAP operating margin for the year was positive at 9 percent, a first for Nutanix and a signal of GAAP profitability being close.

Ramaswami said: “Overall, for fiscal 2023, we demonstrated consistent execution, solid top line growth, strong renewables performance, sharp improvements in profitability and free cash flow and continued progress on our longer-term strategic priorities.”

Nutanix is growing in spite of the poor macro-economic situation. Ramaswami said businesses are choosing Nutanix as they are “looking to optimize their total cost of ownership.” CFO Rukmini Sivaraman mentioned there had been a modest increase in sales cycles but “we are seeing continued new and expansion opportunities for our solutions despite the uncertain macro environment.”

Some 500 new customers came on board in the quarter. There were 430 last quarter after three quarters of declining numbers. It takes the customer count up to 24,550, and the spend per customer continued to increase. In lifetime bookings terms there are now:

- 142 customers with >$10million – up 29 percent Y/Y

- 217 customers with $5 – $10 million – up 22 percent Y/Y

- 326 customers with $3 – $5 million – up 20 percent Y/Y

- 1,498 customers with $1 – $3 million – up 17 percent Y/Y

The land-and-expand customer strategy machine is working well and Nutanix sees a rosy road ahead. Sivaraman said: “Overall, we remain confident in our view around a large and growing market for our solutions combined with a growing mix of renewals as a significant driver of both billings growth and margin expansion over a multi-year period.”

Nutanix sees a big opportunity with AI inferencing models, which start out with training in the public cloud, to operate at customer’s edge sites. Ramaswami said: ”What you’re going to see is companies need to run these AI models where their data is. And in a lot of applications, enterprise applications, sensitive data is stored on-prem or at edge locations where they’re actually gathering the data in the first place.”

That’s the reasoning behind Nutanix’s recent GPT-in-a-box announcement, about which Ramaswami said: “It’s still early days, but I’m excited about where this is going.”

Nutanix is also pleased with its Cisco partnership deal, with Ramaswami saying: “We are excited about working with Cisco on this partnership and having themselves our leading hybrid multi-cloud software, leveraging their extensive go-to-market reach.”

The Broadcom-VMware acquisition is still being seen as an overall positive by Nutanix. Sivaraman said: “We continue to see significant engagement and opportunities related to potential concerns around that transaction,” and mentioned a seven-figure deal won because of such concerns.

Ramaswami added that customer concerns and engagements over VMware’s future were rising. “Clearly, we’ve seen some deals starting to close. And there is still a lot of variability in terms of how the pendulum is going to swing on this one from customers who might just use us to get at a lower price from VMware to customers who truly see us about bringing a second [choice], reducing their risk with an alternative provider.”

The new Cisco partnership deal is valued highly by Nutanix because its gets the firm in front of more customers. Ramaswami said: “We today have about… 25,000 customers roughly, but our addressable market in terms of customers are at least 100,000. And so Cisco’s broad market reach could help us get those initial entries… I look at this as an expansion opportunity for us with a much larger customer base.”

Next quarter’s revenue is expected to be $500 million varying by $5 million, implying 15.3 percent annual growth at the midpoint. Full 2024 revenues are being guided at $2.13 billion varying by $15 million, a 14.3 percent rise.

Comment

Hyperconverged infrastructure is a way to consume storage without having external storage systems, SANs mostly. Nutanix’s main competitor is VMware with its vSAN. But it also competes with external storage suppliers such as Dell, HPE, IBM, NetApp, and Pure Storage. Pure has the smallest revenues of these players, and has just reported a $688.7 million quarter, ahead of Nutanix.

Will Nutanix be able to outgrow Pure over the next few years? The answer partly depends on whether customers want hyperconverged infrastructure more than they want to buy compute, networking, and storage hardware as independent entities. The jury is still out on that.