Toshiba has come out with three flash news announcements detailing a range of smaller, denser and speedier drives.

- 96-layer TLC (3bits/cell) NAND RD500 and RC500 gumstick card SSDs,

- Low-latency XL-FLASH media,

- XFMEXPRESS fingernail-sized flash card for mobile and embedded device use.

RD500 and RC500

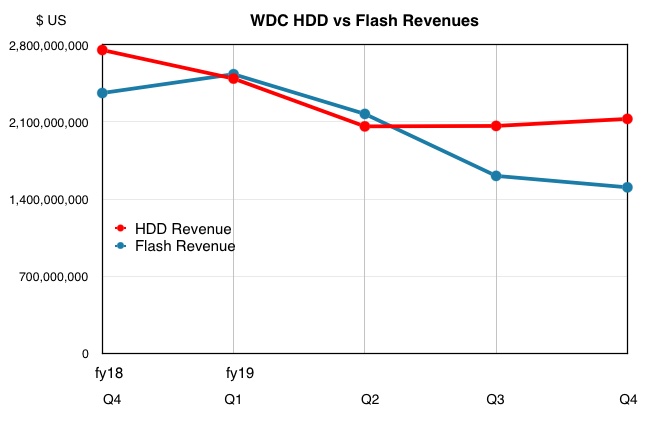

These SSDs use 96-layer 3D NAND, like Western Digital’s SN640 and SN340 announced yesterday. However they are M.2 format drives for gamers (RD500) and mainstream POC (RC500) use.

Both use Toshiba’s 96-layer 3D NAND organised as TLC (3bits/cell) with a faster SLC (1bit/cell) cache. They are connected via the PCIe 3.0/NVMe v1.3c protocol.

The RD500 has 512GB, 1TB and 2TB capacity options while the RC500 has 256BB, 512GB and 1TB capacities. These match Toshiba’s XG6-P (2TB) and XG6 (2576GB, 512GB, 1TB) which are also made with 96-layer TLC flash. The RD500 is faster than the XG6-P.

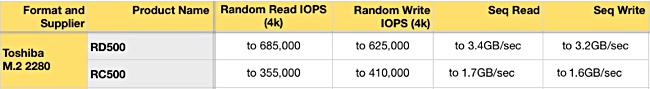

The performance numbers are:

The XG6-P drives are sold to OEMs for mainstream use while the RC 500 and RD500 are for retail sale; RD500 being targeted at gamers.

The RC500 appears to overlap Toshiba’s XG6 drive, being about the same speed on random IO but much slower on sequential IO, as the XG6 does up to 3.18/2.96 GB/sec for read and write respectively.

Toshiba warrants the RD500 for five years and the RC500 for three, but does not provide total-petabytes-written or drive writes/day numbers. Nor does it provide any prices. They’ll hit the shops in the fourth quarter.

XL-FLASH

Toshiba XL-FLASH is fast, low-latency SLC 3D NAND, like Samsung’s Z-NAND, positioned between ordinary and slower NAND and faster DRAM, equivalent to storage-class memory (SCM) such as Optane (3D XPoint) and Samsung’s Z-NAND.

It was first announced by Toshiba at FMS 2018 and Tosh is now telling us it will be producing 128Gbit dies in a 2-die, 4-die, 8-die package. A die will be sectioned into 16 planes for parallelism, with 4Kbit pages. They will be manufactured using the latest BiCS processes, Toshiba’s 3D NAND technology; that implies 96-layers.

The die will be formatted as SLC (1 bit/cell) and the read latency will be down to 5µs, with Tosh saying this is ten times faster than today’s NAND. An Optane DIMM’s read latency is as low as 0.35 µs.

Scott Nelson, GM of Toshiba Memory America, Inc., issued a quote: “SCM is the next frontier for enterprise storage, and our role as one of the world’s largest flash memory suppliers gives XL-FLASH a cost/performance edge over competing SCM solutions,” such as Optane.

Toshiba will sample its XL-FLASH from September onwards with OEMs likely to ship SSD product in 2020. It suggests XL-FLASH could be designed into industry-standard DIMMs connected to a server’s memory channel.

Target applications are high-speed storage and memory extension, just like Optane. We can expect Optane, XL-FLASH and Z-NAND devices competing in the SCM market in 2020.

XFMEXPRESS

Toshiba has devised a new format for fingernail-size flash cards and used it to build a NVMe-connected device; the XFMEXPRESS.

The existing microSD format is sized at 15mm x 11mm x 1mm and a WD Purple QD312 device holds between 32GB and 256GB of data, which can be transferred at up to 30MB/sec.

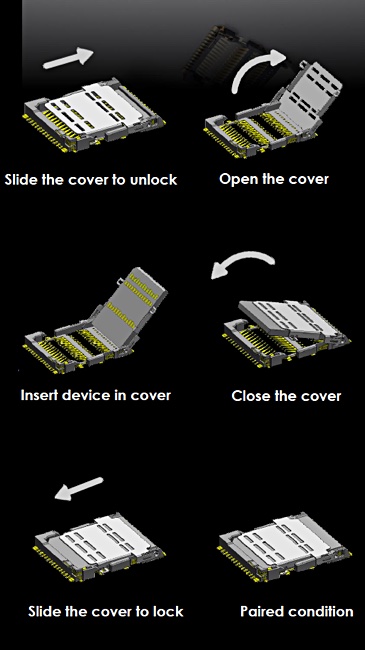

The XFMEXPRESS card is larger at 18mm x 14mm, and it fits in a 1.44mm deep connector slot. It has a proprietary format and uses a fastened hinged connector. That is less removable than a USB stick.

It can transfer data at up to 4GB/sec, across 2 to 4 PCIe 2.0, 3.0 or 4.0 lanes. with a second generation device doubling that to 8GB/sec.

Details of the XFMEXPRESS card’s capacity are non-existent but Toshiba said it can use the latest and future 3D NAND. That means 64-layer, 96-layer and 128-layer technology. We can envisage 512GB-class capacities or possibly greater.

Toshiba said it is for thin and embedded devices like skinny PCs, notebooks, tablets and the like.

Whether Tosh will try and get the format standardised is unsaid. A difficulty is that the SD Association has already proposed a microSD Express standard.

It is slower than Toshiba’s XFMEXPRESS, using a single PCIe 3.1 lane and NVMe v1.3 to enable transfers at up to 985MB/sec; 0.985GB/sec compared to XFMEXPRESS’ 4GB/sec. Adding multi-lane support to microSD Express would nullify Toshiba’s speed advantage.