CTERA is leaving its storage roots behind and becoming a cloud-based data services business selling to large enterprises.

Update. Nasuni comment added 12 April 2022.

That was the message presented to IT Press Tour attendees in Tel-Aviv by co-founder and CEO Liran Eshel and his team.

CTERA is a 14-year old company, VC-funded with its last round worth $30 million in 2018. It has raised $100 million in total and is getting close to being profitable and thus self-funding. CTERA was founded by Eshel and VP for R&D Zohar Kaufman after running an appliance company in the SMB network security area. They built a cloud file storage gateway appliance and software providing file sync and share, and security.

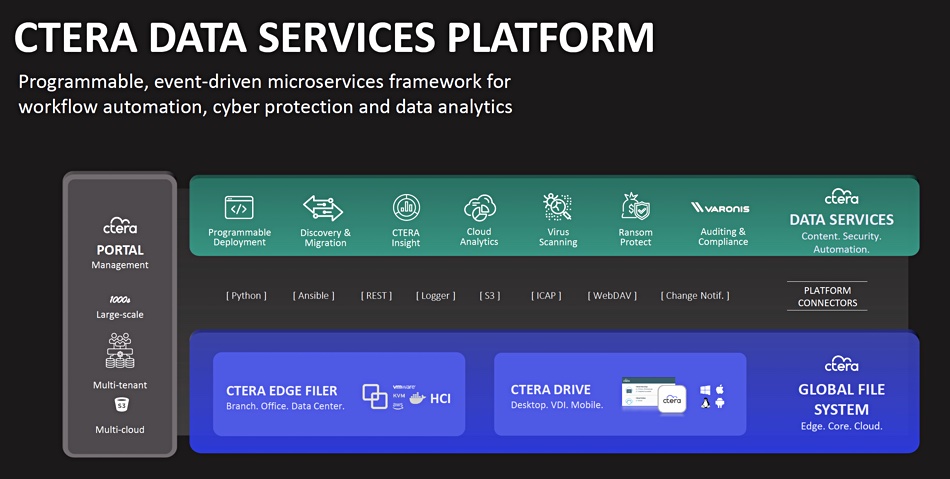

CTERA now presents itself as a Cloud Data Services supplier with a layer of services above its edge filers and edge-to-core-to-cloud global file system:

Programmable deployment is based on a DevOps SDK, which enables developers to automate system rollout. CTERA says an edge filer can be deployed in 90 seconds using the SDK. Discovery and migration supports customer file and object discovery across their IT estate. It can then migrate files to the cloud, using network transmission for SMB customers and Amazon Snowball for larger projects.

Eshel says CTERA thought about working with Datadobi on migration but realized it could do things better by taking advantage of its edge filers. It deduplicates and compresses every block sent up to the cloud using them.

CTERA Insight provides information about files in CTERA’s filesystem and their content. No-code data pipelines can be set up to filter and extract data sets then feed them to analytics applications in the cloud or Lamda functions. Data is extracted from compressed and deduped and written to a new dataset for this purpose.

Cloud Analytics can extract data from CTERA’s immutable S3 buckets using filters, rehydrate it, and send it to analytics applications using an S3 data export microservice. CTERA also provides multi-layer virus scanning and malware protection combining on-access edge scanning with a cloud-based ICAP service for later detected threats. The ransomware protection involves continuous replication into immutable S3 buckets, zero-day detection, and instant recovery using rollback.

CTERA competition

CTERA sees itself mostly competing with NetApp, aiming to replace its filers. But it also competes with Nasuni and Panzura, fellow companies in the cloud file services and collaboration space.

Eshel thinks CTERA can scale much farther than Nasuni, with support for thousands of endpoints. He suggested Nasuni installations typically amounted to 30 or so endpoints and thinks CTERA has superior deployment and automation capabilities to Nasuni.

In general, we can assume it is easier for CTERA, or Nasuni and Panzura, to sell to customers who have on-premises filers and no connected public cloud file system or collaboration resources than to try and replace each other. Greenfield should be an easier sell than brownfield.

NetApp is the giant to beat for CTERA, as for Nasuni and Panzura. Nasuni has raised around $229 million, with a $60 million round earlier this year. Our thinking is that it is second in revenue behind CTERA in this distributed cloud file system services market, with Panzura in third place. (Update; see the Nasuni comment below.)

