It’s been a hard year for Western Digital but things look like getting better.

Western Digital’s fourth fiscal 2019 quarter saw depressed revenues and a loss compared to a year ago,

Q4 (“June quarter”) fy2019 numbers:

- Revenues – $3.6bn, 20.4 per cent down y/y from $5.1bn

- Profit – loss of $197m compared to $756m profit a year ago

- Operating cash flow – negative $169m; it was $863m a year ago

- Free cash flow – negative $179m compared to $638m a year ago

- Cash & cash equivalents – $3.45bn

Full 2019 year numbers:

- Revenues $16,6bn, 19.6 per cent less than last year’s $20.65bn

- Profit $754m loss compared to $675m profit in fy2018

Financial analysts were not phased by these results for the June quarter as they were in line with Western Digital’s estimates in April.

Product snapshot

Western Digital has two product categories; hard disk drives (HDDs) and SSDs. Both are sold as drives, consumer systems and data centre array products. Drive sales are classified by units and also by capacity.

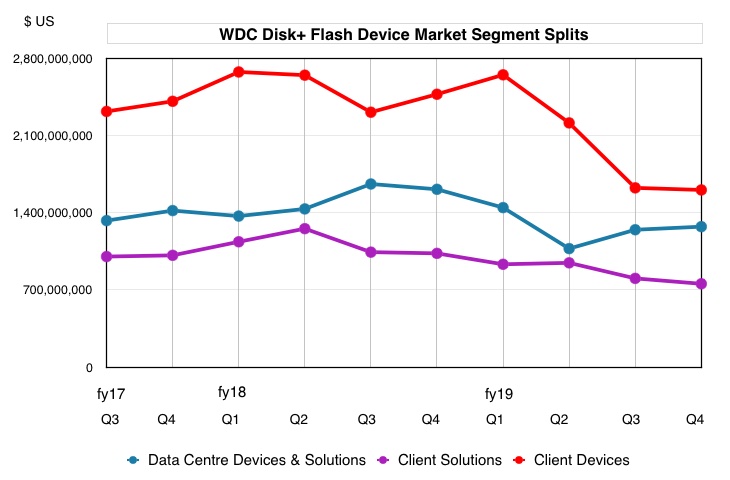

HDD and SSD product sales are made into client devices, client solution and data centre (devices and solutions) markets.

Damage report

The main damage in product revenues came from a $1bn slump in client device sales, from $2.65bn in the first quarter to $1.6bn in the fourth:

WD said there was a decline in mobile embedded revenue and weak client device flash pricing. Client solutions product sales also fell but WD said it had increased market share in this segment.

Data centre devices sales initially fell and then staged a recovery.

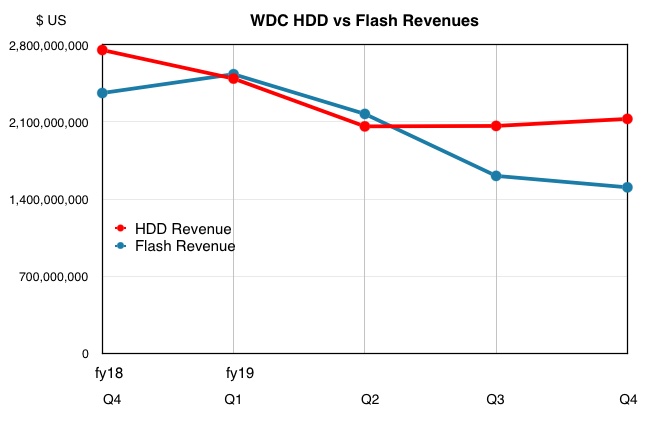

The Q1 to Q2 fall affected both HDD and SSD product sales but HDD sales levelled out and then rose slightly while SSD sales continued falling throughout Q3 and Q4;

In WD’s full fiscal 2019 year HDD unit ships fell significantly, from 34.1m in the first quarter to 27.7m in the fourth quarter. As the chart above shows, HDD revenues were $2.5bn in Q1 and slipped to $2.13bn in Q4. Capacity increases kept prices higher than otherwise.

