Filer – A storage array using SSDs or disk drives or both to store files in folders and make them available to many accessing servers and/or personal computing devices using a network protocol such as NFS.

File

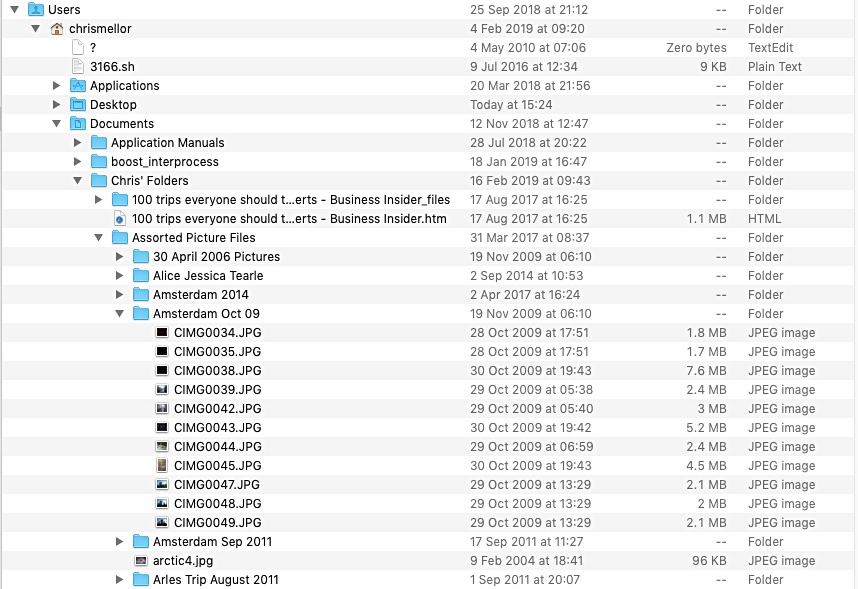

File – a file is set of data items, such as this document, with a name and an entry in a nested file and folder structure. This starts from a so-called root directory which contains entries for sub-directories or folders or files. A folder can, in turn, contain sub-folders or files and so on with a file-folder structure capable of having 100s of levels and billions of files. A file-folder structure is implemented on desktop and notebook computers and can also be implemented on servers. A shared storage device holding files is called a filer or NAS, Network-Attached Storage system, and it is accessed using the Unix Network File System (NFS) or Windows Server Message Block (SMB) protocol. CIFS (Common Internet File System) is an SMB dialect.

FICON

FICON – Fibre Channel Connection. This is IBM’s name for Fibre Channel and its replacement for ESCON as a mainframe connection hardware+software cabling system to link a mainframe host to peripheral storage devices. It uses Fibre Channel switches and directors to build a networking fabric, with rates of 1, 2, 4, 8 and 16[1] Gbps at up to 100 km distances.

ESCON

ESCON – Enterprise System Connection – an IBM-devized cable and protocol dating from 1990 and the System 390 mainframe. It was used to connect mainframe computers to peripheral devices scubas tape drives and displays. It was based on an optical fibre, half-duplex, serial interface, and initially operated at . This was later upgraded to 17MBps. The maximum cable distance between the mainframe host and its peripherals is 43km. It was replaced by FICON which operates over Fiber Channel.

Peer Software replication spawning more features

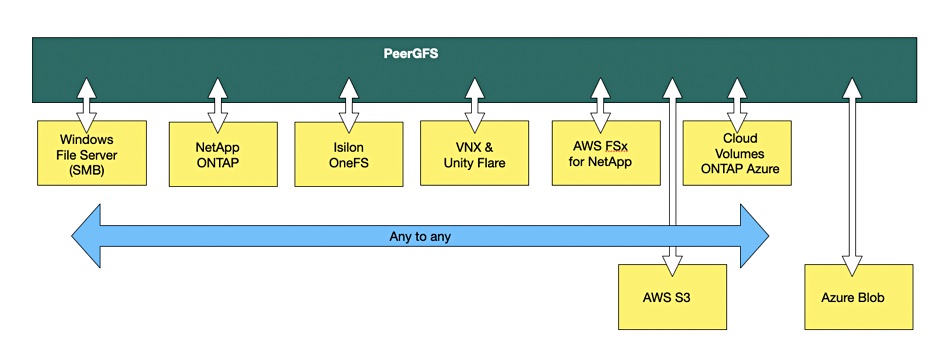

Privately owned Peer Software has sold its file-replicating Windows Server software to more than 10,000 customers who use it to replicate files to/from NetApp ONTAP and PowerScale Isilon OneFS filers. It also offers file migration and analysis services.

