Two-tier hierarchical sub-file management can accelerate slow capacity storage to fast performance storage speeds and speed up servers on the cheap.

This is what Enmotus’s Virtual SSD server software does. It combines a fast storage tier with a slower one into a singe virtual drive. The software dynamically moves high-access rate data blocks to the fast tier, giving the overall impression of a single large fast tier.

Fast storage is more expensive than slow-access storage. The main benefit of Virtual SSD (VSSD) is that customers can buy a smaller fast storage tier than otherwise and still get overall fast access to all their data in their less expensive capacity tier of storage, Ron Macleod, EMEA VP of Enmotus, said.

In an interview with Blocks & Files this week, Macleod claimed the VSSD capacity storage layer operates at the speed of the highest performance storage devices but overall cost is up to one-fifth the cost of all-flash/memory tier equivalents. It also means that less compute capacity is required to provide a higher level of performance than from capacity storage alone.

The fast storage tier can be Optane DIMMs or SSDs, NVMe SSDs or even SAS SSDs. The capacity tier can be disk drives or SSDs, and is defined in relation to the fast tier.

Enmotus history

Enmotus was founded in Orange County, California in 2010 by CEO Andy Mills and CTO Marshall Lee. It has received $5.6m in funding from two investors: Tech Coast Angels and Exponential Partners.

The founders recognised that file-level tiering, as seen in hierarchical storage management (HSM) and information lifecycle management (ILM) products was not granular enough. Sub-file file level tiering would be quicker than moving entire files between tiers and also optimise use of expensive fast storage.

Inside the operating system with a block-tiering engine was the best place to do this – this maximises the types of applications that can benefit from the speed-up.

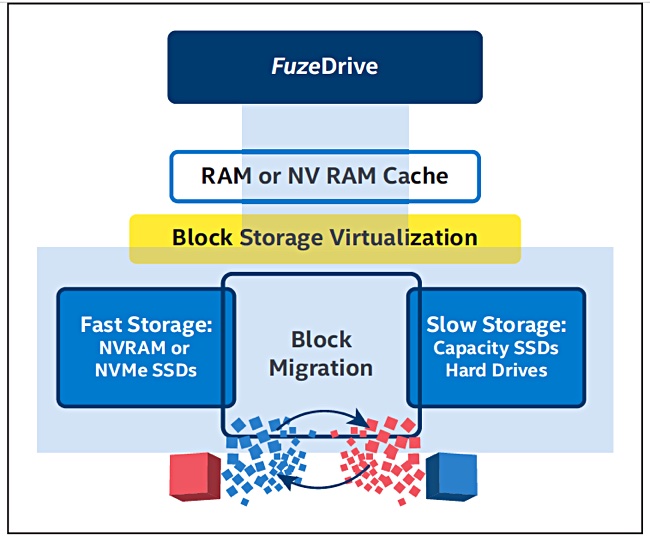

This software layer, implementing a virtual drive, intercepts low-level storage requests at block level, groups of either 522 or 4K bytes, before they reach the physical drives and remaps them to a fast or slower storage tier.

Data is moved between the tiers in real time as data block access patterns change.

Virtual SSD tiering technology

According to Enmotus documentation, data usage patterns do not have random IO access across the entire logical block address (LBA) range of the data set. In most cases the active data stays within the bounds of 5-10 per cent of the LBA of the current data. The other data can be viewed as being at rest, with no need to store it on the fastest storage.

It can be stored on less expensive media and promoted when needed. Data blocks are promoted into the fast tier and demoted with:

- 3-tier scheme – RAM, Performance drive and capacity drive – HDD/bulk SSD

- MicroTiering policy driven data movement that operates in real time and is user-tunable

- Fast sub 1 μs translation overhead, < 1 per cent CPU loading when storage is balanced

- Ability to migrate SSDs in and out of different virtual disks as application loads change

Altogether the Virtual SSD software supports up to 1PB virtual drives. Enmotus said it is not caching data on the faster drives within the total but tiering it. All the media used is persistent and RAM is not used as a tier.

Its VSSD analytics software identifies the size of a customer’s working data set, so helping the customer buy the right amount of high-performance needed.

Enmotus said storage could be dynamically shrunk or grown, older storage retired and replaced with newer faster storage while the host computer system(s) continues to use the virtual drive storage.

FuzeDrive product

Enmotus’s FuzeDrive software for AMD and Intel combines Virtual SSD software with their hardware to move data blocks into and out of the fast tier. The company said machine learning is involved.

Various Enmotus white papers discuss using VSSD and FuzeDrive software to accelerate systems. For example, one discusses accelerating Hyper-V with Intel NAND or Optane NVMe drives or Optane DIMMs.

Dell and NetApp Enmotus solution briefs, using FuzeDrive, can be found here.

Intel H10 drive

Intel introduced the H10 drive in April 2019, which combines Optane memory and QLC (4bits.cell) flash in one device. Intel’s RST software is used to combine the separate Optane and QLC flash stores on the card and present them as a single volume to accessing applications.

This is drive-level tiering, proprietary to Intel, and limited to capacities it chooses to provide. Enmotus’s Virtual SSD virtualizes multiple drives and is not limited to Intel devices. It can also work with AMD processors and Samsung’s Z-SSD drives, for example.

Comment

The greater the speed difference between fast and slow tiers, the more data access acceleration is possible. This means SSD and disk drive tiers are a great match for VirtualSSD. NVMe and SAS or SATA SSDs benefit to a medium degree and an Optane and NAND combination benefits the least.

The greater the cost differential between the fast and slow tiers the larger the price/performance benefit to customers. Thus VirtualSSD software used to accelerate NAND drives with a high-priced Optane tier can be effective, even though the relative speed up is lower than using a SATA SSD tier accelerating capacity disk drive.

Go to market

Enmotus has developed partner deals with system suppliers to help bring its tiering software to customers. It aims to sell to small and medium businesses with a focus on low-latency data needs, data centres and financial trading.

Macleod said Dell is reselling the Enmotus technology. There is a consumer version of the software, with two drives supported, costing around $70.

He wouldn’t reveal enterprise pricing but said the cost, related to capacity and drive numbers, amortised across 24 drives was “amazingly low.”

Why hasn’t Enmotus grown to be bigger and more prominent? We see several reasons:

- The funding total is small,

- Partnership deals are not getting a lot of marketing promotion,

- Ron Macleod is a consultant rather than a full-time employee,

- Limited channel program,

- Marketing focused on white papers and solution briefs.

There is no channel programme as such, with market development funding, grades of reseller and qualification programs, like ones we would associate with storage suppliers with ten or a hundred times as much funding as Enmotus.

But then they have the money for channel and marketing programs and Enmotus doesn’t. It looks like good technology that could do with being pushed harder.