Flash revenues were $2.53bn in Q1 and slipped to $1.5bn in Q4; a larger decline than that seen in disk drives due to a flash supply glut causing price falls. This did not happen in the more stable HDD market where just three suppliers, Seagate, Toshiba and WDC, operate.

In contrast there are six competing flash product suppliers; Intel, Micron, Samsung, SK hynix, Toshiba and WD. Each company has an integrated flash-foundry-to-SSD manufacturing operation whereas SSD suppliers like Kingston and Seagate buy in flash media from one of the big six.

Even though WD increased its SSD exabytes shipments, overall flash revenue fell due to weak pricing.

How did WD execs account for these revenue events; the depressed client device sales and the deeper SDD decline than HDD fall, in the earnings call?

Earnings Call

CEO Steve Milligan talked about: “various challenges on both the market and geopolitical fronts…We accelerated the streamlining of our hard drive manufacturing footprint. We also made significant progress in lowering our operating expenses.”

The “streamlining” refers to the closure of the WD Kuala Lumpur disk manufacturing plant.

WD has detected “a more stable pricing environment for our flash business,” and believes the NAND market has reached a cyclical trough. This confirms indications from SK hynix and Samsung’s latest quarterly results.

President and COO Mike Cordano said: “Due to market conditions and geopolitical dynamics, we reduced our participation in mobile during the June quarter and expect to see immediate recovery of our participation in mobile in the September quarter.”

He said the addition of Huawei to the US restricted export entity list caused a $100m impact on WD’s revenues in the quarter.

CFO Bob Eulau said Client Devices revenue fell slightly, on a quarterly basis, as growth in the client SSD market was offset by declines in the client HDD and flash mobile applications.

Fresh problems

WD temporarily stopped ships to Huawei once its name was added to the US export-restricting entity list, then resumed when it realised entity list restrictions did not apply to already qualified product. Restrictions still apply to other products though. Cordano said WD’s near-term opportunities at Huawei have been reduced.

The power outage at the Yokkaichi fabs in Japan operated by the Toshiba/WD joint venture caused the loss of approximately six exabytes of wafer output for WD. Most of the impact will come in the September quarter but the company expects it will be able to largely mitigate any revenue impact for the September and December quarters.

Eulau told earnings call listeners: “We and our partner (Toshiba Memory) will be vigorously pursuing recovery of our losses associated with this event.”

Outlook

Milligan’s expectation for “a stronger demand environment for the second half of calendar year 2019 remains intact for both our flash and hard drive products.” Next quarter’s revenues are expected to be between $3.8bn and $4.0bn; $3.9bn at the mid-point.

They were $5.03bn in the year-ago quarter, so revenues are still depressed but at least there is a sequential rise on the current quarter’s revenues.

The CEO said WD’s “continued transformation into a data infrastructure company is on solid footing and we look forward to reporting on our progress.” And we look forward to hearing more about this move to sell more data infrastructure systems such as IntelliFlash and ActiveScale storage arrays and composable systems.

Their revenues currently are relatively insignificant compared to the torrent of disk drives and SSDs being sold be WD.

Cordano said “surveillance continues to be a long term driver for client HDDs,” and WD sees a transition to drive-managed shingled media recording (SMR) drives with greater capacity. It expects a strong revenue rise from drive-managed surveillance SMR drives in the September quarter.

Eulau was asked about free cashflow generation, after two negative quarters, and said: “We’re not going to give a forecast for free cash flow for next year, but we’re definitely expecting to generate cash. … I think it’ll be a pretty good cash generation year.”

Wells Fargo senior analyst Aaron Rakers thinks WD will benefit from a coming ramp of NVMe enterprise SSDs, where the company has a “notably underweight market share vs. Samsung and Intel,” and “with major cloud and OEM customers [purchases] commencing in F1Q20.”