CEO Jimmy Tam spoke to B&F about his US-based company that was founded in 1993 by Paul Marsala in Centreville, Virginia, to provide a better way to synchronize files between Windows Server systems in and between datacenters. The product is PeerGFS, with GFS meaning Global File Service.

Distributed file service

DFRS (Distributed File Replication Service) is a Windows Server feature that can replicate and synchronize files across multiple servers in the same or different locations. It does not support non-Windows cloud, Unix/Linux or NAS file systems, has scaling and performance limitations, no file locking when files are in use or version management, and problematic debugging.

Peer says PeerGFS fixes these problems and provides a distributed file system service layer above Windows File Server. It supports NetApp ONTAP and PowerScale/Isilon filers, on-premises and, where appropriate, in the public cloud. Both NFS and SMB were supported originally but Peer “pulled out of NFS because it didn’t scale.”

Amazon S3 and Azure Blob support has also been added. Tam said Peer tends to replicate to S3 or Azure Blob and not from those targets. S3 and Blob are separate from a distributed file system. According to Tam: “Object is a backup for file systems for our customers.”

The company has taken in no venture capital funding whatsoever and says it was profitable since it started trading. It has operated in a specific niche, gradually extending outwards from its Windows Server base to add in support for NetApp ONTAP, Isilon and PowerScale, and also S3. AWS FSx for NetApp is now supported as is Cloud Volumes ONTAP for Azure. Azure NetApp Files support is a work in progress.

Tam said: “We might look at supporting Qumulo in the future. It has a massive media and entertainment presence.”

Peer competes with CTERA, DataDobi, DataDynamics, Egnyte, Komprise, Nasuni, Panzura, and WANdisco. All these companies have different products and services in the file and object replication, migration, synchronization, and analysis markets, and partial overlap with each other’s products.

Under the radar

Peer has three offices in the US and three in Europe, around 100 employees, and 1,200 customers with active support contracts. Sales are split roughly 50:50 between direct and the channel – with Dell EMC, NetApp, and Nutanix included as channel partners. There is a 60-35-25 percent sales split between the North America, EMEA, and APAC respectively.

Tam said: “We are about twice the size of Nasuni’s corporate accounts business.”

Peer has a new product program rolling out and needs to raise its profile, particularly against the migrators and cloud file system suppliers like Nasuni and CTERA. Tam said Peer’s main differentiation is that its replication does not involve scanning a complete file system, apart from the initial full scan for a new customer on day one. It is driven by events, a file creation write or delete, or folder creation or delete, occurring in the source system’s file event log, which Peer accesses through an API, such as Dell EMC’s CEE (Common Event Enabler).

He told B&F: “We take each company’s file event stream and normalize it, coalescing three events in one company’s stream to one in another’s if necessary.”

This means it is real-time and asynchronous. This facilitates an active:active relationship between the source and target systems for disaster recovery failover and failback. Not an active:passive one.

No filer replacement ambition

Peer has no wish to replace the edge file systems or the core data centre filers with a cloud-based global file system, which is the Nasuni and CTERA concept. It is an adjunct to them, providing a global distributed file system above them but not instead of them. Tam said his customers are relieved because “we are not a file system… They can have a distributed file system service and synchronized files without having to replace their familiar NetApp or Isilon systems… We are not a Cloud NAS like Nasuni, CTERA or Panzura. We overlay our service on top of NetApp, Isilon, etc.”

As far as filer suppliers are concerned, “we are agnostic. We’re storage Switzerland.”

