Panzura claims it’s the leading cloud file data services supplier, having overtaken CTERA and Nasuni in providing a global file environment.

Multi-location businesses, particularly ones with remote workers, need to share files and manage their file data estate. The traditional way to do this is with filers at every on-premises location – but that does not suit remote access, and ensuring a single version of file truth with a single master file copy is difficult. A newer way is to have a cloud-based and centrally managed global file data service, with edge caching for speed, that supports file sharing and collaboration and is built for that purpose. Panzura, founded in 2008, helped pioneer this, and then encountered difficult times before being bought by private equity in May 2020.

CEO Jill Stelfox briefed Blocks & Files, and said she was part of the Profile Capital Management private equity investment group that bought Panzura in May 2020. “Since then, we’ve grown 485 percent” annually, she tells us, by providing “enterprise hybrid, multi-cloud data management.” Panzura is cash flow positive and this, she said: “puts us in a unique position in this space, I think we’re the only ones that are cashflow positive. … running a financially sound company might be unique in Silicon Valley.”

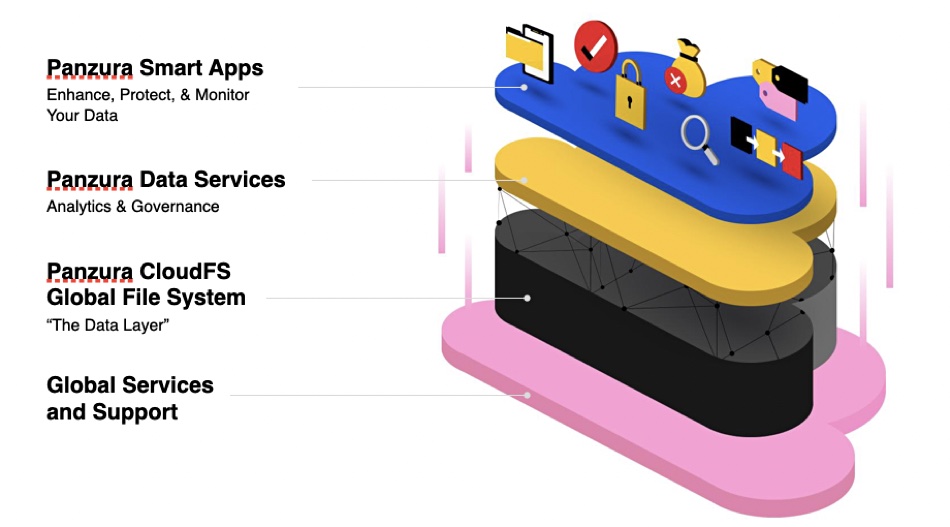

The company sees itself as providing a cloud-based distributed and global primary and secondary file data access and management platform that negates the need for on-premises filers. Its software is divided into four layers.

The base pink layer is a set of global services to move and migrate data. The black layer is where the CloudFS (Cloud File System) unstructured data storage and management platform is located. CloudFS provides a global file namespace with distributed fie locking using a global metadata store. It uses snapshots to save file state and has global deduplication capabilities. You can read a technical white paper here.

A data services layer (yellow) sits above this, with a data management dashboard accessing search, audit, analytics, and governance facilities. Stelfox explained: “The number one reason we did Panzura Data Services is because CIOs are struggling with the answer to ‘What is where?’ And with [our] standard data services, you can know where all your data is.”

The top blue layer contains seven Panzura-written Smart Apps for data access, management, collaboration, and monitoring. They include:

- An edge application to manage security and intellectual property on a mobile device such as an iPad or laptop;

- Company Connect, which is the ability to set up a quasi-DMZ (de-militarized zone) – a safe place where companies can share files, even if they don’t have Panzura. This is used, for example, in selling mortgage applications to securities companies;

- Panzura Protect, which provides ransomware alerts within two seconds of an attack taking place, telling you if it’s internal, where it’s coming from and if data is being encrypted;

- Deep content search.

More are coming, with Stelfox saying: “We’re working on a global metadata catalog. That’s actually not complete yet, although we do have all the logistics and provisioning. You can choose where you want data to be; move this to an S3 bucket, move that to a different datacenter. We give you recommendations based on our AI/ML layer.”

Market positioning

Stelfox said: “We’re going after three different segments: data storage – that’s our original CloudFS products that we’ve purchased – and then data services and data intelligence.”

