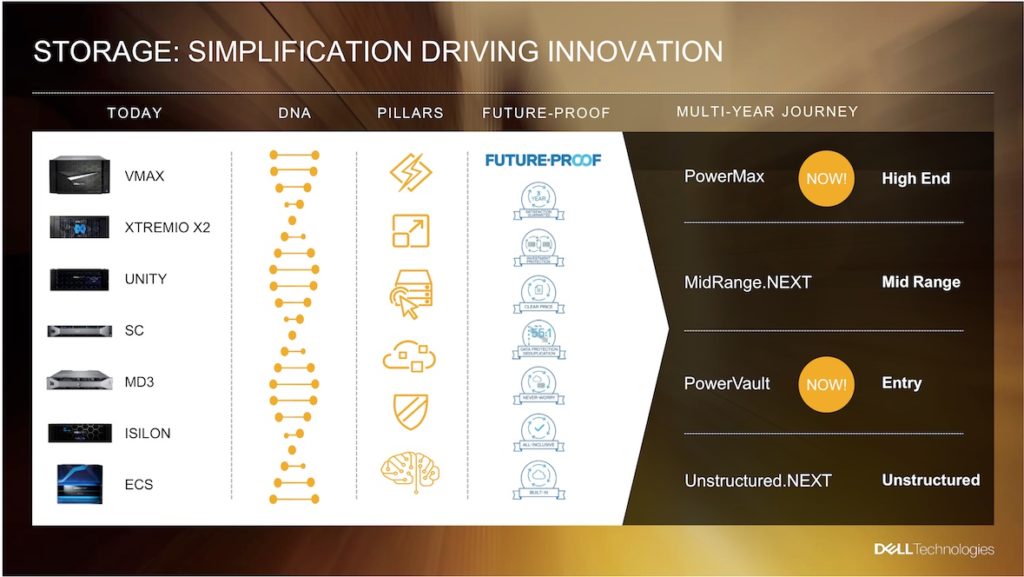

Update May 5, 2020. Dell EMC today launched the PowerStore (formerly called Midrange.NEXT) data storage array line. Check out our PowerStore explainer. Our editor thinks this is “most important development in data storage hardware for many years”.

MidRange.NEXT is Dell EMC’s upcoming replacement for the SC, Unity and XIO mid-range arrays.

The three array lines came into being when Dell and EMC were independent. Dell acquired Compellent and its SC array products in 2010. EMC developed Unity from its existing VNX line, based on Clarion technology acquired from Data General in 1999.

EMC acquired XtremIO in 2012 as a way of producing an all-flash array. Subsequently Unity and the SC both gained an all-flash array model. When Dell bought EMC it determined that operating three mid-range array products was expensive and wasteful. It decided to meld the three ranges into one: MidRange.NEXT.

Dell EMC has made its intentions to simplify and update the mid-range portfolio abundantly clear, for instance at Dell World, Las Vegas in April 2019.

But the company has been far less forthcoming on product details. Based on our conversations with several sources this is what we know so far.

Code name and brand name

MidRange.NEXT is how Dell publicly refers to the project. The internal project name is Trident and the likely brand name is PowerSTORE, according to sources. However, there is ambiguity in the status of Dell’s application to register PowerSTORE as a trademark.

This shares the “Power” brand identity with PowerEdge servers, the PowerMAX high-end array, PowerVault low-end arrays and PowerSwitch networking gear.

MidRange.NEXT launch date

Dell EMC is currently targeting the V1.0 release date for March- May 2020, according to our sources. There is a Dell Technologies World event in Las Vegas, May 4-11. We think that Midrange.next aka PowerStore will be announced then.

In early February 2020, Dell EMC emailed us this statement: “Customers have taken part in Midrange.next’s early access program since Q4FY20 and feedback to date has been very positive.”

Dell EMC originally pencilled September 2019 for V1 launch and provisionally scheduled V2.0 and v3.0 for 2020 and 2021, with the federating ability getting stronger, release by release.

