SK hynix has detected signs of the end of the memory and NAND chip glut but but a Japan-Korea trade dispute is threatening the supply of chemicals it needs to make its chips.

Chemical trade warfare

The restricted chemical supply will also affect SK hynixs larger Korean rival, Samsung. These chemicals are needed to make semiconductor chips and smartphone displays. LG Display, Samsung and SK hynix are seeking alternative sources for these chemicals and ways to reduce the amount needed in their plants.

The dispute stems from a South Korea court ruling last year that Japanese companies owed compensation to Koreans forced to work in Japanese factories when Japan occupied Korea in the second world war. This ruling was followed by Japan tightening high-tech export trade procedures with South Korea for three chemicals: fluorinated polyimide, hydrogen fluoride and resists, effectively limiting their supply.

Japan is the leading supplier of the three chemicals and the effects could be severe.

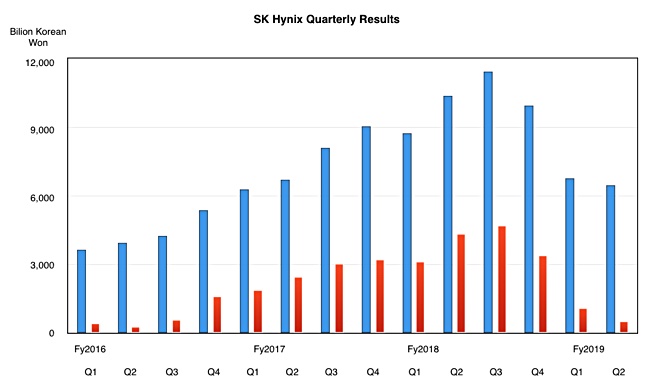

SK hynix revenues and profit

Revenues in SK hynix’s second quarter were 6.45 trillion Korean won ($547.7bn), down 38 per cent y/y and five per cent q/q, as the chart below illustrates:

Q2 profit was Won537 billion ($455.8m), down a savage 88 per cent y/y and 51 per cent q/q.

Although the quarter-on-quarter declines were much lower than the year-on-year declines, SK Hynix said it had expected more of a recovery in the DRAM and NAND markets.

Market characteristics

Strong competition between a few well-funded suppliers is a feature of both markets. The vendors are using technology transitions to produce more capacity from a wafer and so lower tosts. They all forecast NAND and DRAM demand growth in mid- and long term.

At present we are in a period of low demand and excess production, leading to lower prices. Suppliers are cutting production and say they are seeing signs of demand picking up. In a balancing act they need to invest to fund technology transitions to denser wafers. At the same time they must but scale back production to clear their inventory and to avoid cutting prices even further.

DRAM

SK hynix said DRAM bit shipments increased 13 per cent q/q with higher demand growth in the mobile and PC DRAM markets, where demand growth was relatively high. Overall demand was weak and the average DRAM selling price dropped 24 per cent.

Wells Fargo senior analyst Aaron Rakers said SK hynix provided a weakened forward DRAM outlook – most notably in terms of server DRAM.

The company will cut DRAM production capacity from the fourth quarter onwards. SK hynix will also convert part of the DRAM production lines of its M10 FAB in Icheon, Korea, to CMOS image sensor mass production from the second half of the year. It said DRAM capacity is likely to continue to fall until 2020.

However, it intends to increase the proportion of 1Xnm and 1Ynm DRAM to 80 per cent by the end of this year and start to selling 1Ynm computing products from the second half of this year.

NAND

NAND flash bit shipments increased 40 per cent QoQ because of demand recovery fed by to price declines, with the average selling price decreasing by 25 per cent.

In response SK hynix will cut NAND wafer starts by more than 15 per cent compared to last year. Previously it said it will cut starts by more than 10 per cent.

On the bright side, Rakers said Hynix expects a considerable slowdown in NAND price falls because of supplier inventory declines, wafer production cuts and the impact of the Toshiba fab outage in June 2019.

SK hynix will focus on 72-layer NAND but will increase the proportion of 96-layer NAND in the second half of the year to target high-end smartphone and SSD markets. SK hynix is also preparing for mass production of 128-layer 1Tbit TLC (3bits/cell) flash at the end of this year.

Plans for securing additional clean room space at its M15 FAB in Cheongju, Korea, and installing equipment at the M16 FAB in Icheon, are delayed in light of current demand. This means icapital investment in 2020 is expected to be significantly lower than this year.