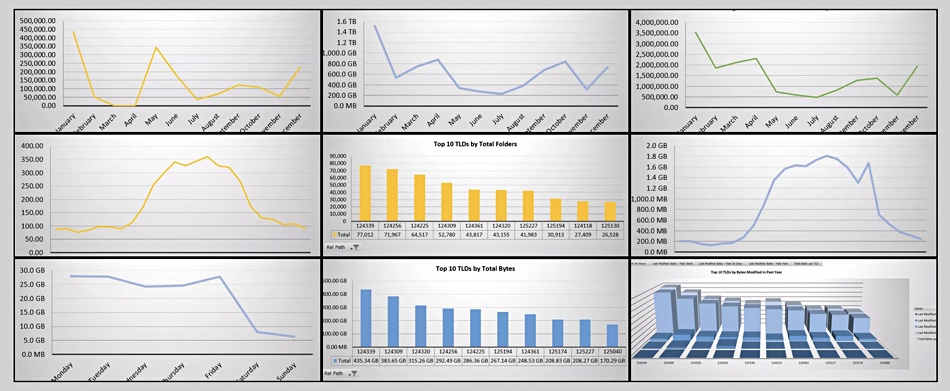

Peer also has a PeerSync Migration product, about which Tam said: “We have done a lot of migration historically but it is not our core business.” And there is PeerFSA, a scan-based File System Analyzer offering which can analyse a file system and report on aspects of it, such as storage used per folder and file, files per folder, and so forth. Tam added: “We give the telemetry of the file system to customers.”

Future developments include tiering of files, cyber-resilience, more dashboard-type analytics and the return of NFS support. We expect to hear more throughout the summer and fall.

Western Digital: COVID, contamination dent profits

Western Digital achieved better quarterly results than Seagate reported this week, but profits fell and it’s facing a sales downturn next quarter.

Revenues in the quarter ended April 1 were $4.38 billion, a 6 percent increase year-on-year. Western Digital had forecast a range with a $4.3 billion midpoint and beat that. However, profits were only $25 million compared to $197 million last year and $564 million in the previous quarter. This was largely due to Chinese COVID lockdown measures, supply chain issues, and flash fab contamination

CEO David Goeckeler said: “We delivered excellent performance in the quarter, with revenue of $4.4 billion and non-GAAP gross margin of 31.7 percent, both of which are at the higher end of our updated guidance ranges we provided in early March.”

He added: ”The entire Western Digital team worked together to deliver excellent financial performance while navigating a dynamic geopolitical and macroeconomic environment, as well as ongoing supply challenges.”

The recent chemical contamination at the NAND fab in Japan, in which Western Digital lost about 7EB of capacity, was a problem. Goeckeler said: “Our overall [flash] business was impacted by our ability to ship product due to the fab excursion.”

A Shenzhen disk drive products facility also had to close for a couple of weeks in the quarter, due to COVID-related measures, and that affected WD’s disk output and costs.

Financial summary

- Gross margin – 27 percent; it was 32.8 percent in prior quarter and COVID was a factor

