Dell reported revenues in the second quarter ended August 4 of $22.9 billion, 13 percent less than a year ago, with a net income of $455 million, 10 percent down annually, as both its CSG and ISG business units recorded stronger sales than in their poor first quarter.

CFO Yvonne McGill said: “Revenue grew 10 percent sequentially to $22.9 billion, with strong cash flow from operations of $3.2 billion in Q2 and $8.1 billion over the last 12 months. We continue to deliver value to shareholders and have flexibility to increase our return of capital going forward.”

Jeff Clarke, vice chairman and COO, put a good gloss on these numbers with his quote: “With a better demand environment and strong execution, we delivered extraordinary Q2 results.” They were better than Dell’s high-end guidance of $21.2 billion by $1.7 billion. That is extraordinary, even though this quarter is seasonally stronger for Dell than its first quarter.

He said in the earnings call: “Coming into the quarter, we were cautious given our Q1 results, but the demand environment improved at a faster rate than we anticipated, particularly as we moved into June and July.”

Clarke added: ”We continue to focus on the most profitable segments of the market where we have a leading position. Demand for our proprietary software-defined storage solution has now grown eight consecutive quarters. Our client solutions group business was up 8 percent sequentially with strong attach rates. And AI is already showing it’s a long-term tailwind, with continued demand growth across our portfolio.”

Financial summary

- Operating income: $1.2 billion down 8 percent Y/Y

- Operating cash flow: $3.2 billion

- Recurring revenue: $5.6 billion, 8 percent higher Y/Y

- Cash and investments: $9.9 billion

- Total debt: $27.4 billion vs $27.2 billion a year ago

The PC-focused Client Solutions Group (CSG) saw its revenues fall 16 percent Y/Y to $12.9 billion, with $10.6 billion coming from the commercial side and $2.4 billion from consumers.

The Infrastructure Solutions Group (ISG) earned $8.5 billion, 11 percent down annually, with $4.3 billion in servers and networking revenue, down 17.6 percent Y/Y, but with growth seen for AI-optimized servers.

Dell said its storage revenue was $4.2 billion, 2.9 percent down annually, so doing better than servers and networking. There was continued demand growth in its midrange PowerStore array and software-defined PowerFlex storage – its non-VMware hyperconverged infrastructure offering. PowerFlex has now grown eight consecutive quarters with second quarter demand more than doubling year-over-year.

Clarke said: “Our performance was primarily driven by our strength in HCI, most notably, our PowerFlex …We’re seeing great momentum there [with] its ability to independently scale compute and storage for high-performance applications. … it grew triple digits, more than doubled in the quarter.”

It’s interesting that HCI vendor Nutanix also did well with its non-VMware offering, suggesting that VMware’s continued HCI dominance is at risk.

The upper end of its storage products did not do so well, Clarke saying: “Our high-end storage is going through that down cycle where we saw the mainframe refresh, we saw a buildup through the COVID time ,or now in the digestion of that capacity that was brought online.” He’s optimistic that the AI demand surge could drove unstructured (file) and object storage sales, meaning PowerScale and ECS product sales.

But the outlook for the next quarter is for a storage revenue downturn, with Clarke saying: “It’s seasonally down Q2 to Q3. And with the weakness in our enterprise customers, they happen to be the greatest concentration of the high-end or high-priced band storage arrays that we sell.” THere could well be an upturn in the fourth quarter though.

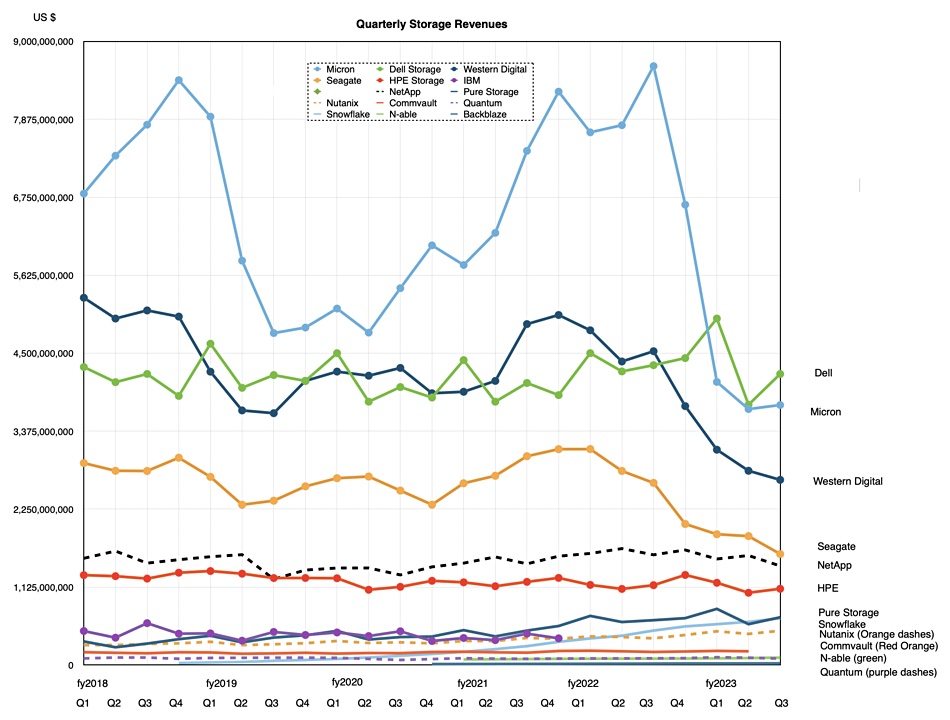

We’d love to know the revenues for each storage product line but we don’t get to see those numbers. Dell’s storage revenue makes it the clear storage systems market leader, with higher revenues than drive suppliers Micron (DRAM and SSD), Western Digital (HDD and Seagate (HDD). Micron and Western Digital have traditionally had higher revenues than Dell. Here’s a chart of storage suppliers’ revenues over time to show how their businesses have progressed:

Once the DRAM and NAND memory glut is over then we can expect Micron and WD revenues to soar above Dell again. No other storage system vendor represents a current threat to Dell’s across the board storage leadership, neither NetApp, HPE, IBM, Pure Storage nor Nutanix.

Jeff Clarke: “We think there’s going to be AI factories everywhere.”

Looking ahead Dell expects its total addressable AI market to have a compound annual growth rate of around 19 percent over the next few years to around $90 billion. It says AI servers accounted for roughly 20 percent of its servers sold in the first half of 2023, it has about $2 billion in AI server backlog and a strong sales pipeline.

Clarke said: “We think there’s going to be AI factories everywhere, little ones and big ones and little ones on the edge and medium-sized ones in datacenters and large ones at cloud scale. That paints a picture of a pretty significant opportunity for us.”

He thinks that: “In the near term, we are seeing organizations concentrate on so-called fourth generation AI use cases: customer operations, content creation and management, software development and sales. And internally, we are doing the same to enhance how we build products, service our customers and improve productivity and efficiency.”

He also said AI-related hardware was developing rapidly: “We’re tracking at least 30 different accelerator chips that are in the pipeline in development that are coming.”

The outlook for the next quarter is for revenues between $22.5 billion and $23.5 billion, well down on the year ago third quarter’s $24.7 billion at the $23 billion guidance mid-point. Dell has raised its full fy24 revenue expectations, due to expected sequential growth in the Q4, to be between $89.5 billion and $91.5 billion, down 12 percent Y/Y at the $90.5 billion mid-point.