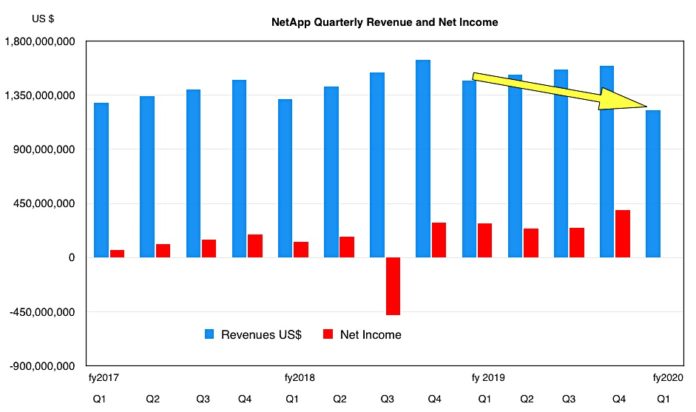

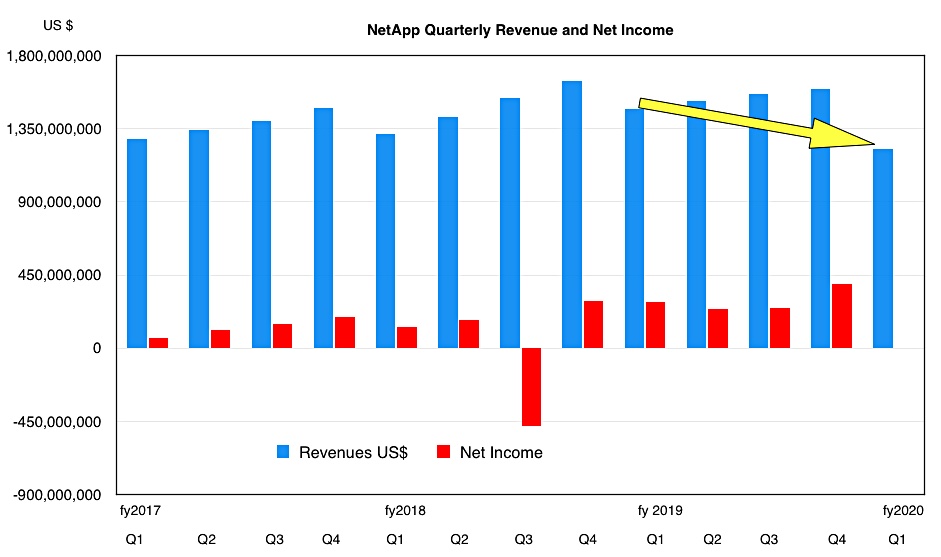

NetApp expects a big revenue miss in the first 2020 quarter due to large global accounts spending less in response to the US-China trade dispute and other macroeconomic uncertainties.

The company has also suffered self-inflicted harm because some of its North America sales teams failed to win enough new accounts to offset dependency on large global accounts.

The preliminary calculation is for revenues between $1.22bn and $1.23bn, down 17 per cent y/y on previous guidance.

Full fy2020 revenues are now expected to fall between 5 and 10 per cent y/y, again below previous guidance. Fy2019 revenues were $6.146bn and the company had expected fy2020 revenues to grow in the low mid-single-digits.

The company had anticipated a revenue range of $1.315bn to $1.465bn in the current quarter. A year ago first fiscal 2019 revenues included $90m from enterprise software license agreements (ELAs) which did not repeat in the current quarter. That accounts for 12 points of the 17 per cent drop.

In a statement, CEO George Kurian said: “We believe we can return to growth over time by prudently reallocating investments to expand sales coverage and accelerate our participation in the growing Private Cloud and Cloud Data Services markets.”

Storage slowdown

NetApp ran a conference call yesterday to discuss the Q1 revenue downgrade.

Kurian said: “In summary, our shortfall was primarily due to lower IT hardware spending related to macro concerns at our largest customers, and to a lesser extent execution issues in the Americas.”

“I think that the macro was about two-thirds of the miss. Factors that we could have controlled is probably one-third of the miss.“

The miss became apparent in the second half of the quarter with deal closures getting pushed out and a small proportion of deals cancelled. However, NetApp public sector revenues in APAC, Europe and US were mostly on track.

Kurian revealed: “This weakness was contained to our storage business. Both Private Cloud and Cloud Data Services grew year over year in Q1, but there’s still a small part of our business and not yet able to offset the slowdown in storage.”

Private cloud refers to object storage and hyperconverged systems. The slowdown in storage spending was part-evidenced by lack of traditional hardware refresh cycles in NetApp’s customer base. NetApp’s mid-range storage will be under further pressure when Dell-EMC releases its MidRange.NEXT refresh later this year.

China woes

The China-US trade dispute was an important factor. Kurian said: “Two of our largest customers that were impacted by the China dispute, shrank their capital spending by 30 per cent year on year and that has meaningful consequences even to IT hardware spending.“

NetApp can’t fix the macro-environment but it can recruit more new account-chasing sales reps. However, “it typically takes three to four quarters for a sales rep to be onboard and fully productive,” Kurian said. “We have been hiring some amount of reps even in Q1, right? So, it’s not like we’ve done nothing over the last quarter, quarter-and-a-half.”

Also NetApp will more aggressively attack Private Cloud and Cloud Data Services opportunities.

Kurian said the fundamental fix would be to remedy the macro uncertainties. “To improve the overall capital spending environment, we need to see certainty, certainty on trade policy, certainty on the economic outlook. That has caused a spending pause in some of the largest global accounts that are most exposed to it.”

He emphasised that NetApp wasn’t losing out to competitors; there was no decline in in rates and product gross margins remained strong.

In that case other storage suppliers to large enterprises should experience the same slowdown effect; meaning Dell-EMC, Hitachi Vantara, HPE, IBM, Nutanix and Pure Storage. Their revenue expectations may get Trumped as well.