Western Digital’s third quarter results were boosted by a strong rise in disk revenues along with increased demand for SSDs.

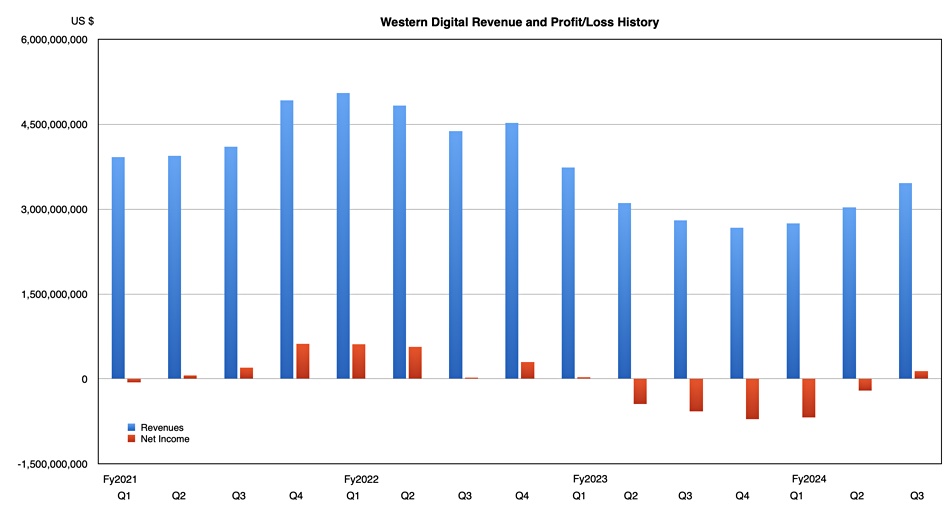

Its revenue slump is ending. Earnings in its third fy2025 quarter rose 29 percent year-on-year to $3.46 billion, beating its $3.3 billion outlook, and it made a $135 million profit, after five consecutive loss-making quarters.

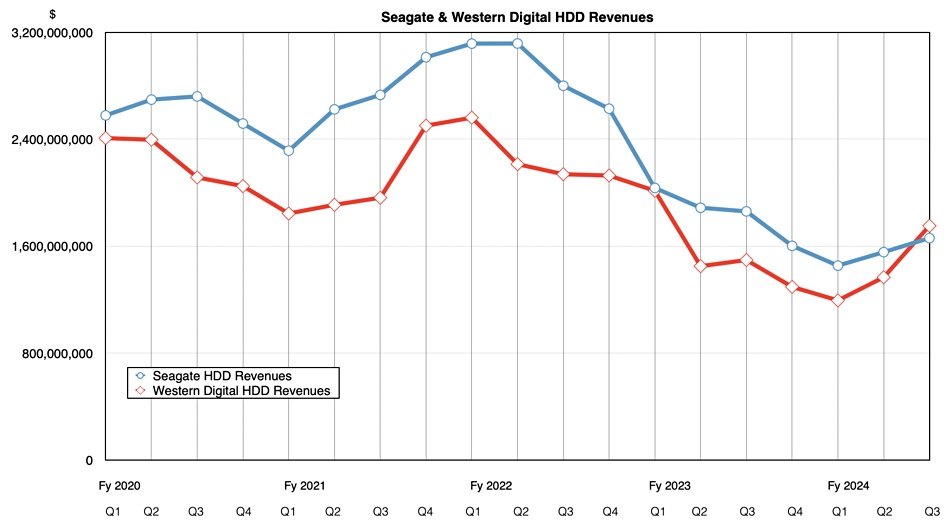

This contrasts with HDD maker rival Seagate where revenues of $1.66 billion were down 11 percent year-on-year with a $25 million profit. WD made $1.75 billion in disk revenues, overtaking Seagate after years of playing second fiddle. Seagate’s bet on HAMR technology is not, so far, paying off.

WD CEO David Goeckeler said in prepared remarks: “As evidenced by our excellent third quarter results, Western Digital continues improving through-cycle profitability and dampening business cycles by leveraging our strategy of developing a diversified portfolio of industry-leading products across a broad range of end markets.”

