Seagate successfully squeezed out cash from its disk drive business in its latest quarter despite long-term revenue decline, and with little or no help from enterprise arrays and SSDs.

Seagate’s fourth fy2019 quarter revenues were 5.4 per cent down annually at $2.37bn, but above the mid-point of its guidance, keeping the analysts happy. Net income was up a humungous 113 per cent to $983m, largely due to a one-time $702m tax benefit. Taking that away profits would have been $281m, 39 per cent lower than a year ago.

This was better than Western Digital’s latest quarter which saw depressed revenues and a loss.

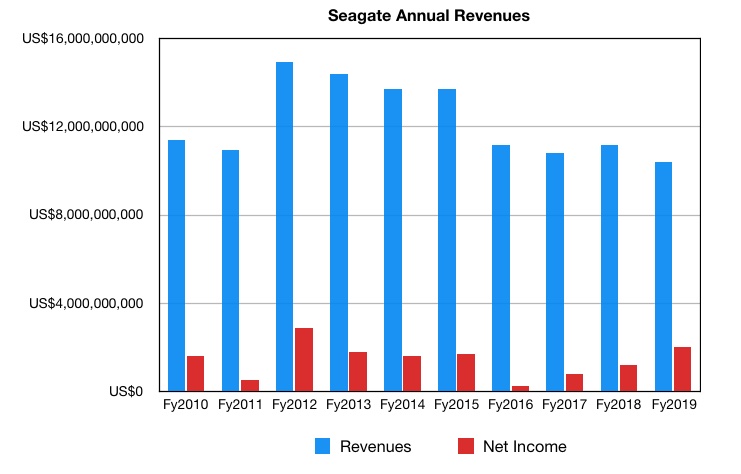

Full fy2019 revenues for Seagate were $10.4bn, 6.3 per cent less than a year ago. Net income for the year was $2bn ($1.8bn) recorded last year. If we take away the Q4 one-time tax benefit again, then full year profits were $1.31bn.

Cashflow from operations in the quarter was $448m and free cashflow was $297m. For the full year cashflow from operations was $1.8bn and free cash flow was $1.2bn.

CEO Dave Mosley said in as statement: “We continued to execute well in the June quarter in the midst of an uncertain global environment. We once again delivered on all of our financial expectations, while driving higher operating profit and earnings per share quarter-over-quarter, and demonstrating our ongoing focus on optimizing free cash flow,”

He said global industry conditions were starting to improve, particularly among cloud and hyperscale customers. Seagate expects to make revenues of $2.55bn plus or minus 5 per cent in the next quarter, 14.7 per cent down on $2.99bn last year.

The long view

Looking at the past seven years, Seagate is getting smaller. Revenues have shrunk 30.4 per cent from $14.94bn in fy2012 to $10.4bn in fy2019.

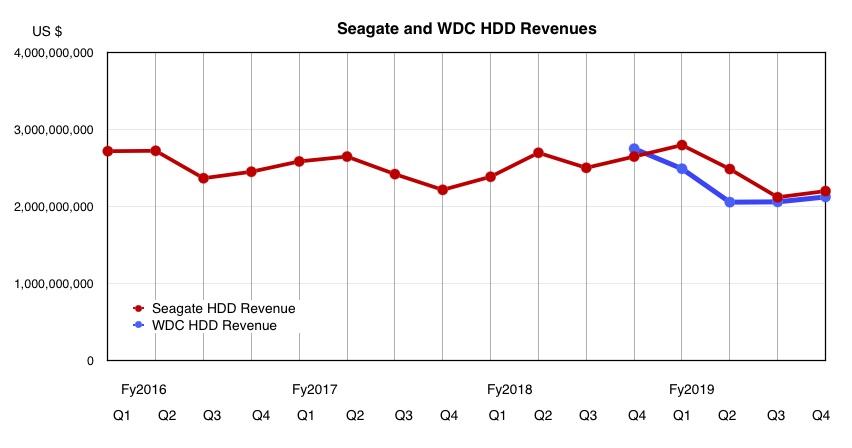

The disk drive business’ revenues have remained more or less flat over the 2016-2019 period.

It is now the largest disk drive manufacturer by revenues.

The chart above shows Seagate’s HDD revenues since fy2016 and for comparison includes WD’s five most recent quarters of digital disk revenues. Seagate’s lead in HDD revenues has persisted for four quarters although it is currently slim.

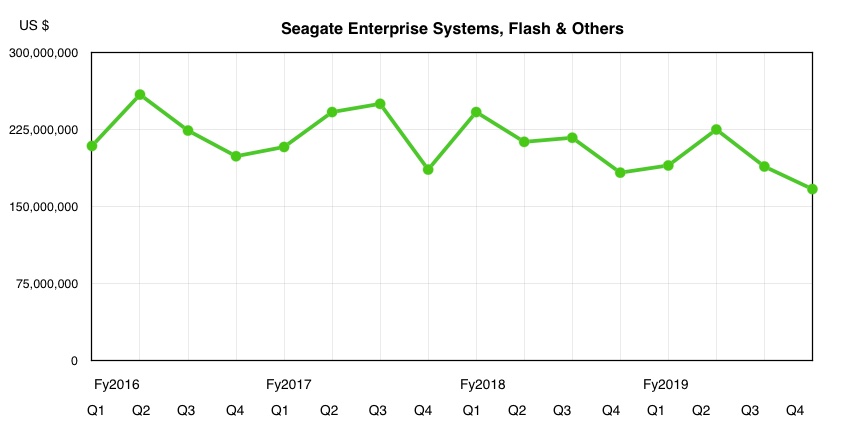

The company’s forays into enterprise arrays and flash memory are not doing so well, with revenues trending down from $209m in the first fy2016 quarter to $167m in the latest quarter.

In comparison Western Digital earned $1.5bn from flash-based products in the quarter.

Seagate focus

Seagate generates tremendous amounts of cash, much used for dividends and share buybacks. The company is content to spin cash from disk drives, believing there is a long-term future in capacity-optimised drives for enterprise data centres, cloud service providers and other hyperscale customers, and the surveillance business.

Disks are pretty much everything for Seagate. The enterprise systems (storage arrays) and flash business represents just seven per cent of revenues.

Western Digital has invested to become a significant integrated NAND and SSD supplier, and is now investing again to build a storage array business. Seagate by contrast is wedded to the hard disk drive business.

Blocks & Files thinks we might even see the company offload its enterprise systems and flash businesses. If it can do better with dollars invested in making disks rather than arrays and SSDs, then it may decide to concentrate everything on disk drives and spin off the array and SSD distractions.