What MidRange.NEXT is

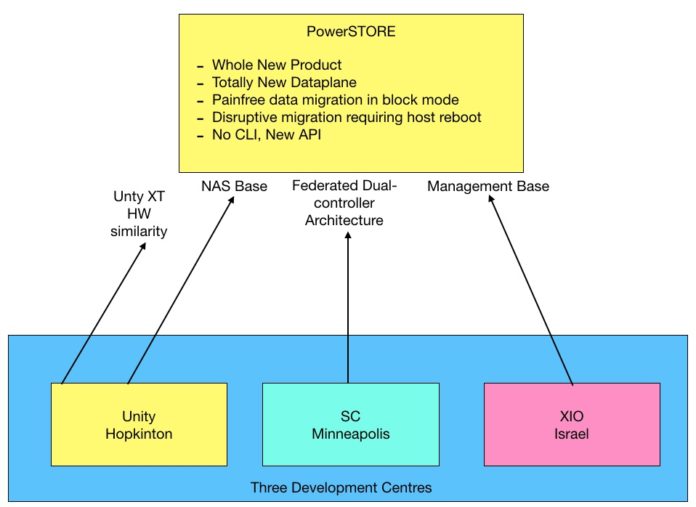

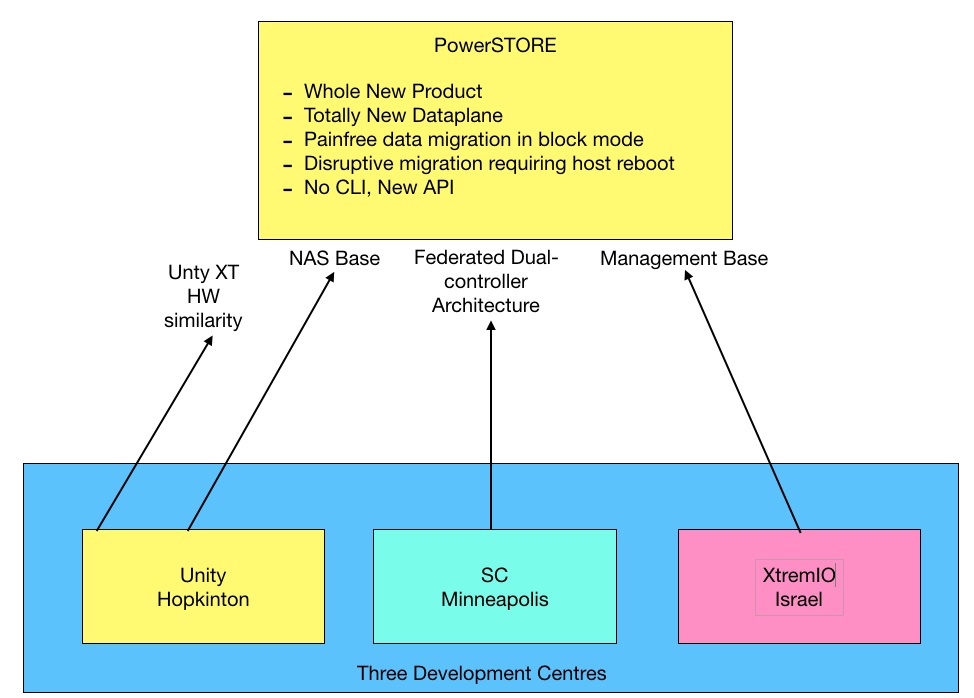

In essence Midrange.NEXT is an almost ground-up new software design with smallish pieces from Unity (NAS), SC and XIO (management). The dataplane is all new and there is a new API and no CLI.

The overall architecture involves federated dual-controller nodes and is similar to the SC. The hardware is a development based on Unity XT, which was announced in April 2019.

Our sources say MidRange.NEXT features:

- 25 NVMe slots in the base 2U Drive Array Enclosure (DAE) with 4 used by NVRAM modules,

- 2U Expansion DAE is SAS-only with 25 slots, with 3 DAEs supported,

- Entire array can be configured with flash or Storage-Class Memory (SCM) but media cannot be mixed,

- Up to 21 SCM drives with 750GB capacity and NVMe only,

- Or up to 96 flash drives, up to 16TB in capacity, and a mix of NVMe (21) and SAS (75).

- No tiering,

- No NVMe-oF (possibly in v3),

- 32Bit/s FC or 25Gbit/s iSCSI.

At time of publication Dell has not corroborated any of these details.

From September 2019 onwards Unity will have some new features added but SC and XtremIO are effectively in maintenance mode.

Midrange.NEXT development is taking place in three locations: Hopkinton, Mass, (Unity base), Minneapolis (SC base) and Israel (XtremIO base). Some engineers in each location are working on the existing Unity, SC and XtremIO products but most are working on MidRange.NEXT.

According to our sources, engineer retention is an issue and many senior people have left.