Financial Summary

- Gross margin: 29 percent vs 29.3 percent a year ago

- Operating cash flow: $58 million vs -$110 million a year ago

- Free cash flow: $91 million

- Cash & cash equivalents: $1.9 billion

- EPS: $0.34 vs $0.63 last year

Flash revenues were $1.7 billion, up 30.5 percent annually, while disk revenues of $1.75 billion rose 17.1 percent annually and overtook the SSD earnings after three lagging quarters. Nearline drive revenue reached a six-quarter high point. HDD exabyte shipments increased 41 percent quarter-on-quarter and the average HDD selling price increased from $109.00 a year ago to $145.00.

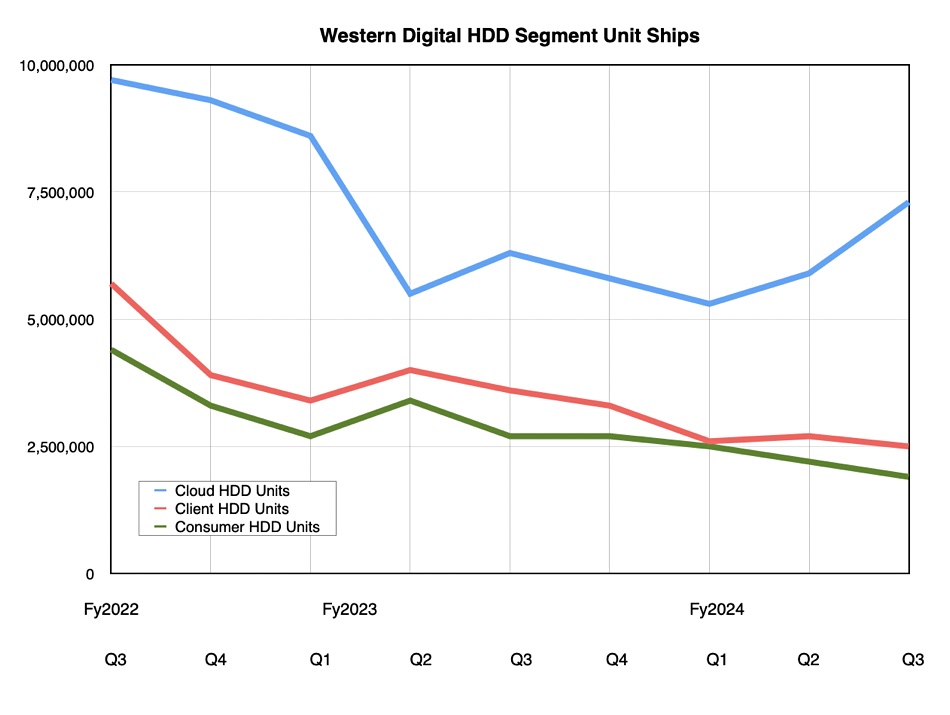

Disk units totalled 11.7 million, down 7.1 percent annually but the second consecutive quarterly rise. Cloud buyers bought 7.3 million drives, 15.9 percent more than a year ago, while there was a 30.7 percent Y/Y drop in client drive (non-cloud OEM and enterprise) units to 2.5 million and a 29.6 percent drop in consumer drive shipments to 1.9 million. Cloud buyers bought 62 percent of WD’s disk drives in the quarter and represent its largest unit shipment and HDD revenue market. Gpesckeler said the quarter saw WD’s largest HDD sequential exabyte growth in some time.

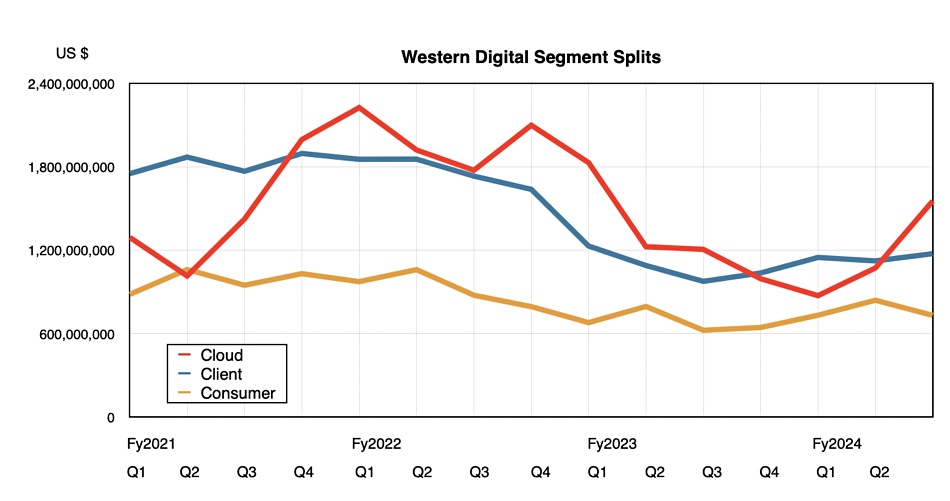

Two of the three main market segments were affected by rising HDD demand while all three were affected by SSD revenue rises:

