Scandal struck data replicator WANdisco was readmitted to the AIM stock market yesterday after shareholders approved proposals to raise fresh capital via a new share issue.

The company’s stock was suspended from AIM in early March when WANdisco’s claimed that a single senior sales rep had fabricated sales in calendar 2022: the reported $24 million revenue for the year turned out to be just $9.7 million worth of genuine turnover.

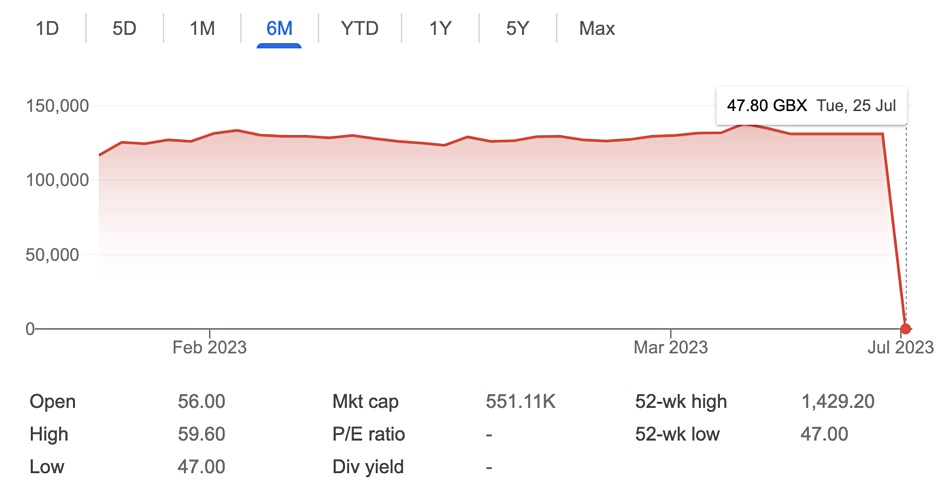

A wholesale restructuring of the board and the C-suite followed, with co-founder, chairman and CEO Dave Richards and CFO Erik Miller both leaving. WANdisco was forecast to run out of cash earlier this month and shareholders were asked to approve a capital infusion through issuing new shares. This they did on July 24 and the company raised $30 million at £0.50/share.

Some 99.97 percent of shareholders approved this resolution an a General Meeting yesterday. Chairman Ken Lever, who was installed earlier this year, said in a statement:

“We are absolutely delighted that the resolution to increase the authorised share capital has received such overwhelming support, which will enable the company to conclude the fundraise. The board and the executive management can now concentrate on driving the business forward to achieve growth in value for shareholders and all stakeholders.”

The shares are now trading at 46.74 GBX (£0.4674), compared to their 131,000 GBX (£13.10) value immediately before the suspension. Lever’s exec team have a mountain to climb.

Management has hatched a turnaround plan and this could involve a name change at some point.

Just last month, WANdisco filed its 2022 annual report which revealed a going concern warning, indicating that every dollar it generated during the trading year cost $3: turnover was $9.7 million and the net loss came in at $29.7 million.

Anthony Miller, co-founder and managing partner at TechMarketView, said the overwehelming shareholder support WANdisco received at its AGM was a “show of confidence worthy of an autocratic regime”.

“As a result, WANdisco’s shares were re-listed on AIM this morning at 50p. They last traded at £13.10p,” he added, “WANdisco shares are now no more than casino chips. Place your bets and see if you can beat the banker.”