Veteran Affairs

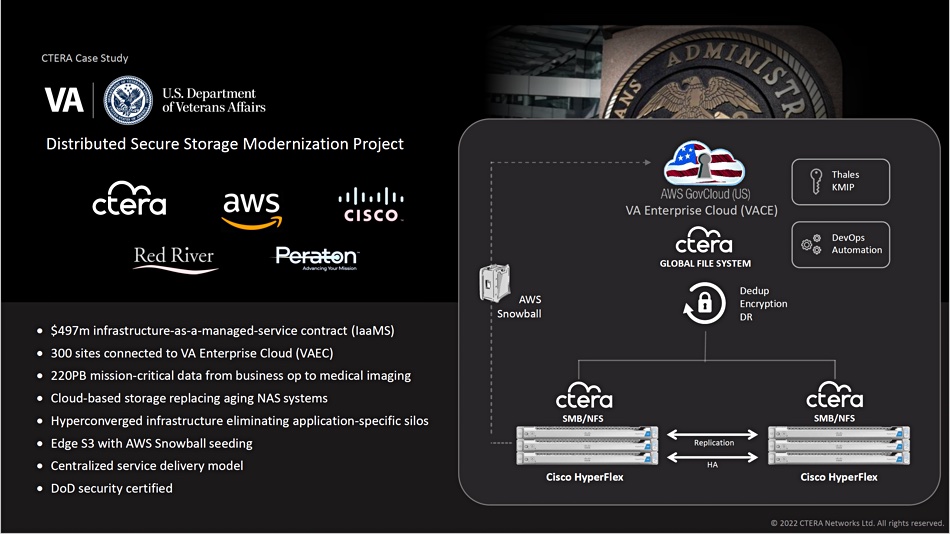

In December 2021 CTERA won a place in Peraton’s Department of Veteran Affairs bid for a $497 million contract to provide infrastructure-as-a-managed-service (laaMS) for storage and computing facilities across the US and globally. CTERA, which provides the only global filesystem included on the Department of Defense Information Network (DoDIN) Approved Products List (APL), will deliver file services for mission-critical workloads, connecting up to 300 distributed sites (hospitals) to the VA Enterprise Cloud powered by AWS GovCloud (US).

This involved 220PB of data from business operations to medical imaging. It uses edge filers, based on Cisco HyperFlex hyperconverged systems, and CTERA-supported 80TB Amazon Snowball boxes being used to ship data up to the AWS GovCloud for S3 storage. This cloud-based storage replaced NetApp storage systems and HPE servers.

HPE and NetApp bid a system using 3PAR tier 1 and NetApp StorageGRID tier 2 storage through system integrator Thundercat. It failed to win, even after Thundercat protested the contract being awarded to Peraton.

Eshel thinks CTERA is taking share from NetApp because it is growing faster. As a supplier of caching, cloud-connected edge filers, CTERA says it is about much more than storage, with cloud-based data services being an essential part of its deployments. CTERA is a cloud-centric data services business whereas, in our view, NetApp is an on-premises storage supplier with a very good cloud connectivity story.

Eshel said he has no plans to raise more VC money. He wouldn’t reveal his run rate. The Veteran Affairs was a huge win for CTERA and other wins – such as Iron Mountain (hundred of endpoints worldwide), and the Thales-led London Underground digital modernization – suggest to us it has attained a run rate amounting to multiple tens of million dollars a year. Data services is bringing in the dollars.

Nasuni

On seeing this article Nasuni told me;

- On market and growth aspects, Nasuni can point to evidence in the public domain (such as number of LinkedIn employees) which would suggest that it is substantially larger in terms of revenue, employees and customers than CTERA

- Nasuni is nearing a revenue milestone that will see it surpass CTERA and Panzura substantially

- Nasuni’s last funding round added to the company’s cash balance of $100 million which suggests there has been little cash burn from operations over the last 2-3 years

- On Nasuni scalability, Nasuni customers AECOM (the world’s biggest engineering and design firm) and Omnicom (the world’s largest advertising company) can confirm that Nasuni Edge instances are running in hundreds of sites that are all managed through Nasuni’s central management console

- Regarding endpoints, CTERA appear to mean their desktop sync client running on home user desktops, rather than caching instances serving up files in branch or remote office locations – so they seem to be comparing apples with oranges somewhat there

- Nasuni competes with NetApp in the enterprise 95 percent of the time and Panzura and CTERA only in SMB.