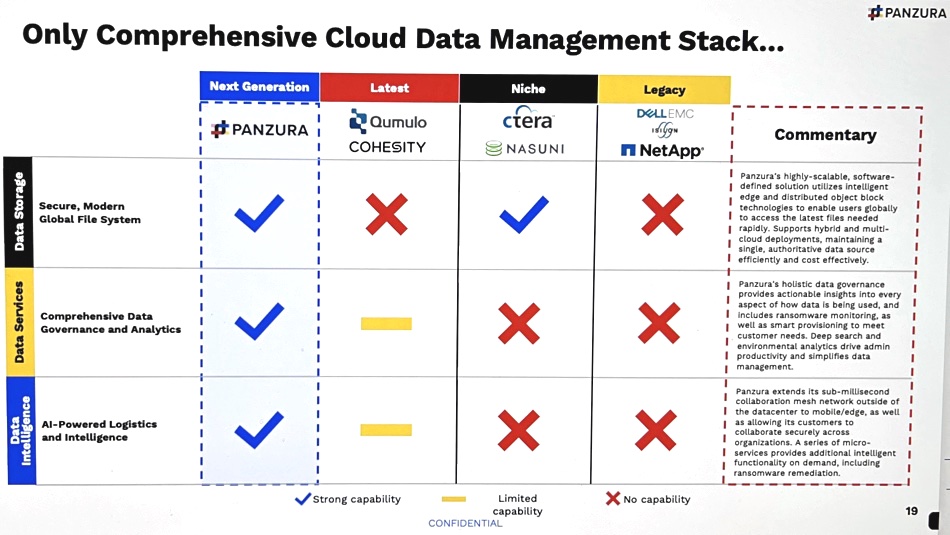

A couple of diagrams summarize Panzura’s view of its positioning versus its competition. First the overall view:

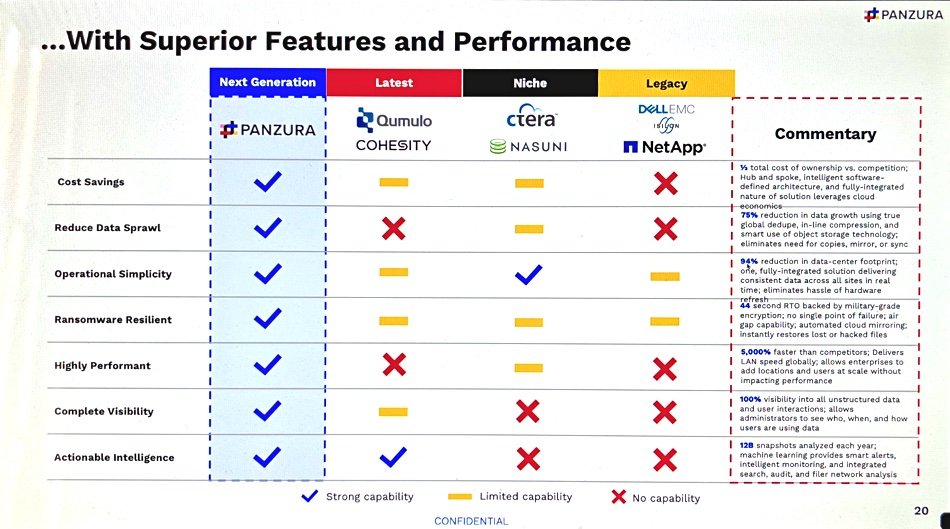

And then a more detailed view:

The competitive environment is formed from three kinds of vendors. First there are “the legacy guys, the NetApps and Isilons, and the’’re not really doing hybrid cloud.” For example, “the ONTAP offering … is really just pushing files to cloud. It’s not a true hybrid cloud system that connects files between servers and the cloud. It’s just a sort of migration tool.”

“Then there’s the niche players, the CTERAs and Nasunis, and they do have a product similar to CloudFS. It doesn’t scale to the size of Panzura, but it’s similar. But they don’t have any of the data services pieces that we do.”

Hammerspace, another niche player, has functionality similar to Panzura Data Services, “where they can see data on storage platforms and and bring insights around your data. But they don’t have the full storage capability of the data storage layer.”

The third group is the “Qumulos and the Cohesity that definitely do have a storage layer. They also have a little bit of data services. But all of that is on secondary data and not primary data – which is, in some respects, easier, because … you’re not worried about interrupting the user flow or segregating speed of user access to files or speed of rewrites; that gets saved.”

In her view: “It’s OK if it takes five minutes to do something [on secondary storage] because nobody cares. But can you imagine if it took five minutes [to write] a file? It’s just unacceptable.”

Stelfox said: “Qumulo talks about having a little bit of the data layer, like Cohesity does, but they they don’t do it for real-time data. And it’s not a robust protocol. But we’ve seen them in the field and competed against them in the field.”

In general, though: “We actually compete against NetApp and Isilon much more than Nasuni and CTERA.”

Comment

Imagine CTERA, Nasuni, Panzura, and Hammerspace offering a set of functionalities to global users which we place on the surface of a black box. They all have basically, a “cloud” approach as opposed to one centered on on-premises filers.

The “how” of providing these services is inside the black box and software engineers and architects can argue about the best way to architect and construct such services. They can explain how their approaches optimize performance, scale, costs, user productivity, and so forth.

Without objective benchmarks, the only way a customer can evaluate the different approaches in detail is with pilot installations and bake-offs – checking for functionality, ease of use and scalability.