HPE showed its storage business doing proportionally better in the third quarter than its main competitors who all saw worse revenue declines.

Update: Pure results on Aug 30 showed 6 percent revenue growth, outpacing HPE.

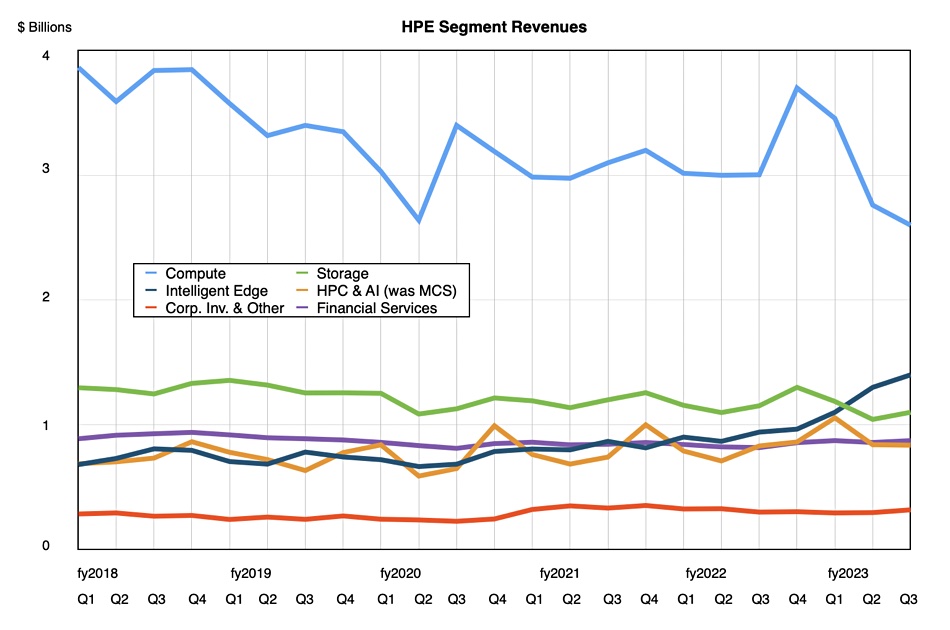

Revenues for the quarter, ended July 31, were $7 billion, up just 0.7 percent year-over-year, with a profit of $464 million, 13.4 percent up annually. The company’s four main business units had mixed fortunes, with compute down 13 percent to $2.6 billion, storage down 4.5 percent to $1.1 billion, Intelligent Edge (Aruba) up a CEO-pleasing 50 percent to $1.4 billion, and passing storage revenues for the first time. HPC and AI revenues of $836 million rose 1 percent year-over-year as a large set of orders started their prolonged delivery and revenue recognition journey.

HPE CEO Antonio Neri focused on operating efficiency, the edge, HPC/AI, and Greenlake numbers in his earnings call comments, saying: ”In Q3, our Intelligent Edge business contributed 20 percent of our total company revenue. It is now the largest source of HPE’s operating profit at 49 percent of our total segment operating profit. Our HPE GreenLake hybrid cloud platform is accelerating our other service pivots, delivering an annualized revenue run rate, or ARR, of $1.3 billion, a 48 percent increase year-over-year. Our strategic shift towards edge, hybrid cloud and AI delivered through our HPE GreenLake cloud platform is working, and we are delivering on our financial commitments.”

The large decrease in compute revenues, 13 percent, contrasted with the 4.5 percent storage decrease. That held up well when compared to recent storage results from Dell, down 11 percent to $3.76 billion, NetApp, down 10 percent to $1.43 billion, and Pure Storage, down 5 percent to $598 million in its prior Q1 fy24 earnings. But, in its latest, Q2, results, announced on August 30, Pure said it had 6 percent Y/Y revenue growth, much better than HPE, Dell and NetApp.

The economic environment is depressed, but AI and similar digital projects are getting priority in customer IT spending. Neri said: “While the broader IT market is still pressured, demand for our products and services grew sequentially in the third quarter across all key segments of our business, driven by high-growth areas like AI and HPE GreenLake … we exited the quarter with the largest HPC and AI order book we have ever had.”

It was all down to the Alletra storage product line apparently. Interim CFO Jeremy Cox said: “HPE Alletra revenue grew triple digits in Q3 for the fifth consecutive quarter. It is now one of our higher revenue products and thus growth rates may normalize. This product is shifting our mix within Storage to higher-margin, software-intensive revenue and is a key driver of our ARR growth. We’ll continue to invest in R&D and our owned IP products in this business unit, such as our new file-as-a-service and HPE Alletra MP offerings.”

The Alletra file-as-a-service mention refers to the OEM’d VAST Data software and that came too late in the quarter to have any material effect on sales.

HPE did not reveal its all-flash array revenue numbers.

Neri said that HPE’s storage plan was working: “The team and I drove an intentional strategy to pivot that portfolio, which was a conglomerate of different offerings that we built over 15 years or so to one consistent architecture that allows customers to consume data services, both primary and secondary in a cloud-native way and a subscription-based model.

“So, HPE Alletra is our primary storage that now covers pretty much all the price segments, price bands if you will, of the traditional storage from general purpose to business critical to mission-critical. And we address block and file. And in the future, we’re also going to address the object piece.”

No doubt HPE partners Cloudian, Scality, and VAST will all be hoping to supply their object storage software to enable HPE to address the object piece.

Neri added this point about Alletra: “This business went from zero to in excess of $1 billion very, very quickly. And it’s amazing that it’s one of the fastest-growing products in our portfolio, growing triple digits. But what I’m really pleased is that it comes with a significant subscription, which is growing double digits.“

We don’t know which parts of the Alletra portfolio, the Nimble or Primera product components, are growing fastest, but we can be sure that other parts of HPE’s storage portfolio are looking less bright, such as SimpliVity HCI and StoreOnce deduplicating backup appliances. Maybe they will get an Alletra brand makeover.

The outlook for HPE’s next quarter is revenues between $7.2 billion and $7.5 billion, $7.35 billion at the mid-point and 6.6 percent down on a year ago. It will make fiscal 2023 revenues of $29.1 billion, 2.2 percent more than fiscal 2022.

This is low overall growth, and the Q4 number suggests that HPE’s storage revenues may decline again. Perhaps AI storage demand may help growth in fiscal 2024.