Newcomer StorCentric has acquired four storage companies and aspires to become a world-class storage company. What’s the score?

The company emerged in August last year through the acquisition of the Nexsan array and Drobo storage businesses from their owner. Neither had fulfilled their initial potential, according to StorCentric CEO Mihir Shah.

In June 2019 the company bought Retrospect, a backup software vendor with half a million customers but skinny revenues, and the following month it bought Vexata, an ailing enterprise NVMe array startup. Prices were undisclosed but it is safe to assume that Vexata shareholders took a big hair cut.

A pattern is emerging here. StorCentric is about buying struggling companies and making them healthy. StorCentric’s investors are in it for the long term, Shah said. “It’s not about squeezing cost, cutting it, and finding a home for it – not churn and burn.”

Storage products for the entire bit cycle

In a phone interview with Blocks & Files, Shah characterised StorCentric’s acquisitions as “very good technology of high quality that hasn’t been able to liberate itself”. The previous owners had “not listened to the customer”.

He is on a mission to find such technologies and aims to build StorCentric into “the next world-class storage company”, with products for the entire bit lifecycle.

The big vendors focus on $30m-per-year customers and “forget about everyone else,” according to Shah.

He has identified a gap in the market where “customers are frustrated with big vendors” because they push forklift upgrades and jack-up maintenance prices on older products if customers don’t upgrade.

StorCentric will focus on selling affordable products to the everyone elses, said Shah. Things that just work.

The history boys

StorCentric’s roots extend back to Drobo and Nexsan. Drobo set up in 2005 to make consumer storage that wouldn’t lose data. In 2013 it was joined with Connected Data in a transaction process called “merging into” rather than a straightforward acquisition and had never been profitable.

Connected Data set Drobo up as a standalone business in May 2015, with Mihir Shah brought in as a turnaround CEO.

His background included a corporate development position at IBM in 2004-2009 – he was part of the team that handled the XIV all-flash array acquisition in 2008. He joined Drobo from Bluefin, an IT support company, where he was CEO.

Imation bought Connected Data in October 2015.

Over at Nexsan, Gary Watson was its co-founder and one-time CEO. The company made primary data and archival storage arrays and was bought by Imation in January 2013. The idea was that Imation could grow the storage array business while its tape and optical media businesses were declining. Buying Connected Data was part of the overall strategy.

It didn’t pan out, and Nexsan and Connected Data were spun out to private equity in January 2017 as part of Imation’s restructuring under activist investor control.

The private equity people set up the combined Nexsan and Drobo businesses as StorCentric in 2018, headquartered in Sunnyvale, CA. Shah was appointed as its CEO and there was a core team of a dozen or so. He ran Nexsan and Drobo as separate business units. Watson left Nexsan in March 2019, leaving Shah to run the show. The company then bought Retrospect and Vexata.

StorCentric foursome

Today StorCentric’s four storage properties are organised into four independent, wholly-owned business units.

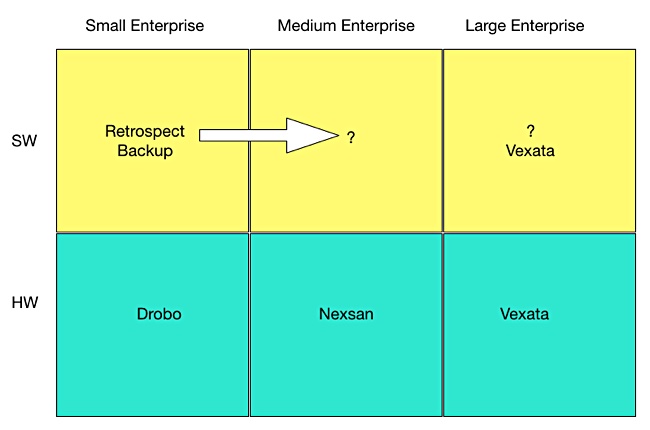

We can characterise the four as hardware or software, and small, medium or large enterprise, using a 6-box diagram:

Technology development

StorCentric does not intend to have a central and unified engineering team – and the four business units will develop their own technology.

“We will build on the brands and they will go distinctively to their market segments. A Drobo customer is unlikely to buy a Vexata box,” Shah said.

Technologies could be imported from one to another though, such as Vexata taking on board Nexsan replication.

Shah did say Nexsan and Vexata fit together. One impetus for the Vexata purchase was that Nexsan customers were asking for NVMe storage. Another line of thinking is that Nexsan and Retrospect represent tier 2 storage, while Vexata takes StorCentric into tier 1 storage.

What next? Surya Varanasi, co-founder and CTO of Vexata, is developing a technology roadmap for StorCentric. Shah didn’t expand on that, apart from saying two new Drobo products are due in the next six months and a Drobo+Retrospect backup appliance is being considered.

Blocks & Files envisages StorCentric making more acquisitions. We think some kind of cloud storage gateway functionality might be on its radar, but Shah declined to give us any clues.