- EPS – $1.75, up from $1.02 a year ago

- Operating cash flow – $398 million

- Free cash flow – $148 million

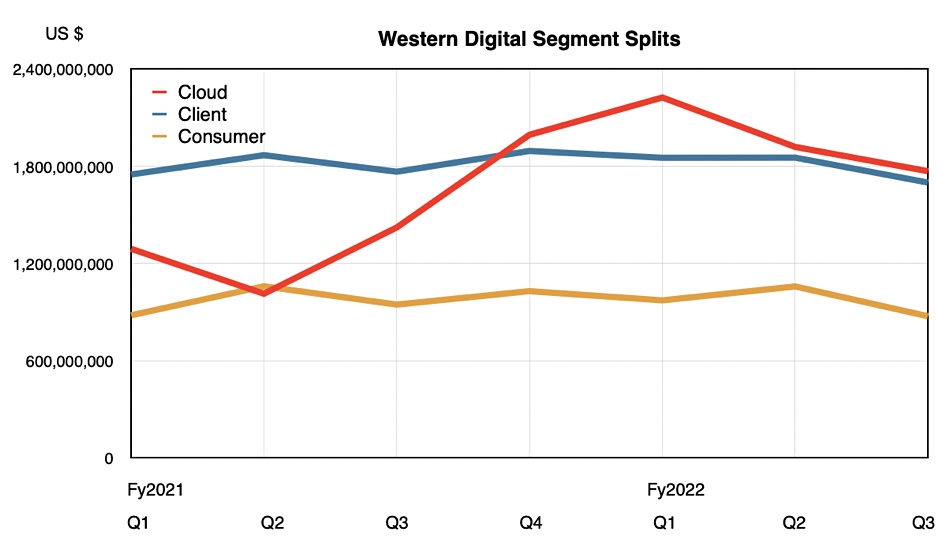

Segment splits

WD’s Cloud revenues were $1.77 billion, up 25 percent on the year. Within that there was a near 40 percent increase in nearline (high-capacity) disk drive revenue. Enterprise SSD and video disk drive earnings were lower, though. Revenues from client product sales were $1.7 billion, down 2 per cent on the year; a seasonal pattern, although client (PC) SSD sales rose. This was attributed to PC manufacturers dealing well with their supply chain problems. Consumer product revenues were down 8 percent year-on-year to $875 million as retail SSD sales declined.

Goeckeler said on an earnings call: “In consumer, we are experiencing short-term demand weakness outside the US tied to the geopolitical events in Europe, as well as COVID-related lockdowns in China.“

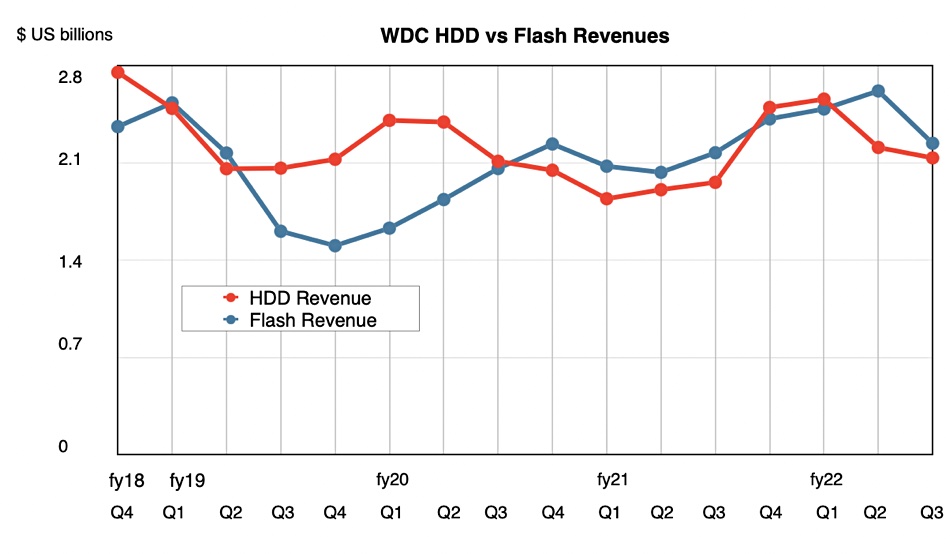

Cutting the revenue numbers another way, disk drive revenues were $2.14 billion, up 9 percent on the year, while SSD earnings were $2.24 billion, up 3 percent. However, the growth curves have turned down on a quarterly basis as a second chart shows:

Outlook

Goeckeler said: “Looking ahead, we are optimistic about the business outlook for calendar year 2022. We believe the secular demand for storage and our new product ramps in HDD and flash will drive growth across our end markets.”

In the consumer area: “We are confident in the strength of the business as we are entering a seasonally stronger second half of the calendar year with a number of new innovative products.”

The PC area looks good too: “The increase in cloud capital investment for datacenter build-outs is expected to propel growth for our HDD and Flash products in this growing end market. In client, PC end demand growth has been solid for the last two years, and we are starting to see some normalization in the PC market. We expect PC unit demand to remain significantly above pre-pandemic levels, with the return-to-site trend driving a mix shift towards commercial and enterprise PCs with richer client SSD content versus consumer-oriented PCs.”

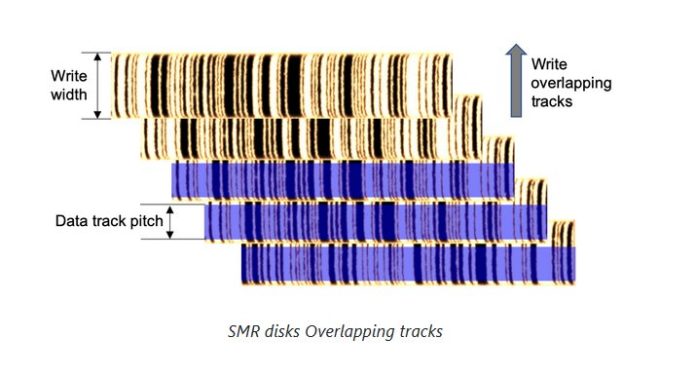

Western Digital said qualification of its OptiNAND-based disk drives went as planned across its many cloud and OEM customers. Its largest cloud customers will be accelerating adoption of its shingled magnetic recording (SMR) disk drives later this year. Goeckeler said: “We’re continuing to see more momentum towards SMR. That is the future of the cloud HDD business, SMR. All the big players are now moving down that path… this is the next leg of growth in this industry.”

