Western Digital achieved better quarterly results than Seagate reported this week, but profits fell and it’s facing a sales downturn next quarter.

Revenues in the quarter ended April 1 were $4.38 billion, a 6 percent increase year-on-year. Western Digital had forecast a range with a $4.3 billion midpoint and beat that. However, profits were only $25 million compared to $197 million last year and $564 million in the previous quarter. This was largely due to Chinese COVID lockdown measures, supply chain issues, and flash fab contamination

CEO David Goeckeler said: “We delivered excellent performance in the quarter, with revenue of $4.4 billion and non-GAAP gross margin of 31.7 percent, both of which are at the higher end of our updated guidance ranges we provided in early March.”

He added: ”The entire Western Digital team worked together to deliver excellent financial performance while navigating a dynamic geopolitical and macroeconomic environment, as well as ongoing supply challenges.”

The recent chemical contamination at the NAND fab in Japan, in which Western Digital lost about 7EB of capacity, was a problem. Goeckeler said: “Our overall [flash] business was impacted by our ability to ship product due to the fab excursion.”

A Shenzhen disk drive products facility also had to close for a couple of weeks in the quarter, due to COVID-related measures, and that affected WD’s disk output and costs.

Financial summary

- Gross margin – 27 percent; it was 32.8 percent in prior quarter and COVID was a factor

- EPS – $1.75, up from $1.02 a year ago

- Operating cash flow – $398 million

- Free cash flow – $148 million

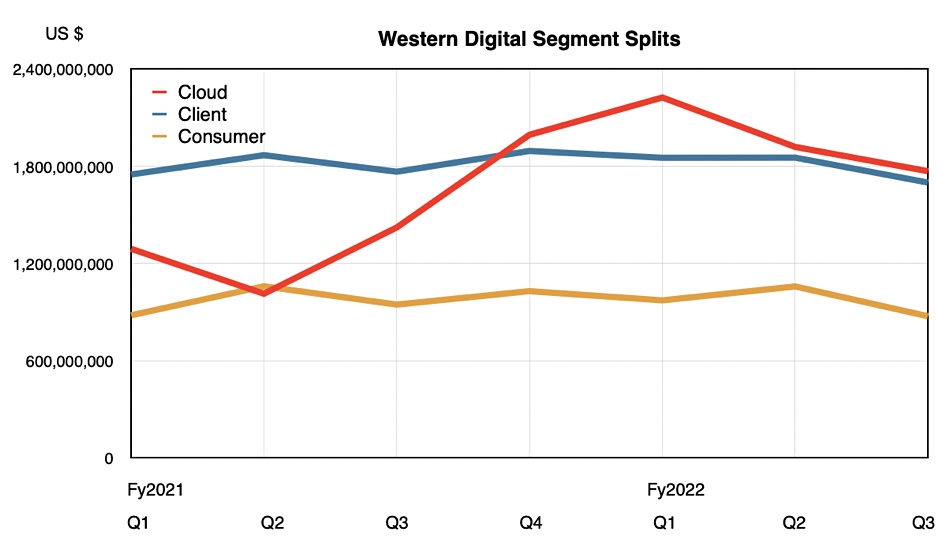

Segment splits

WD’s Cloud revenues were $1.77 billion, up 25 percent on the year. Within that there was a near 40 percent increase in nearline (high-capacity) disk drive revenue. Enterprise SSD and video disk drive earnings were lower, though. Revenues from client product sales were $1.7 billion, down 2 per cent on the year; a seasonal pattern, although client (PC) SSD sales rose. This was attributed to PC manufacturers dealing well with their supply chain problems. Consumer product revenues were down 8 percent year-on-year to $875 million as retail SSD sales declined.

Goeckeler said on an earnings call: “In consumer, we are experiencing short-term demand weakness outside the US tied to the geopolitical events in Europe, as well as COVID-related lockdowns in China.“

