HPE revenues grew hardly at all in its second 2022 quarter, restrained by supply difficulties, but demand was robust and both orders and backlog grew strongly.

Revenues in the quarter ended April 30 were $6.7 billion, up just 0.2 percent year-on-year, with a profit of $250 million, 3.5 percent less than a year ago. The earnings were near the midpoint of HPE’s guidance with negative effects from the Ukraine war, HPE’s Russia operations closedown, and the China shutdown.

This prompted CEO Antonio Neri to mainly focus on underlying positivity in his results statement: ”Persistent demand led to another quarter of significant order growth and higher revenue for HPE, underscoring the accelerating interest customers have in our unique edge-to-cloud portfolio and our HPE GreenLake platform.” Mentioning “higher revenue” with just 0.2 percent revenue growth is a tad unbelievable.

Neri said he is ”optimistic that demand will continue to be strong, given our customers’ need to accelerate their business resilience and competitiveness. We remain focused on innovating for our customers and on executing with discipline so that we translate that demand into profitable growth for HPE.”

Yes, well, profitable growth has been lacking in HPE for quite some time, and was lacking this quarter too. It was not able to satisfy all the demand for its products due to supply chain woes, and stressed that the underlying business signals are very positive. For example:

- Annualised revenue run-rate (ARR) was up 25 percent on the year to $829 million

- Total as-a-service orders were up 107 percent; the third consecutive quarter of orders doubling

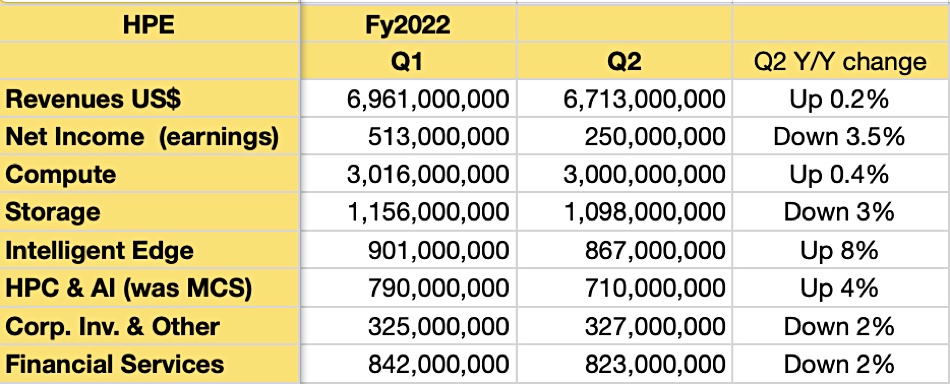

Business unit splits

HPE splits its business into several segments and the picture there was mixed;

There are two growth segments; HPC and AI on the one hand and Intelligent Edge on the other. We can see from the table above that these grew revenues year-on-year while the others were almost flat (Compute) or declined.

Yet orders for Compute were 20 percent-plus higher year-on-year for the 4th quarter in a row. The Storage backlog increased to record levels and this segment had the highest as-a-service ARR growth. There was double-digit year-on-year growth in Nimble, Big Data and HCI (Simplivity) although Storage revenue overall declined for the second quarter in a row. That indicates that 3PAR/Primera and the Alletra 9000 did not do so well this quarter.

Within Intelligent Edge orders grew more than 35 percent for the fifth consecutive quarter. Aruba Services revenue was up double-digits from the prior-year period and Intelligent Edge as-a-Service ARR was up 50 percent-plus from the prior-year period.

The HPC & AI segment had delayed acceptances and the order backlog grew to an impressive $3 billion with 15 percent-plus year-on-year order growth.

This is a jam-tomorrow story, and HPE’s revenues were hobbled by supply chain issues, unlike the revenues in the latest quarters for Dell, NetApp, and Pure Storage. Compared to them, and relatively-speaking, HPE is under-performing in its response to the supply-chain problems that are affecting the entire IT hardware industry.

Another issue is that HPE is withdrawing from Russia and Belarus and took a $126 million charge because of this in the quarter.

Financial summary

- Gross margin: 32.4 percent, down 170 basis points on the year primarily due to $105 million of Russia-related charges

- Diluted EPS: $0.19, flat from the prior-year period mostly due to $126 million of Russia-related charges

- Cash flow from operations: $379 million

- Free cash flow: -$211 million in line with normal seasonality

- Capital returns to shareholders of $214 million in the form of share repurchases and dividends

HPE has not provided a revenue target for the next quarter but suggests it will see 3 to 4 percent revenue growth for the full 2022 year (adjusted for currency changes).