He promised more cloud product technology announcements at a May 10 investor day event.

Even so, with all this optimistic outlook, next quarter’s revenues are being guided below the year-ago quarter’s $4.9 billion.

It seems that the quarter-on-quarter downturns across WD’s segments is indicative of a continuing problem in the short term. The outlook for its fourth fiscal 2022 quarter is for revenues between $4.5 billion and $4.7 billion, $4.6 billion at the midpoint, which would represent a 6.5 percent decrease year-on-year. Some onlookers may say a recession could be coming, helped along by lockdowns, the Ukraine war, inflation, and supply chain difficulties.

As WD chief exec, Goeckeler is not such a doubter: “We feel good about the overall demand in calendar year 2022. We are continuing to navigate the macroeconomic and geopolitical factors I mentioned earlier. While these transitory issues are affecting both revenue and gross margin in the near term, we expect them to subside over time. We are confident that the growth and profitability opportunities in front of us have not changed.”

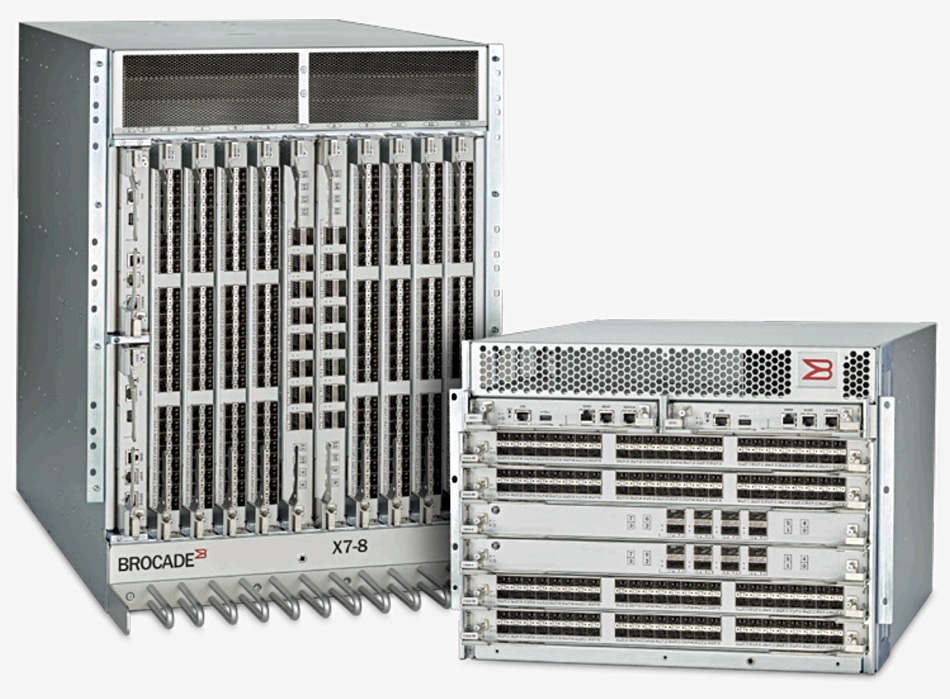

Fibre Channel

Fibre Channel – a lossless storage networking protocol and cabling technology for linking SANs and accessing devices. Fibre Channel is a derivation of ESCON for open systems, widely used today for external storage arrays and internally in some legacy platforms for connecting drives. Servers and storage arrays connect to a Fibre Channel network using Host Bus Adapters (HBAs). The network can use switches to agglomerate traffic and very large switches, called Directors, to agglomerate it further. It comes in generations with each being faster than the preceding generation;

- Gen 1 – 1Gbps

- Gen 2 – 2 Gbps

- Gen 3 – 4 Gbps

- Gen 4 – 8 Gbps

- Gen 5 – 16 Gbps

- Gen 6 – 32 Gbps

- Gen 7 – 64 Gbps

- Gen 8 – 128Gbps – roadmap item.

