HPE execs have told investment analysts the company is relying on disaster recovery and data management for storage growth.

Update. HPE TAM expansion slide replaced. Oct 21, 2022.

The execs spoke at HPE’s Securities Analyst Meeting at its Houston HQ on October 19 – watch the webcast here. The meeting covered all of HPE’s activities but we’re zeroing in on the storage side.

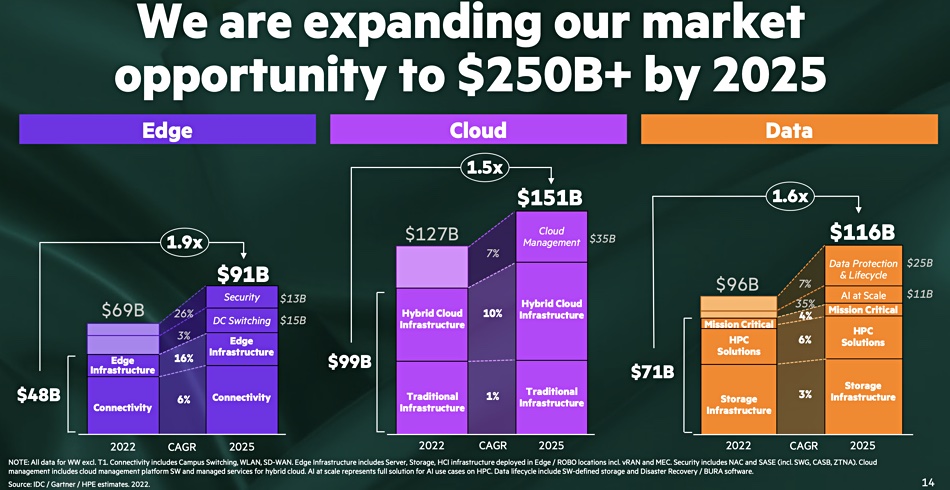

Wells Fargo analyst Aaron Rakers told his mailing list recipients that HPE saw its total addressable market (TAM) expanding to more than $250 billion by 2025 by “expanding into new addressable market opportunities.” There are four of these: Data Center Switching, Data Protection and Lifecycle Management, Hybrid Cloud Management, and AI at Scale Infrastructure.

The execs mentioned three TAM expansion areas:

- Compute with a $64 billion TAM growing at a 7 percent CAGR to 2025

- Data with a storage TAM of $64 billion and a 4 percent CAGR

- Intelligent Edge and a $69 billion TAM now, growing to $91 billion in 2025

President and CEO Antonio Neri said hybrid multi-cloud adoption is accelerating for the most demanding workloads. Half of HPE’s customers today prefer hybrid multi-cloud over the alternatives, such as all-in on-premises or a public cloud. This proportion should grow to 70 percent of customers by 2025.

A chart listed TAM growth in the Edge, Cloud and Data categories:

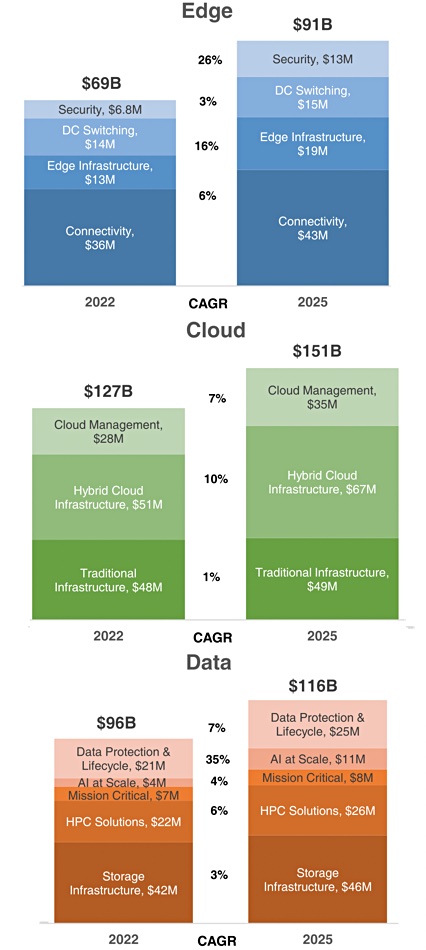

Wells Fargo analyst Aaron Rakers crunched some numbers and reinterpreted the slide;

In the Data category we see Data Protection & Lifecycle with a $21 billion TAM today, growing with a 7 percent CAGR to $25 billion in 2025. Storage infrastructure has a $42 billion TAM today which will be $46 billion in 2025, courtesy of a 3 percent CAGR.

Neri said customers want built-in data services in GreenLake, HPE’s everything-as-a-cloud service delivery and subscription business model. There are 65,000 GreenLake customers now and 120,000 users, with a total contract value (TCV) of $67.7 billion, two million connected devices, and more than an exabyte of data under management. GreenLake TCV was about $5.2 billion a year ago.

CFO Tarek Robbiati said the emphasis in storage is on organic growth with software-defined offerings. He said HPE expects its storage revenues to be in line with or greater than the overall storage market growth rate.

HPE will increase its storage TAM with disaster recovery (DR) and backup, replication, and archive offerings. Rakers wonders if HPE’s current internal offerings, like Zerto, can achieve this and suggests acquisitions might be needed.

If that is the case, the life cycle management area looks like a potential acquisition focus for HPE.