- Cloud (up 29 percent to $1.56 billion) was 45 percent of total revenue with growth primarily attributed to higher nearline shipments, improved nearline unit pricing, and flash revenue up both sequentially and year-over-year.

- Client rose 20 percent annually to $1.17 billion and was 34 percent of total revenue. Sequentially, the increase in flash ASP more than offset a decline in flash bit shipments while HDD revenue decreased. The year-over-year increase was driven by growth in both flash and HDD ASPs and flash bit shipments.

- Consumer at $730 million was up 17 percent annually and represented 21 percent of total revenue. Sequentially, both flash and HDD were down at approximately similar rates and in line with seasonality. The year-over-year increase was driven by growth in flash bit shipments and ASP.

Earnings call

The earnings call saw an anodyne comment about the looming separation of WD’s disk and NAND/SSD businesses by Goeckleler: “I am proud of the team’s ongoing efforts as we drive toward completion of the separation in the second half of the calendar year. We remain focused on achieving the separation as soon as possible, and we’ll continue to provide further updates on our progress as appropriate.” But he couldn’t really say anything else.

He commented on the flash market: “We are seeing demand returning for NVMe SSDs that we qualified before the downturn. We are also experiencing significant interest in providing these products in dramatically higher capacities for AI-related applications, which we expect to ship in the second half of the year.” WD currently ships DC SN640 TLC PCIe gen 3 SSDs with up to 30.72 TB capacity and PCIe gen 4 SN650 and 655 drives with 15.36 TB. We now expect 60 TB SSDs to be announced by WD later this year, with Goeckeler saying customers: “want them in much bigger capacity points, 30 and 60 TB capacity points.”

SMR drives are being adoped by hyperscalers, with Goeckeler saying: “Our cloud customers continue to transition to SMR with our 26 TB and 28 TB UltraSMR drives, quickly becoming a significant portion of our capacity enterprise exabyte shipments. SMR-based drives represented approximately 50 percent of nearline exabyte shipments in the quarter.”

He reckons: “Our portfolio strategy to commercialize ePMR, OptiNAND, and UltraSMR technologies in advance of our transition to HAMR, has proven to be the winning strategy and enables us to deliver to customers the industry’s highest capacity and leading TCO drives.” It’s certainly led to WD’s disk revenues overtaking those of Seagate.

HAMR is on WD’s roadmap; Goeckeler saying: “The right time for HAMR is at 40 terabytes. And we’ve got a lot of development going on that product. … [We] have a lot of confidence in our HAMR development. And quite frankly, our customers know exactly what we’re doing, and where we’re at, and what our plans are, and they’re comfortable with that as well.”

Seagate is planning on launching its 40 TB HAMR drives in the second half of calendar 2025.

Flash killing disk

Goeckeler was asked about SSDs cannibalizing the HDD market, as Pure Storage has proposed. This is how he responded: “We do not see any cannibalization. Clearly, HDD plays a big role in the AI storage life cycle as well as the whole ingest phase, because all of the big data lakes and all of the raw data sets; those are all going to be stored on HDD. It’s just the economics of where you store that data, and how do you access that data. It’s all that part of the AI pipeline, if you will, is going to be HDD.”

And SSD’s role: “Now, you have all of these other new use cases around training and inference, and those are all going to be SSDs. So, it’s really about growth as opposed to substitution. And that’s what’s so exciting about this. And obviously, once you get the models trained, then the models are going to turn out more data, which is going to be stored on HDD.”

He emphasized this: “You’ve got this virtuous cycle going. So, it’s kind of literally rising tide lifts all boats. It’s not a substitution game.” Basically Pure Storage is wrong.

WD expects fourth fy 2024 quarter revenues to be in the range of $3.6 billion to $3.8 billion. The $3.7 billion mid-point would represent a 38.8 percent annual increase, making for a $12.94 billion full year; a 4.8 percent rise on fy 2023.