The latest generation of Fibre Channel (128GFC) has a rate of 112.2Gbps (PAM4) for a single lane variant. This speed is 5.6% faster than 100Gb Ethernet single lane variants. Fibre Channel was able to increase the speed while still maintaining two generations of backward compatibility. Previous generation SFP optical modules (32GFC and 64GFC) will be able to plug into the latest generation of Fibre Channel 128GFC products, and 128GFC products will be able to seamlessly interoperate with previous generations of Fibre Channel products.

128GFC products will support existing infrastructure of fiber cables for multi-mode variants and single mode variants. 128GFC is also able to support the previous reach of 100 meters of OM4 without sacrificing performance in link quality or increasing errors (BER).

FERAM

FERAM – Ferro-Electric Random Access Memory. FERAM is a type of non-volatile memory used in smart cards and some portable devices. Compared to Flash, it offers many more read/write cycles before failure, much faster writing and lower power consumption. FERAM chips are structured much like ordinary DRAM, but use a ferroelectric material in place of the dielectric to achieve their unique features. FERAM can use a lead zirconate titanate (PZT) ferroelectric, but the technology suffers from low storage densities and high cost: hence its use mainly in low-capacity low-power devices requiring durability, like smartcards.

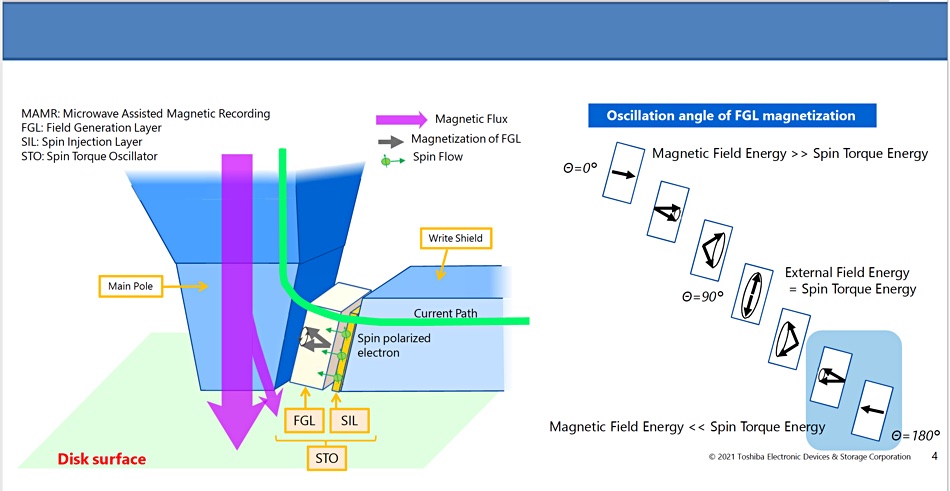

FC-MAMR

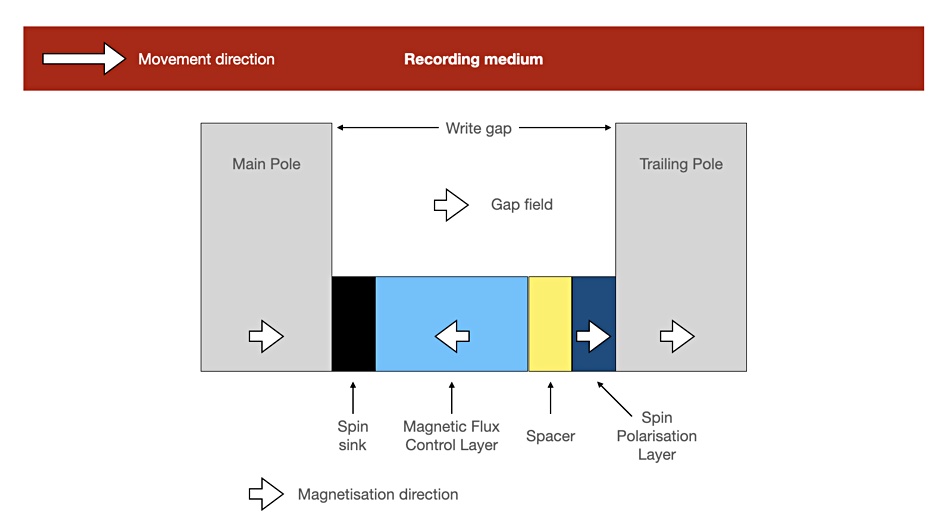

FC-MAMR – Flux Control – Microwave-Assisted Magnetic Recording. A Toshiba technology. Microwaves are generated by a Spin Torque Oscillator (STO) positioned next to a disk drive write head. The STO used includes a microwave Field Generation Layer (FGL) and a Spin Injection Layer (SIL). FC-MAMR is an approach technology for full MAMR. It involves reversing the direction of the STO and so providing a 20 per cent areal density gain to PMR technology.

FCOE

FCOE – Fibre Channel over Ethernet. This storage networking scheme carries Fibre Channel protocol messages over an Ethernet LAN cabling system.

AWS launches IceLake Nitro SSD instances

AWS has added fast compute instances called I4i using Intel Xeon IceLake servers and 30TB of NVMe Nitro SSD storage.

These Nitro SSDs and the Xeons deliver up to 60 per cent lower I/O latency, 75 per cent lower latency variability compared to the prior I3 instances, and up to 30 per cent better compute price/performance. The processors have an all-core turbo frequency of 3.5GHz. There is a I41.32xlarge instance size with 128 vCPUs and 1,024GiB (1.1 TB) of storage using 8x 3,750MiB (3.9GB) Nitro SSDs – a total of 31.2TB of SSD capacity.