Comment

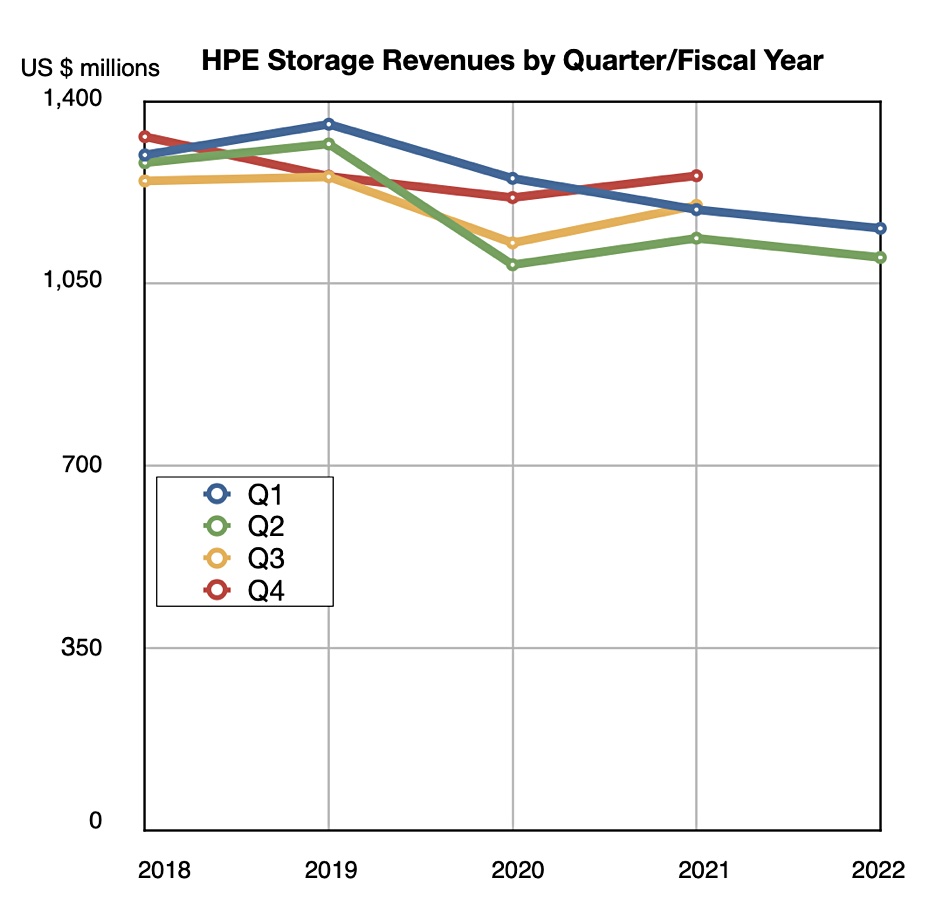

Storage, for HPE, is not a growth business.

Like Compute, Storage is classed by HPE as a core business while HPC & AI and Intelligent Edge (Aruba) are the two growth businesses. The aim with core businesses is more to preserve revenues and profitability, and keep margins up than build revenues higher. In contrast, storage is seen as very much a growth business for the storage-product-dominated NetApp and Pure Storage. It’s also seen as a growth opportunity by Dell. And that difference shows in all three of these vendors’ much better storage results.

It prompts the asking of a question: has HPE made a strategic mistake by not classing Compute and Storage as growth businesses? Is it, as a result, not spending enough R&D dollars to build better – and winning – Compute and Storage products?

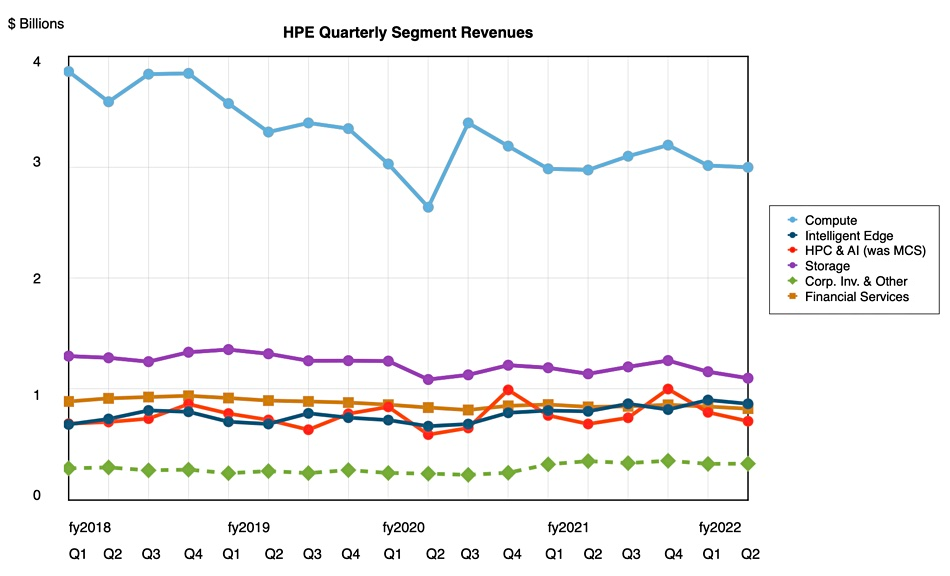

Look at this another way: HPE’s two growth businesses are simply not growing fast enough to offset declines elsewhere, as a chart of HPE’s quarterly segment revenues shows:

We can see that the overall growth in HPC & AI is slight and patchy, and only gradual in the Intelligent Edge segment. The much bigger generally declining $3 billion Compute and billion-dollar-plus Storage segments, not to mention flattish Corporate Investments and gently declining Financial Services areas, mask the positive single digit percent improvements in the two sub-billion dollar growth segments.

HPC & AI could and should grow much more in the future, propelled by HPE’s Frontier exascale supercomputer win. This business is lumpy, going up and down quarter by quarter, and revenues are not yet growing consistently or strongly. But HPE has a $3 billion backlog here so it should turn sharply upwards eventually. The Intelligent Edge needs double-digit growth to start making a real difference to HPE’s revenues and we are waiting for that to happen. Again, the order growth is promising.

All of this is taking place against the background of a transition away from perpetual license sales to GreenLake subscription revenues and that has a dampening effect on revenue growth. And the supply chain problems are also holding back revenue growth. But demand is strong, orders growing, billings growing, and ARR growing so we should – maybe – give HPE the benefit of any doubt and look forward to a glowing future. Antonio and his execs hopefully know what they are doing.

Let’s close with a comment from EVP and CFO Tarek Robbiati: “With record levels of high-quality backlog, we are well positioned for growth in FY22 and beyond.”