What we don’t know yet

We assume that MidRange.NEXT will be a unified file and block access array with support for public cloud back-end storage, but don’t know this for certain.

A Dell EMC spokesperson said about all this: “We are going to decline comment on anything specific related to our future product roadmap.”

Data migration

The existing Dell EMC midrange arrays will co-exist with the new mid-range system, possibly for many years. There will be no speedy end-of-life moves.

Data migration from SC, Unity and XIO will be simple in block mode. It will be more complicated in other modes. When either SC, Unity or XIO are migrated to Midrange.NEXT a host reboot or two will be needed.

Chris Evans, author of the Architecting IT blog, suggests: “Forcing customers to rewrite scripts and change processes is probably necessary. Finding a way to do this without incurring risk and cost will be the challenge. For data itself, customers will need some kind of migration tools and even interfaces between existing platforms and MidRange.NEXT.

“Where systems are already virtualised, the migration process is relatively simple – create new datastores and vMotion. File shares are harder and physical servers require some more thought. These migrations can get really complex when there are many dependencies like snapshots and replication – or even public cloud.”

The mid-range array market

A mid-range storage array is typically a dual-controller design with expansion shelves and a capacity range of 20TB to 2PB. Such arrays can be clustered or federated tother to provide large capacities and a higher number of IOPS.

The array operating system (controller software) provides management and protection of the storage drives, and typically includes functionality such as thin-provisioning, data reduction, replication and tiering to the public cloud.

A high-end array, such as an IBM DS8000 or Dell EMC PowerMAX, generally has a multiple controller design and high capacities, heading up to multiple petabytes and beyond. They may support mainframe connectivity.

Low-end arrays, such as Dell EMC’s PowerVault, will have generally lower capacities, from single-digit terabytes to, say, 100TB, and less software functionality.

Mid-range array costs can span from $15,000 to $1m-plus.

Why a new Dell EMC mid-range array?

The mid-range combined block and file array market is hugely important for Dell EMC; its Unity array is probably the most popular storage array in history,

In November 2017 Dell EMC told a Tech Field Day event that it had accumulated more than $2.3bn revenues from 20,000-plus Unity customers and more than 35,000 arrays installed.

We have been unable to ascertain SC and XTremIO revenues but can safely assume that their contributions make storage arrays even more significant to Dell EMC.

However, as previously mentioned, Dell sees three competing products as wasteful of resources, from engineering through marketing to sales channels and support.

Mid-range market size

IDC sized the enterprise storage market at $13bn in Q1 2018, growing 34.4 per cent on the previous year. The all-flash array category was $2.1bn, growing 55 per cent year-on-year, and the hybrid flash/disk category was $2.5bn, growing 24 per cent y-o-y.

Combining the two gives a mid-range array market size of $4.6bn in 2018’s Q1 or $18.4bn – roughly – for the whole year.

The competition

Because of Dell EMC’s number one position in the storage array market Midrange.NEXT will be a hugely important product, and the response of the SC, Unity and XIO customer bases is crucial to its success.

IBM, HPE, NetApp, Pure Storage and others will circle like hungry predators, alert for any opening that could let their sales channels into the Dell EMC customer base.

Competing products for PowerSTORE are:

Mainstream vendors:

- Fujitsu ETERNUS Arrays

- Hitachi Vantara VSP array

- Huawei OceanStore

- HPE Primera, 3PAR and Nimble arrays,

- IBM Storwize and FlashSystem

- NetApp all-flash AFF and hybrid flash/disk FAS arrays running ONTAP software; also SolidFire all-flash arrays

- Pure Storage FlashArray

Startups, private equity firms and expansion-minded suppliers:

- Apeiron NVMe-oF array

- DDN Tintri arrays

- E8 NVMe-oF array

- Excelero NVMe-oF array

- Infinidat InfiniBox arrays

- Kaminario composable NVMe-oF array

- Pavilion Data Systems NVMe-oF array

- Reduxio array

- StorCentric Nexsan and Vexata NVMe-oF array

- StorOne array

- VAST Data array

- Violin Systems all-flash array

- Western Digital’s IntelliFlash array, based on acquired Tegile technology

Midrange.NEXT will be the second all-new or substantially new storage array design announced this year. HPE’s Primera, a re-architecting of the company’s 3Par line, was first out of the block in June 2019.

It’s a moot point whether Primera and MidRange.NEXT will push vendors with established mid-range array product lines, such as Fujitsu and IBM, to re-architect their products.