Yiftach Shoolman, co-founder and CTO of Redis, offered a testimonial: “Our testing shows I4i instances delivering an astonishing 2.9x higher query throughput than the previous generation I3 instances. We have also tested with various read and write mixes, and observed consistent and linearly scaling performance.”

Avi Kivity, co-founder and CTO of ScyllaDB, had similar to say: “When we tested I4i instances, we observed up to 2.7x increase in throughput per vCPU compared to I3 instances for reads. With an even mix of reads and writes, we observed 2.2x higher throughput per vCPU, with a 40 per cent reduction in average latency than I3 instances.”

The I4i.16xlarge and I4i.32xlarge instances give users control over C-states, and the I4i.32xlarge instances support non-uniform memory access (NUMA). All of the instances support AVX-512, and use Intel Total Memory. I4i instances give customers up to 75Gbit/sec of networking speed and 40Gbit/sec of bandwidth to Amazon’s EBS (Elastic Block Store). Overall, applications go faster for less money.

Nitro SSD

Intel says AWS’s Nitro System is a combination of dedicated hardware and lightweight hypervisor. The I4i instances deliver practically all compute and memory resources of the host hardware to instances.

AWS says a Nitro SSD has firmware inside responsible for implementing many lower-level functions, with designed-in operational telemetry and diagnostics. It has code to manage the instance-level storage to improve reliability and deliver consistent performance.

AWS says these SSDs are engineered to deliver maximum performance under a sustained, continuous load, with the firmware responsible for garbage collection and wear-leveling to even out Program-Erase cycles per cell over time. The firmware can also be updated, AWS says, at at cloud scale and at cloud speed – more often than commodity SSDs, at any rate.

Accelerated apps

The new instances, AWS says, “are designed to minimize latency and maximize transactions per second (TPS) on workloads that need very fast access to medium-sized datasets on local storage. This includes transactional databases such as MySQL, Oracle DB, and Microsoft SQL Server, as well as NoSQL databases: MongoDB, Couchbase, Aerospike, Redis, and the like. They are also an ideal fit for workloads that can benefit from very high compute performance per TB of storage such as data analytics and search engines.”

AWS customers can launch I4i instances today in the AWS US East (N Virginia), US East (Ohio), US West (Oregon), and Europe (Ireland) Regions (with more to come) in On-Demand and Spot form. Savings Plans and Reserved Instances are available, as are Dedicated Instances and Dedicated Hosts.

In order to take advantage of the performance benefits, customers must use recent AMIs that include current ENA drivers and support for NVMe 1.4. The I4i instance home page has more information.