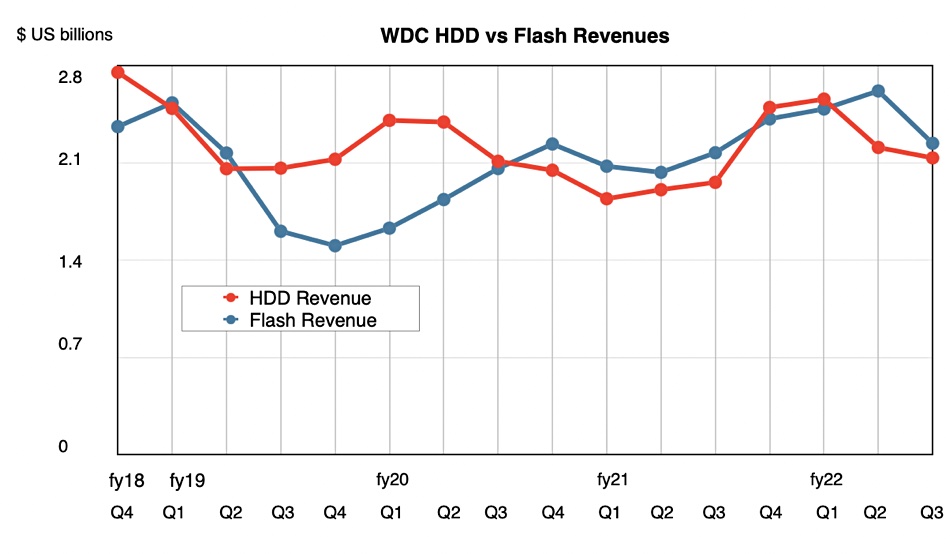

Cutting the revenue numbers another way, disk drive revenues were $2.14 billion, up 9 percent on the year, while SSD earnings were $2.24 billion, up 3 percent. However, the growth curves have turned down on a quarterly basis as a second chart shows:

Outlook

Goeckeler said: “Looking ahead, we are optimistic about the business outlook for calendar year 2022. We believe the secular demand for storage and our new product ramps in HDD and flash will drive growth across our end markets.”

In the consumer area: “We are confident in the strength of the business as we are entering a seasonally stronger second half of the calendar year with a number of new innovative products.”

The PC area looks good too: “The increase in cloud capital investment for datacenter build-outs is expected to propel growth for our HDD and Flash products in this growing end market. In client, PC end demand growth has been solid for the last two years, and we are starting to see some normalization in the PC market. We expect PC unit demand to remain significantly above pre-pandemic levels, with the return-to-site trend driving a mix shift towards commercial and enterprise PCs with richer client SSD content versus consumer-oriented PCs.”

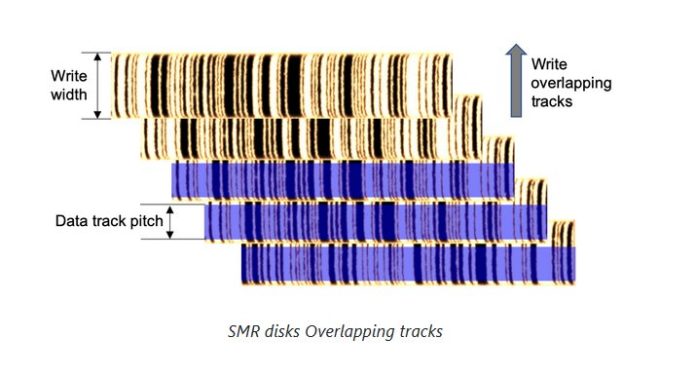

Western Digital said qualification of its OptiNAND-based disk drives went as planned across its many cloud and OEM customers. Its largest cloud customers will be accelerating adoption of its shingled magnetic recording (SMR) disk drives later this year. Goeckeler said: “We’re continuing to see more momentum towards SMR. That is the future of the cloud HDD business, SMR. All the big players are now moving down that path… this is the next leg of growth in this industry.”

He promised more cloud product technology announcements at a May 10 investor day event.

Even so, with all this optimistic outlook, next quarter’s revenues are being guided below the year-ago quarter’s $4.9 billion.

It seems that the quarter-on-quarter downturns across WD’s segments is indicative of a continuing problem in the short term. The outlook for its fourth fiscal 2022 quarter is for revenues between $4.5 billion and $4.7 billion, $4.6 billion at the midpoint, which would represent a 6.5 percent decrease year-on-year. Some onlookers may say a recession could be coming, helped along by lockdowns, the Ukraine war, inflation, and supply chain difficulties.

As WD chief exec, Goeckeler is not such a doubter: “We feel good about the overall demand in calendar year 2022. We are continuing to navigate the macroeconomic and geopolitical factors I mentioned earlier. While these transitory issues are affecting both revenue and gross margin in the near term, we expect them to subside over time. We are confident that the growth and profitability opportunities in front of us have not changed.”